Navigating The Evolving Landscape: M&A Trends Shaping 2025

Navigating the Evolving Landscape: M&A Trends Shaping 2025

Related Articles: Navigating the Evolving Landscape: M&A Trends Shaping 2025

Introduction

With great pleasure, we will explore the intriguing topic related to Navigating the Evolving Landscape: M&A Trends Shaping 2025. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating the Evolving Landscape: M&A Trends Shaping 2025

The mergers and acquisitions (M&A) landscape is constantly shifting, driven by technological advancements, evolving market dynamics, and changing investor preferences. While predicting the future with absolute certainty is impossible, analyzing current trends and their potential impact allows for informed speculation about the M&A landscape of 2025.

Key Trends Shaping M&A in 2025

Several key trends are expected to shape the M&A landscape in 2025, influencing deal flow, deal structure, and the overall approach to mergers and acquisitions.

1. The Rise of Strategic Acquisitions:

- Focus on Growth and Innovation: Companies are increasingly seeking acquisitions that bolster their core businesses, expand into new markets, or enhance their technological capabilities. This shift towards strategic acquisitions reflects a growing emphasis on long-term growth and innovation.

- Vertical Integration: Acquisitions focused on vertical integration are expected to gain traction, allowing companies to control more of their supply chain and reduce reliance on external vendors. This trend is particularly prominent in industries like manufacturing, technology, and healthcare.

- Diversification and Expansion: Companies are looking to diversify their portfolios and expand into new sectors, mitigating risk and tapping into emerging growth opportunities. Acquisitions are a key tool for achieving this diversification, allowing companies to enter new markets quickly and efficiently.

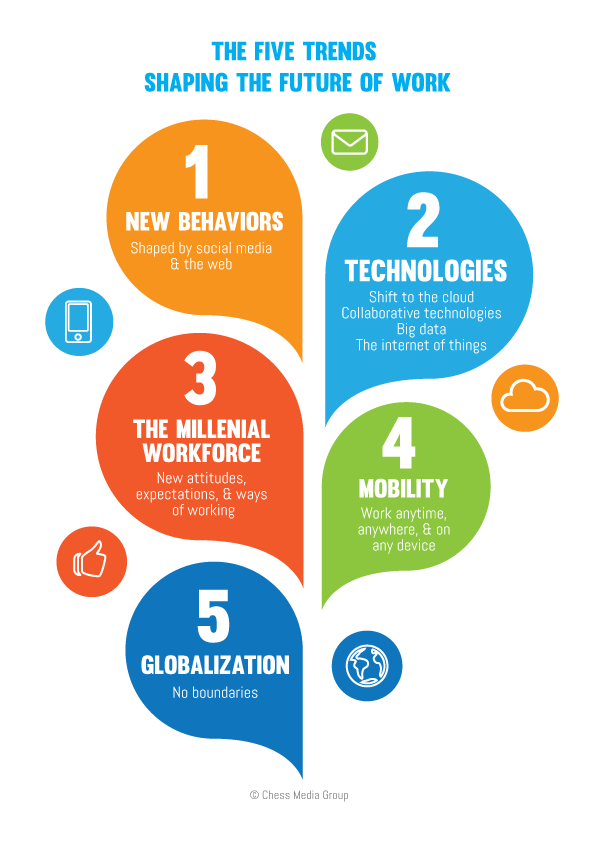

2. Technology-Driven M&A:

- Artificial Intelligence (AI) and Machine Learning (ML): The integration of AI and ML into business operations is driving a surge in M&A activity, with companies acquiring firms that possess advanced AI capabilities. This trend is particularly prevalent in industries like finance, retail, and manufacturing, where AI-powered solutions can enhance efficiency and customer experience.

- Cybersecurity: With cyber threats becoming increasingly sophisticated, companies are prioritizing cybersecurity investments. M&A activity in this sector is expected to increase, with companies acquiring cybersecurity firms to strengthen their defenses and build a competitive advantage.

- Cloud Computing: The shift towards cloud-based solutions is fueling M&A activity in the cloud computing sector. Companies are acquiring cloud service providers to enhance their cloud infrastructure and gain access to new capabilities.

3. The Influence of Private Equity:

- Increased Private Equity Activity: Private equity firms are playing an increasingly active role in M&A, fueled by abundant capital and a search for attractive investment opportunities. This increased activity is expected to continue in 2025, driving a surge in leveraged buyouts (LBOs) and other private equity-backed acquisitions.

- Focus on Special Purpose Acquisition Companies (SPACs): SPACs have gained significant popularity in recent years, providing an alternative path for companies to go public. This trend is expected to continue in 2025, with SPACs playing a more prominent role in M&A activity.

4. Environmental, Social, and Governance (ESG) Considerations:

- Growing Investor Interest: ESG factors are increasingly influencing investment decisions, with investors seeking companies that demonstrate a commitment to sustainability, social responsibility, and good governance. This trend is driving M&A activity, as companies seek to acquire businesses with strong ESG credentials.

- ESG-Focused Acquisitions: Companies are increasingly making ESG-focused acquisitions, acquiring businesses that align with their sustainability goals or that operate in industries with strong ESG potential. This trend is expected to gain momentum in 2025, as investors prioritize companies with strong ESG performance.

5. Cross-Border M&A:

- Global Expansion: Companies are increasingly looking to expand their operations into new geographic markets, seeking to tap into emerging growth opportunities and diversify their revenue streams. Cross-border M&A is a key strategy for achieving this global expansion.

