Macroeconomic Analysis: Unveiling The Broader Landscape For Investment Decisions

Macroeconomic Analysis: Unveiling the Broader Landscape for Investment Decisions

Related Articles: Macroeconomic Analysis: Unveiling the Broader Landscape for Investment Decisions

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to Macroeconomic Analysis: Unveiling the Broader Landscape for Investment Decisions. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Macroeconomic Analysis: Unveiling the Broader Landscape for Investment Decisions

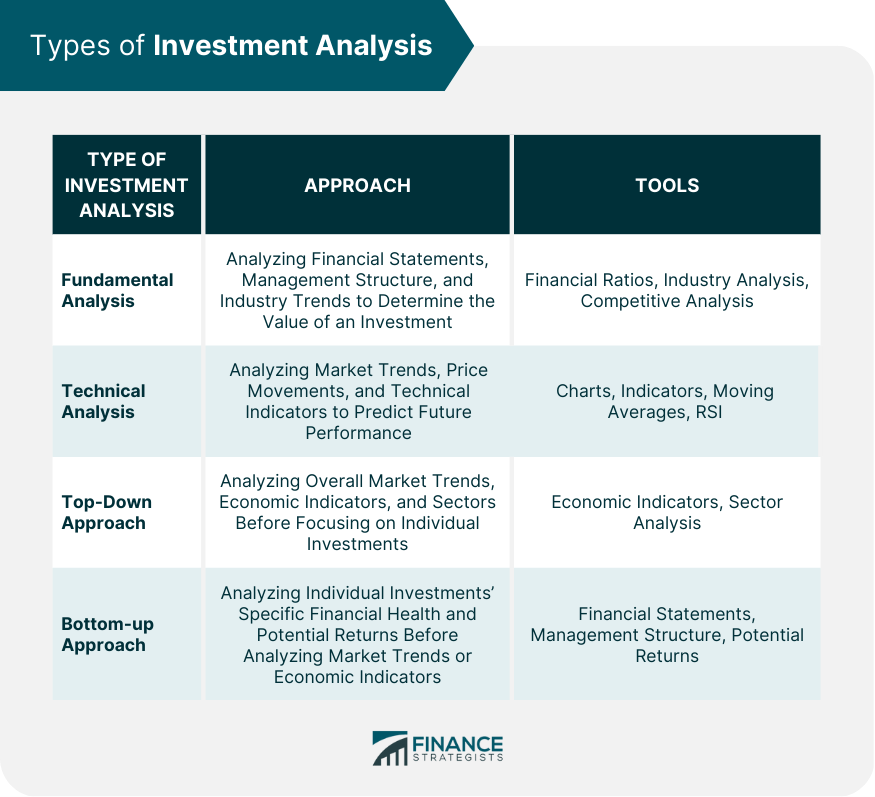

In the intricate world of stock market investing, understanding the overarching forces shaping the market is paramount. While individual company analysis plays a crucial role, macroeconomic analysis stands as the cornerstone for discerning long-term trends and navigating the complexities of the investment landscape.

Understanding the Macroeconomic Lens

Macroeconomic analysis delves into the broad economic forces that influence the performance of entire markets. It goes beyond the minutiae of individual companies and sectors, focusing on the big picture:

- Global Economic Growth: This encompasses factors like GDP growth, inflation, interest rates, and employment. A robust global economy generally fosters a positive investment climate.

- Government Policies: Fiscal and monetary policies, including tax rates, government spending, and central bank actions, directly impact economic activity and market sentiment.

- Geopolitical Events: Wars, trade disputes, and political instability can create volatility and uncertainty in the markets, requiring investors to assess their impact on global economic prospects.

- Technological Advancements: Technological disruptions can reshape entire industries and create new investment opportunities. Understanding these trends is crucial for identifying growth sectors.

- Demographics: Shifts in population demographics, such as aging populations or urbanization, influence consumer behavior and demand patterns, impacting specific industries.

