Fintech Trends Shaping The Future Of Asset Management In 2025

Fintech Trends Shaping the Future of Asset Management in 2025

Related Articles: Fintech Trends Shaping the Future of Asset Management in 2025

Introduction

With enthusiasm, let’s navigate through the intriguing topic related to Fintech Trends Shaping the Future of Asset Management in 2025. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

- 1 Related Articles: Fintech Trends Shaping the Future of Asset Management in 2025

- 2 Introduction

- 3 Fintech Trends Shaping the Future of Asset Management in 2025

- 3.1 1. Artificial Intelligence (AI) and Machine Learning (ML)

- 3.2 2. Blockchain Technology

- 3.3 3. Big Data Analytics

- 3.4 4. Cloud Computing

- 3.5 5. Regulatory Technology (RegTech)

- 3.6 6. Open Banking

- 3.7 7. Gamification

- 3.8 8. Sustainable Investing

- 3.9 FAQs by Fintech Trends for the Future of Asset Management 2025

- 3.10 Tips by Fintech Trends for the Future of Asset Management 2025

- 3.11 Conclusion by Fintech Trends for the Future of Asset Management 2025

- 4 Closure

Fintech Trends Shaping the Future of Asset Management in 2025

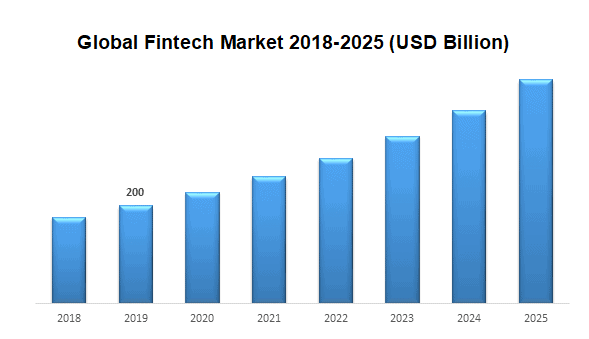

The asset management industry is undergoing a dramatic transformation, driven by technological advancements and evolving investor demands. Fintech trends are rapidly reshaping the landscape, offering innovative solutions and enhancing the efficiency and accessibility of investment management. By 2025, these trends will have significantly altered the industry, empowering investors with greater control, transparency, and personalized experiences.

Here’s a comprehensive exploration of key fintech trends that will define the future of asset management:

1. Artificial Intelligence (AI) and Machine Learning (ML)

AI and ML are revolutionizing asset management by automating tasks, improving investment strategies, and personalizing client experiences.

- Automated Portfolio Management: AI-powered robo-advisors are becoming increasingly sophisticated, offering automated portfolio management solutions tailored to individual risk profiles and financial goals. These platforms utilize algorithms to analyze market data, execute trades, and rebalance portfolios, offering cost-effective and personalized investment solutions for mass-market investors.

- Enhanced Investment Research: AI and ML algorithms can analyze vast amounts of data, including news articles, social media sentiment, and financial reports, to identify trends, predict market movements, and generate investment insights. This data-driven approach empowers portfolio managers to make more informed investment decisions and potentially achieve better returns.

- Personalized Investment Advice: AI-powered chatbots and virtual assistants are becoming more commonplace in asset management, offering personalized investment advice and support to clients. These platforms can analyze individual financial data, provide tailored recommendations, and answer questions in real time, improving client engagement and satisfaction.

Benefits:

- Improved Efficiency: AI automates repetitive tasks, freeing up human analysts to focus on more strategic activities.

- Enhanced Accuracy: AI algorithms can analyze vast datasets and identify patterns that humans might miss, leading to more accurate predictions and better investment decisions.

- Reduced Costs: AI-powered solutions can reduce operational costs and make investment management more accessible to a wider range of investors.

- Personalized Experiences: AI enables personalized investment advice and portfolio management, catering to individual needs and preferences.

Challenges:

- Data Quality: The accuracy of AI models depends on the quality and completeness of the data they are trained on. Ensuring data integrity is crucial for reliable outcomes.

- Explainability: AI models can be complex and difficult to interpret, raising concerns about transparency and accountability. Understanding how AI makes decisions is essential for building trust and ensuring responsible use.

- Ethical Considerations: The use of AI in asset management raises ethical concerns related to bias, privacy, and job displacement. Careful consideration and ethical frameworks are necessary to mitigate potential risks.

