Copper Prices Trends 2025: Navigating The Path To A Sustainable Future

Copper Prices Trends 2025: Navigating the Path to a Sustainable Future

Related Articles: Copper Prices Trends 2025: Navigating the Path to a Sustainable Future

Introduction

With great pleasure, we will explore the intriguing topic related to Copper Prices Trends 2025: Navigating the Path to a Sustainable Future. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Copper Prices Trends 2025: Navigating the Path to a Sustainable Future

Copper, a vital element in the global economy, plays a crucial role in various industries, from construction and manufacturing to energy and technology. As the world transitions toward a more sustainable future, the demand for copper is expected to surge, driving copper prices trends 2025 into uncharted territory.

This article delves into the key factors influencing copper prices in the coming years, exploring the interplay of supply, demand, and geopolitical dynamics. By understanding these forces, we can gain insights into the potential trajectory of copper prices, paving the way for informed decision-making across industries.

Factors Shaping Copper Prices Trends 2025

1. Global Economic Growth: The global economy’s growth trajectory is a primary driver of copper demand. As economies expand, industries require more copper for infrastructure development, manufacturing, and energy production. Projections suggest that sustained economic growth, particularly in emerging markets, will continue to fuel copper demand in the years ahead.

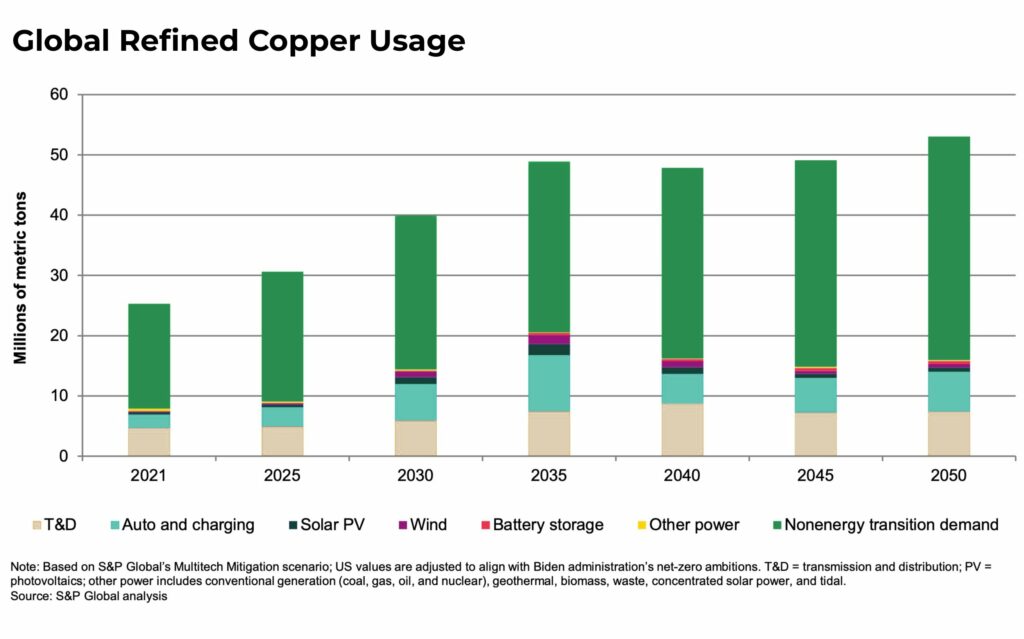

2. Renewable Energy Transition: The transition to renewable energy sources, including solar and wind power, is a significant factor driving copper demand. Copper is a critical component in solar panels, wind turbines, and electric vehicle charging infrastructure. The increasing adoption of renewable energy technologies is expected to create a substantial demand for copper, further influencing copper prices trends 2025.