Why Macroeconomic Analysis Matters

The benefits of understanding macroeconomic trends are undeniable:

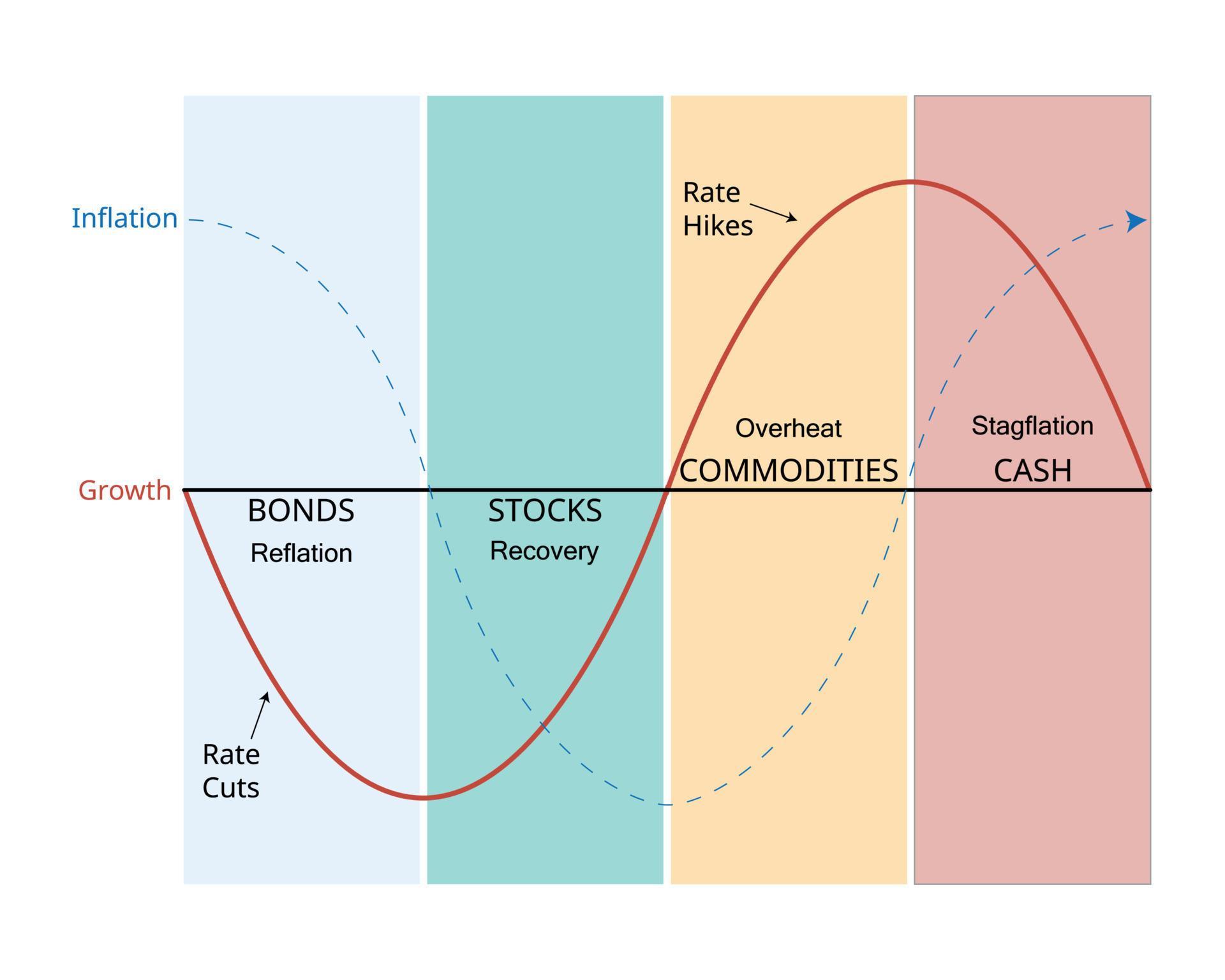

- Informed Investment Decisions: Macroeconomic analysis helps investors identify sectors and companies likely to benefit from prevailing economic conditions. For example, a rising interest rate environment might favor banks, while a strong consumer spending trend could benefit retail companies.