2. Blockchain Technology

Blockchain technology is transforming the way assets are managed, traded, and settled. Its decentralized, secure, and transparent nature offers numerous advantages for asset management.

- Tokenized Securities: Blockchain technology enables the creation of digital representations of traditional assets, such as stocks, bonds, and real estate. These tokenized securities can be traded on decentralized exchanges, offering greater liquidity and reduced transaction costs.

- Improved Transparency and Security: Blockchain’s immutable ledger ensures that all transactions are recorded and verifiable, enhancing transparency and security in asset management. This reduces the risk of fraud and manipulation, fostering greater trust in the investment process.

- Automated Settlement and Custody: Blockchain can automate the settlement of trades and streamline the custody of assets, reducing delays and costs associated with traditional processes. This creates a more efficient and secure environment for managing investments.

Benefits:

- Increased Efficiency: Blockchain streamlines processes, automating tasks and reducing manual intervention.

- Enhanced Security: The decentralized and immutable nature of blockchain provides a secure and tamper-proof record of transactions.

- Improved Transparency: All transactions are publicly auditable, increasing transparency and accountability in asset management.

- Reduced Costs: Blockchain can reduce transaction fees and operational costs associated with traditional asset management.

Challenges:

- Scalability: Current blockchain networks have limited transaction throughput, which could hinder their ability to handle large-scale asset management operations.

- Regulation: The regulatory landscape for blockchain technology is still evolving, creating uncertainty and challenges for asset managers.

- Adoption: Widespread adoption of blockchain in asset management requires collaboration and standardization across the industry.

3. Big Data Analytics

Big data analytics is empowering asset managers to leverage massive amounts of data to gain valuable insights and make better investment decisions.

- Market Sentiment Analysis: By analyzing social media posts, news articles, and other data sources, asset managers can gain insights into market sentiment and identify potential investment opportunities.

- Risk Management: Big data analytics can help asset managers identify and assess risks more effectively, improving portfolio diversification and risk mitigation strategies.

- Performance Optimization: Data analysis can help asset managers track portfolio performance, identify areas for improvement, and optimize investment strategies to maximize returns.

Benefits:

- Data-Driven Insights: Big data analytics provides valuable insights that can inform investment decisions and improve portfolio performance.

- Enhanced Risk Management: Data analysis can help identify and mitigate risks, reducing potential losses and protecting investor capital.

- Personalized Investment Strategies: Big data analytics can be used to tailor investment strategies to individual investor needs and preferences.

Challenges:

- Data Quality: The accuracy of big data analytics depends on the quality and completeness of the data. Ensuring data integrity is crucial for reliable insights.

- Data Security: Protecting sensitive investor data is paramount. Robust security measures are essential to prevent breaches and maintain data privacy.

- Expertise: Effective use of big data analytics requires specialized skills and expertise in data science and analytics.

4. Cloud Computing

Cloud computing provides a scalable, cost-effective, and flexible platform for asset management operations.

- Enhanced Scalability: Cloud platforms can easily scale up or down to accommodate changing business needs, allowing asset managers to handle increased workloads without investing in expensive infrastructure.

- Reduced Costs: Cloud computing eliminates the need for expensive hardware and software investments, reducing operational costs and improving profitability.

- Improved Collaboration: Cloud-based platforms enable seamless collaboration among team members, regardless of location, facilitating efficient communication and data sharing.

Benefits:

- Increased Agility: Cloud computing enables asset managers to adapt to changing market conditions and technological advancements quickly.

- Cost Savings: Cloud platforms reduce infrastructure costs and optimize resource utilization.

- Improved Collaboration: Cloud-based solutions facilitate collaboration and communication among team members, enhancing efficiency and productivity.

Challenges:

- Data Security: Ensuring the security of sensitive data stored in the cloud is paramount. Robust security measures and compliance with regulations are essential.

- Vendor Lock-in: Reliance on a single cloud provider can lead to vendor lock-in, limiting flexibility and potentially increasing costs.

- Connectivity: Reliable internet connectivity is crucial for accessing cloud-based services. Disruptions in connectivity can impact operations and data availability.

5. Regulatory Technology (RegTech)

RegTech solutions are transforming the way asset managers comply with regulations, streamlining processes and reducing compliance costs.