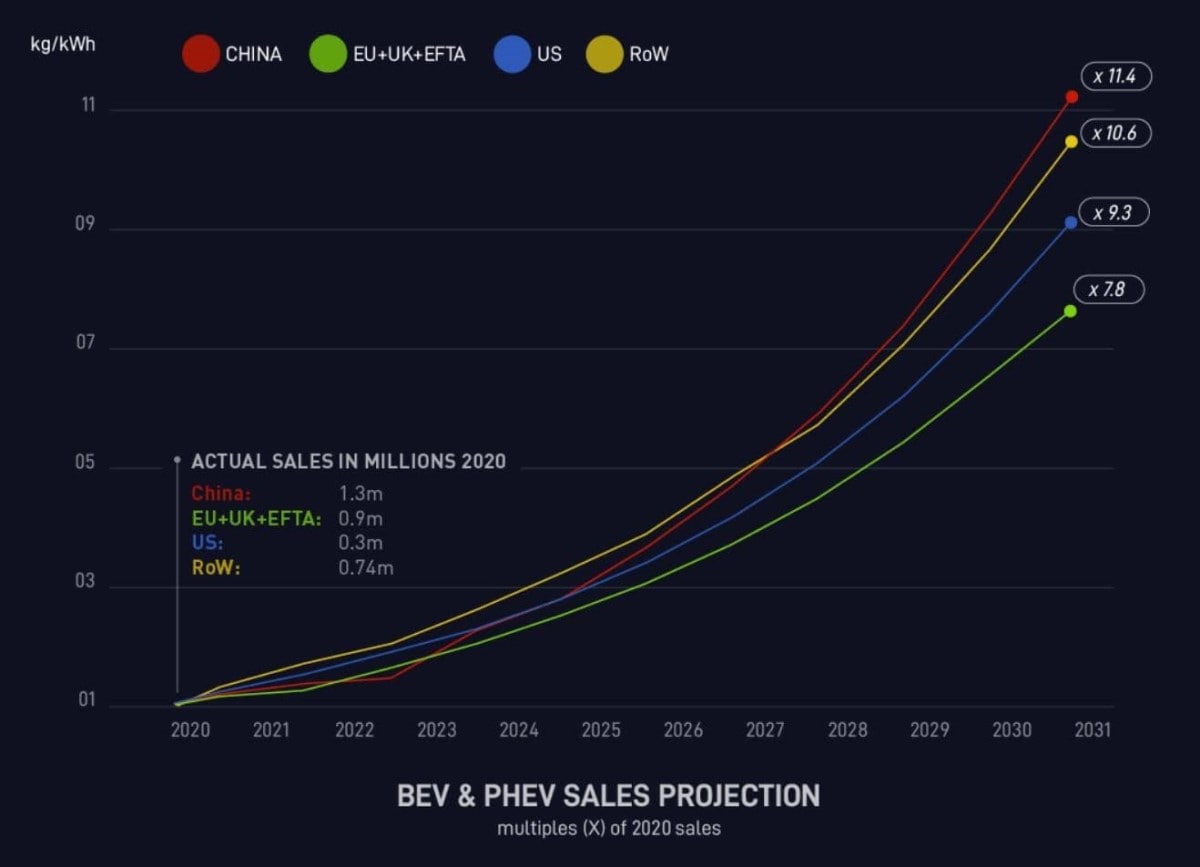

3. Electrification of Transportation: The shift towards electric vehicles (EVs) is another key driver of copper demand. EVs require significantly more copper than traditional gasoline-powered vehicles, due to the need for electric motors, batteries, and charging infrastructure. As the EV market continues to grow, the demand for copper will rise accordingly.

4. Infrastructure Development: The global demand for infrastructure development, including roads, bridges, buildings, and telecommunications networks, requires substantial amounts of copper. As countries invest in infrastructure projects to support economic growth and urbanization, the demand for copper will continue to climb.