- Risk Management: By understanding the broader economic context, investors can assess the risks associated with their investments and adjust their portfolios accordingly. For instance, during periods of high inflation, investors may seek investments that offer protection against rising prices.

- Long-Term Perspective: Macroeconomic analysis encourages a long-term investment perspective, allowing investors to navigate market fluctuations and capitalize on long-term growth trends.

Key Tools for Macroeconomic Analysis

- Economic Indicators: GDP growth, inflation rates, unemployment rates, and consumer confidence indices provide insights into the overall health of the economy.

- Central Bank Statements: Central bank pronouncements on interest rate policies and economic outlook offer valuable clues about the direction of monetary policy.

- Government Reports: Government reports on fiscal policy, trade balances, and employment data provide valuable information about the economic environment.

- Economic Forecasts: Independent economists and research institutions provide forecasts on economic growth, inflation, and other key indicators, offering insights into future economic trends.

Examples of Macroeconomic Analysis in Action

- The Rise of Emerging Markets: The increasing economic growth and rising middle class in emerging markets have fueled investment opportunities in these regions.

- The Impact of Technology on Industries: Technological advancements like artificial intelligence and e-commerce have created new investment opportunities and disrupted traditional industries.

- The Global Energy Transition: The shift towards renewable energy sources has created a growing market for clean energy technologies, influencing investment decisions in the energy sector.

Related Searches

- Economic Indicators: Understanding key economic indicators like GDP, inflation, and unemployment is crucial for macroeconomic analysis.

- Monetary Policy: Central bank policies, such as interest rate adjustments and quantitative easing, directly impact market conditions.

- Fiscal Policy: Government spending and taxation policies influence economic activity and investment sentiment.

- Geopolitical Risk: Global events like wars, trade disputes, and political instability can create volatility in the markets.

- Emerging Markets: Understanding the economic growth and investment opportunities in emerging markets is vital for global investors.

- Technology Trends: Technological advancements are reshaping industries and creating new investment opportunities.

- Demographics: Shifts in population demographics, such as aging populations or urbanization, influence consumer behavior and demand patterns.

- Investment Strategies: Macroeconomic analysis informs investment strategies, helping investors choose assets and allocate capital based on prevailing economic conditions.

FAQs

Q: How can I learn more about macroeconomic analysis?

A: Numerous resources are available to help you learn about macroeconomic analysis. Consider books, online courses, and investment blogs specializing in this field. Additionally, following reputable financial news sources and economic research institutions can provide valuable insights.

Q: Is macroeconomic analysis suitable for all investors?

A: While understanding macroeconomic trends is beneficial for all investors, its importance varies depending on investment goals and time horizons. Long-term investors seeking to capitalize on broad economic trends may find it particularly valuable.

Q: How often should I review macroeconomic data?

A: Regularly reviewing macroeconomic data, such as monthly or quarterly reports, is recommended to stay informed about evolving economic conditions. However, the frequency of review depends on your investment strategy and risk tolerance.

Tips for Utilizing Macroeconomic Analysis

- Focus on Long-Term Trends: Macroeconomic analysis is best suited for understanding long-term trends rather than predicting short-term market fluctuations.

- Seek Diverse Perspectives: Consider various sources of information and analysis to gain a comprehensive understanding of economic conditions.

- Don’t Overreact to Short-Term Events: Avoid making impulsive investment decisions based on short-term economic news. Focus on the broader economic picture.

- Adjust Your Portfolio Accordingly: Based on your understanding of macroeconomic trends, adjust your portfolio to align with your investment goals and risk tolerance.

Conclusion

Macroeconomic analysis is an indispensable tool for navigating the complexities of the stock market. By understanding the broader economic forces shaping the market, investors can make informed investment decisions, manage risk effectively, and capitalize on long-term growth opportunities. While it is not a guaranteed path to success, incorporating macroeconomic analysis into your investment approach can provide a valuable framework for navigating the dynamic world of investing.

Closure

Thus, we hope this article has provided valuable insights into Macroeconomic Analysis: Unveiling the Broader Landscape for Investment Decisions. We hope you find this article informative and beneficial. See you in our next article!