- Automated Compliance Monitoring: RegTech platforms can automate compliance monitoring, identifying potential breaches and ensuring adherence to regulatory requirements.

- Simplified Reporting: RegTech solutions can streamline regulatory reporting processes, reducing the time and effort required to generate and submit reports.

- Enhanced Risk Management: RegTech tools can help asset managers identify and manage regulatory risks more effectively, reducing the likelihood of fines and penalties.

Benefits:

- Improved Compliance: RegTech solutions ensure adherence to regulatory requirements, reducing the risk of fines and penalties.

- Reduced Costs: Automating compliance processes reduces operational costs and improves efficiency.

- Enhanced Risk Management: RegTech tools provide insights into regulatory risks, enabling proactive mitigation strategies.

Challenges:

- Integration: Integrating RegTech solutions with existing systems can be complex and time-consuming.

- Data Security: Protecting sensitive data used by RegTech platforms is crucial. Robust security measures are essential to prevent breaches and maintain data privacy.

- Regulation: The regulatory landscape for RegTech is still evolving, creating uncertainty and challenges for asset managers.

6. Open Banking

Open banking initiatives are promoting data sharing between financial institutions, enabling asset managers to access a wider range of data to personalize investment advice and services.

- Improved Client Onboarding: Open banking allows asset managers to access client financial data from other institutions, streamlining the onboarding process and reducing paperwork.

- Personalized Investment Recommendations: By analyzing client financial data from multiple sources, asset managers can develop more personalized investment recommendations and tailor their services to individual needs.

- Enhanced Risk Management: Open banking enables asset managers to access a more comprehensive view of client financial data, improving risk assessment and portfolio diversification strategies.

Benefits:

- Improved Client Experience: Open banking simplifies client onboarding and provides personalized investment advice.

- Data-Driven Insights: Access to a wider range of data enables asset managers to gain deeper insights into client financial situations and needs.

- Enhanced Competition: Open banking promotes competition and innovation in the asset management industry, benefiting investors with more choice and better services.

Challenges:

- Data Privacy: Ensuring the security and privacy of client financial data is paramount. Robust data protection measures are essential to maintain trust.

- Data Compatibility: Integrating data from different sources can be challenging due to variations in data formats and standards.

- Regulation: The regulatory landscape for open banking is still evolving, creating uncertainty for asset managers.

7. Gamification

Gamification is transforming the way investors interact with asset management platforms, making investing more engaging and accessible.

- Interactive Investment Learning: Gamified platforms can provide interactive learning experiences, making it easier for investors to understand investment concepts and strategies.

- Personalized Investment Challenges: Gamification can encourage investors to take an active role in managing their investments by providing personalized challenges and rewards.

- Enhanced User Engagement: Gamified platforms can increase user engagement and retention by providing a more enjoyable and interactive experience.

Benefits:

- Increased Financial Literacy: Gamification can help investors learn about investment concepts and strategies in a more engaging way.

- Improved User Engagement: Gamified platforms can make investing more fun and engaging, encouraging active participation and long-term engagement.

- Enhanced Investment Outcomes: By encouraging active participation and financial literacy, gamification can potentially lead to better investment outcomes.

Challenges:

- Oversimplification: Gamified platforms should avoid oversimplifying complex investment concepts, ensuring that users receive accurate and comprehensive information.

- Ethical Considerations: Gamification should be used responsibly, avoiding manipulative tactics or creating unrealistic expectations.

- Accessibility: Gamified platforms should be accessible to all investors, regardless of their technical skills or experience level.

8. Sustainable Investing

Sustainable investing is gaining momentum, driven by growing investor interest in aligning investments with environmental, social, and governance (ESG) factors.

- ESG-Focused Portfolios: Asset managers are increasingly offering portfolios that prioritize ESG factors, allowing investors to invest in companies with strong sustainability practices.

- ESG Data Analytics: Data analytics tools are being developed to assess the ESG performance of companies, enabling asset managers to identify and invest in companies with positive social and environmental impact.

- Impact Investing: Impact investing focuses on generating both financial returns and positive social or environmental impact. Asset managers are developing strategies and products that align with this approach.

Benefits:

- Positive Impact: Sustainable investing promotes investment in companies that contribute to a more sustainable and equitable future.

- Risk Mitigation: ESG factors can be linked to long-term financial performance, reducing investment risks and potentially enhancing returns.