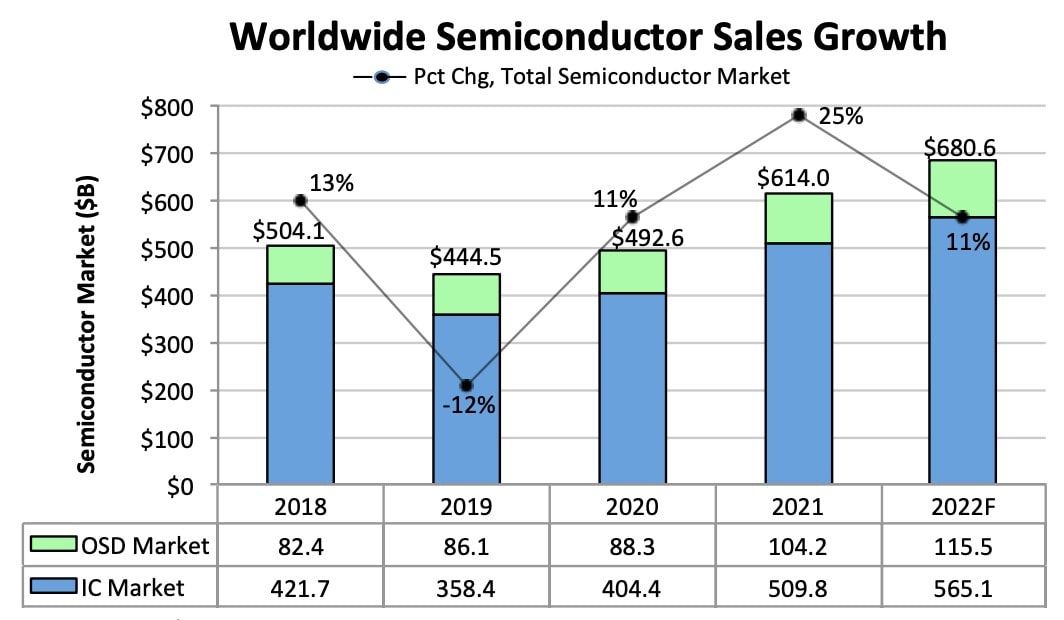

5. Technological Advancements: Technological advancements across various sectors, from data centers to artificial intelligence, are creating new applications for copper. The increased use of copper in high-performance computing, electronic devices, and other emerging technologies will further contribute to the demand for this vital metal.