- Investor Alignment: Sustainable investing allows investors to align their investments with their values and contribute to a more sustainable world.

Challenges:

- Data Availability and Quality: Access to reliable and comprehensive ESG data is crucial for effective sustainable investing.

- Standardization: Lack of standardized ESG reporting frameworks can make it difficult to compare the sustainability performance of different companies.

- Investment Selection: Identifying companies with strong ESG practices and sustainable business models requires careful due diligence and analysis.

FAQs by Fintech Trends for the Future of Asset Management 2025

1. How will AI and ML impact the role of human asset managers in the future?

AI and ML are not meant to replace human asset managers but to augment their capabilities. These technologies can handle repetitive tasks and provide data-driven insights, freeing up human analysts to focus on higher-level tasks such as strategy development, client relationships, and ethical considerations.

2. What are the potential risks associated with using blockchain technology in asset management?

While blockchain offers significant benefits, it also presents certain risks. Scalability issues, regulatory uncertainties, and the need for widespread adoption are key challenges that need to be addressed. Additionally, security concerns and the potential for misuse should be carefully considered.

3. How can asset managers ensure the security of client data in a cloud-based environment?

Cloud providers offer robust security measures, but asset managers must implement additional safeguards. This includes encrypting data at rest and in transit, implementing access controls, and adhering to industry best practices for data security.

4. What are the key considerations for asset managers adopting sustainable investing strategies?

Asset managers need to consider the availability and quality of ESG data, ensure the accuracy of their ESG assessments, and establish clear investment criteria for sustainable portfolios. They also need to communicate their sustainability commitments to investors and demonstrate the positive impact of their investments.

5. How can asset managers leverage gamification to improve investor engagement and financial literacy?

Gamified platforms should provide interactive learning experiences, personalized challenges, and rewards that encourage active participation. They should also ensure that the gamification elements are aligned with investment goals and promote financial literacy without oversimplifying complex concepts.

6. What are the regulatory challenges for fintech trends in asset management?

The regulatory landscape for fintech is evolving rapidly, posing challenges for asset managers. They need to stay informed about new regulations, ensure compliance with existing rules, and advocate for clear and consistent regulations that promote innovation while protecting investors.

Tips by Fintech Trends for the Future of Asset Management 2025

- Embrace Technological Advancements: Asset managers should actively explore and adopt fintech solutions to enhance efficiency, improve client experiences, and gain a competitive edge.

- Focus on Data: Invest in data infrastructure and analytics capabilities to leverage the power of big data and gain valuable insights for investment decisions.

- Prioritize Security: Implement robust security measures to protect sensitive client data, ensuring compliance with regulations and maintaining trust.

- Develop Digital Skills: Invest in training and development programs to equip employees with the digital skills necessary to navigate the evolving technological landscape.

- Embrace Transparency and Communication: Be transparent with clients about the use of fintech solutions and communicate the benefits and potential risks associated with these technologies.

- Foster Collaboration: Collaborate with fintech companies, regulators, and industry peers to promote innovation, address challenges, and shape the future of asset management.

Conclusion by Fintech Trends for the Future of Asset Management 2025

Fintech trends are transforming the asset management industry, offering innovative solutions that enhance efficiency, improve transparency, and personalize client experiences. By embracing these trends, asset managers can navigate the evolving landscape, adapt to changing investor demands, and position themselves for success in the future.

The adoption of AI, blockchain, big data analytics, cloud computing, RegTech, open banking, gamification, and sustainable investing will reshape the industry, empowering investors with greater control, access, and personalized investment solutions. As these trends continue to evolve, asset managers must remain agile, innovative, and committed to providing value to their clients in a rapidly changing world.

![Top 5 Current Fintech Trends [2022 - 2025]](https://assets.website-files.com/61b6d36e8f52d840c65c7d07/64ce86a1dc71cc8c7327e895_Top%205%20fitech%20trends.png)

![Top 5 Current Fintech Trends [2022 - 2025]](https://assets-global.website-files.com/61b6d36e8f52d840c65c7d07/649b2595538cd7ed9258537e_Fintech%20trends.jpg)

Closure

Thus, we hope this article has provided valuable insights into Fintech Trends Shaping the Future of Asset Management in 2025. We hope you find this article informative and beneficial. See you in our next article!