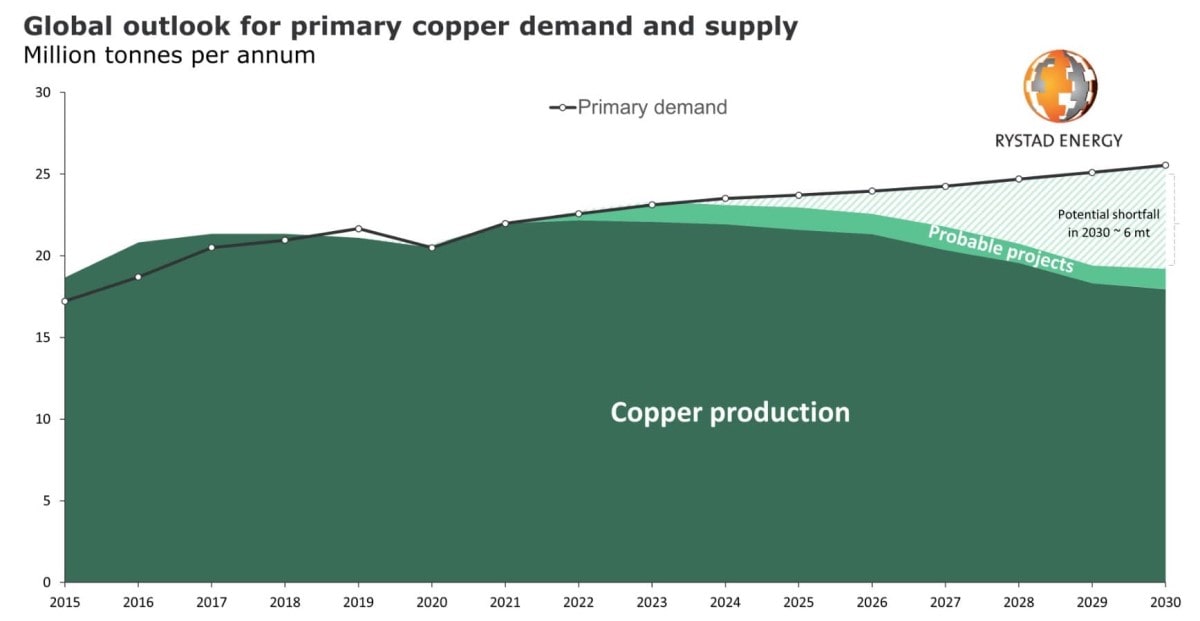

6. Supply Constraints: The availability of copper supply is a critical factor influencing prices. While new copper mines are being developed, it takes several years to bring them online. Furthermore, existing mines face challenges such as declining ore grades, environmental regulations, and labor shortages, all of which can impact copper production and influence copper prices trends 2025.

7. Geopolitical Factors: Geopolitical instability, trade disputes, and government policies can significantly impact copper prices. For example, disruptions in copper production or transportation due to political unrest or sanctions can lead to price fluctuations.

8. Investment Demand: Investor sentiment and investment flows into copper can also impact prices. When investors perceive copper as a good investment, they may increase their holdings, driving up demand and prices. Conversely, a decline in investor confidence can lead to a decrease in demand and lower prices.

Related Searches:

Understanding the factors influencing copper prices trends 2025 requires exploring related search terms that offer a deeper dive into the dynamics of this essential metal. Here are some key areas to investigate:

1. Copper Price Forecast 2025: This search term focuses on predictions and projections of copper prices in 2025. Analyzing these forecasts can provide valuable insights into potential price movements and help businesses plan for the future.

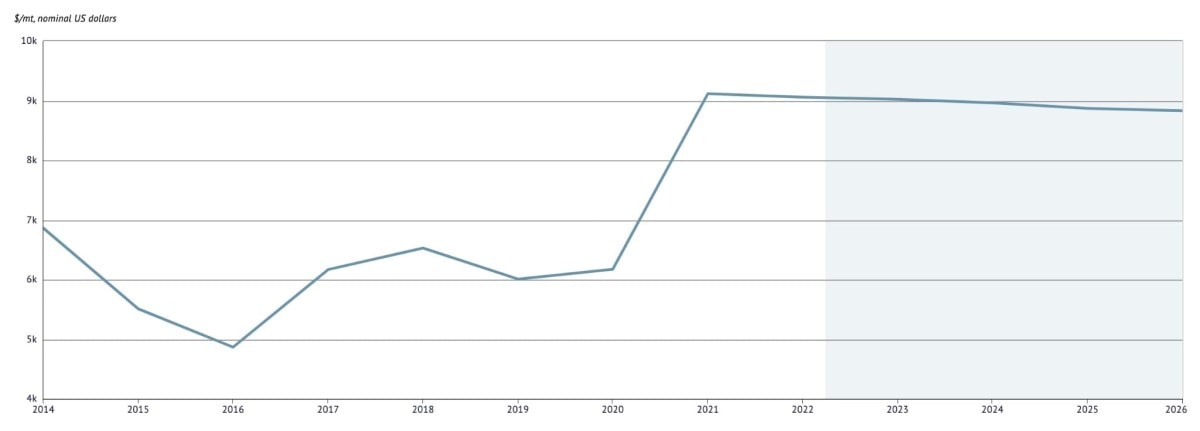

2. Copper Price History: Exploring historical copper prices can provide valuable context for understanding current trends and predicting future price movements. Examining past price fluctuations, along with the factors that drove them, can help identify patterns and anticipate potential shifts in the market.

3. Copper Supply and Demand: This search term examines the balance between copper supply and demand. Understanding the factors influencing supply, such as mine production, and demand, driven by economic growth and technological advancements, is crucial for comprehending the forces shaping copper prices trends 2025.

4. Copper Mining Companies: Researching copper mining companies, their production capacities, and their impact on global supply can provide insights into the potential for future supply disruptions or expansions. This information is essential for understanding the factors influencing copper prices trends 2025.

5. Copper Recycling: Exploring the role of copper recycling in the global market is crucial for understanding the sustainability of copper supply. Analyzing the efficiency of recycling processes and the potential for increased recycling rates can help assess its impact on copper prices trends 2025.

6. Copper Futures Market: Understanding the dynamics of the copper futures market, where contracts for future delivery of copper are traded, can provide valuable insights into market sentiment and potential price fluctuations.

7. Copper ETF: Exploring copper exchange-traded funds (ETFs) allows investors to gain exposure to copper prices without directly investing in physical copper. Understanding the performance of these ETFs and the factors driving their price movements can provide valuable insights into the market.

8. Copper Substitutes: Investigating potential substitutes for copper, such as aluminum and other metals, can help assess their impact on copper demand and prices. Understanding the advantages and disadvantages of these substitutes can provide valuable insights into the competitive landscape for copper.

FAQs:

1. What are the key drivers of copper prices?

Copper prices are driven by a complex interplay of factors, including global economic growth, the transition to renewable energy, electrification of transportation, infrastructure development, technological advancements, supply constraints, geopolitical events, and investment demand.

2. What are the potential risks to copper prices?

Potential risks to copper prices include economic downturns, supply disruptions due to geopolitical instability or environmental regulations, technological advancements leading to the development of copper substitutes, and changes in investor sentiment.

3. How can investors benefit from copper price trends?

Investors can benefit from copper price trends through direct investments in copper mining companies, investing in copper ETFs, or trading copper futures contracts. However, it’s crucial to conduct thorough research and understand the risks associated with these investments.

4. How will copper prices impact the transition to a sustainable future?

Copper is a critical component in many renewable energy technologies, electric vehicles, and sustainable infrastructure projects. Rising copper prices could potentially increase the cost of these technologies and slow down the transition to a sustainable future. However, the long-term demand for copper in sustainable industries is likely to remain strong, driving investment in new copper production and potentially leading to more sustainable mining practices.

5. How can businesses prepare for future copper price fluctuations?

Businesses can prepare for future copper price fluctuations by:

- Diversifying their supply chains: Sourcing copper from multiple suppliers can mitigate risks associated with price volatility and supply disruptions.

- Investing in new technologies: Exploring alternative materials or technologies that require less copper can help reduce dependence on this metal.

- Developing hedging strategies: Using financial instruments such as futures contracts or options can help mitigate price risks.

- Implementing efficient inventory management: Optimizing inventory levels can help businesses manage costs and avoid potential losses due to price fluctuations.

Tips:

1. Stay Informed: Regularly monitor news and industry reports on copper prices, supply and demand trends, and geopolitical developments to stay informed about potential price fluctuations.

2. Conduct Due Diligence: Before investing in copper or copper-related companies, conduct thorough research to understand the risks and potential rewards.

3. Consider Long-Term Trends: When making investment decisions, focus on long-term trends rather than short-term price fluctuations. The demand for copper is expected to remain strong in the coming years, driven by the transition to a sustainable future.

4. Diversify Your Portfolio: Don’t put all your eggs in one basket. Diversify your investments across different asset classes to mitigate risks associated with copper price volatility.

5. Seek Professional Advice: If you’re unsure about how to navigate copper price trends, seek advice from a financial advisor or a professional with expertise in the commodities market.

Conclusion:

Copper prices trends 2025 are expected to be influenced by a complex interplay of factors, including global economic growth, the transition to renewable energy, electrification of transportation, and supply constraints. While the future trajectory of copper prices remains uncertain, understanding the key drivers and potential risks can help businesses and investors navigate this evolving market. By staying informed, conducting due diligence, and considering long-term trends, stakeholders can position themselves for success in the copper market and contribute to a more sustainable future.

Closure

Thus, we hope this article has provided valuable insights into Copper Prices Trends 2025: Navigating the Path to a Sustainable Future. We hope you find this article informative and beneficial. See you in our next article!