- Geopolitical Considerations: Geopolitical factors, such as trade tensions and regional conflicts, can significantly impact cross-border M&A activity. Companies need to carefully consider these factors when evaluating potential acquisitions.

6. Regulatory Landscape:

- Antitrust Scrutiny: Regulators are increasingly scrutinizing M&A deals, particularly in industries with high market concentration. This trend is expected to continue in 2025, with regulators focusing on ensuring fair competition and preventing anti-competitive mergers.

- Data Privacy and Security: Data privacy and security regulations are becoming increasingly stringent, impacting M&A activity in industries that handle sensitive data. Companies need to carefully consider these regulations when evaluating potential acquisitions.

7. The Role of Technology in M&A:

- Virtual Due Diligence: Technology is transforming the due diligence process, enabling companies to conduct virtual due diligence more efficiently and effectively. This trend is expected to continue in 2025, with virtual due diligence becoming the norm for many transactions.

- Data Analytics and Predictive Modeling: Data analytics and predictive modeling are playing an increasingly important role in M&A, providing insights into target companies’ performance, market trends, and potential risks. This trend is expected to continue in 2025, with companies leveraging data analytics to make more informed acquisition decisions.

8. Impact of Economic Uncertainty:

- Market Volatility: Economic uncertainty, including inflation, interest rate hikes, and geopolitical instability, can create volatility in the M&A market. Companies may be hesitant to make large acquisitions during periods of economic uncertainty.

- Valuation Challenges: Economic uncertainty can make it difficult to accurately value target companies, leading to challenges in negotiating deal terms.

Related Searches

1. M&A Trends in Specific Industries:

- Technology M&A: The technology sector is experiencing a surge in M&A activity, driven by innovation, cloud computing, and the rise of artificial intelligence.

- Healthcare M&A: The healthcare sector is seeing increased M&A activity as companies seek to consolidate their operations and expand into new areas, such as telehealth and personalized medicine.

- Financial Services M&A: The financial services sector is experiencing a wave of M&A activity as companies seek to streamline their operations, enhance their technology capabilities, and expand into new markets.

2. M&A Deal Structure:

- Leveraged Buyouts (LBOs): LBOs remain a popular deal structure, with private equity firms using debt to finance acquisitions.

- Merger of Equals (MoE): MoEs are becoming more common, with two companies of similar size merging to create a stronger entity.

- Joint Ventures: Joint ventures are a way for companies to collaborate on specific projects or enter new markets.

3. M&A Due Diligence:

- Virtual Due Diligence: Virtual due diligence is becoming increasingly common, leveraging technology to conduct due diligence remotely.

- Data Analytics and Predictive Modeling: Data analytics and predictive modeling are being used to enhance due diligence processes.

- Cybersecurity Due Diligence: Cybersecurity due diligence is becoming increasingly important, with companies assessing the cybersecurity risks of potential acquisition targets.

4. M&A Integration:

- Post-Merger Integration (PMI): Successful integration is crucial for the success of any M&A transaction. Companies are increasingly investing in PMI planning and execution.

- Change Management: Effective change management is essential for integrating acquired companies and ensuring a smooth transition.

- Culture Integration: Integrating the cultures of two companies is a critical aspect of PMI, ensuring a successful merger.

5. M&A Valuation:

- Valuation Methods: Various valuation methods are used to determine the fair market value of a target company.

- Deal Structure and Financing: Deal structure and financing arrangements can significantly impact valuation.

- Market Conditions: Market conditions, including interest rates and economic growth, can influence valuation.

6. M&A Legal and Regulatory Considerations:

- Antitrust Laws: Antitrust laws regulate M&A activity to prevent monopolies and promote fair competition.

- Data Privacy and Security Regulations: Data privacy and security regulations can impact M&A transactions, particularly in industries that handle sensitive data.

- Tax Implications: M&A transactions have significant tax implications, which must be carefully considered.

7. M&A Technology and Tools:

- M&A Software: Specialized M&A software is available to streamline deal processes and enhance efficiency.

- Data Analytics Platforms: Data analytics platforms provide insights into target companies and market trends.

- Virtual Data Rooms: Virtual data rooms facilitate secure document sharing and collaboration during due diligence.

8. M&A Trends in Emerging Markets:

- Growth Opportunities: Emerging markets offer significant growth opportunities for companies seeking to expand their operations.

- Regulatory Considerations: Companies must carefully consider the regulatory landscape when pursuing M&A transactions in emerging markets.

- Cultural Differences: Cultural differences can impact M&A transactions in emerging markets.

FAQs

1. What are the key drivers of M&A activity in 2025?

The key drivers of M&A activity in 2025 include:

- Growth and Innovation: Companies are seeking acquisitions that enhance their growth and innovation capabilities.

- Technological Advancements: The rapid pace of technological advancements is driving M&A activity in sectors like AI, cybersecurity, and cloud computing.

- Private Equity Activity: Private equity firms are playing an increasingly active role in M&A, fueled by abundant capital.

- ESG Considerations: Investors are prioritizing companies with strong ESG credentials, driving M&A activity in this area.

- Global Expansion: Companies are seeking to expand their operations into new geographic markets.

2. What are the biggest challenges facing companies considering M&A in 2025?

The biggest challenges facing companies considering M&A in 2025 include:

- Economic Uncertainty: Economic volatility can make it difficult to value target companies and negotiate deal terms.

- Regulatory Scrutiny: Regulators are increasingly scrutinizing M&A deals, particularly in industries with high market concentration.

- Data Privacy and Security Regulations: Data privacy and security regulations are becoming increasingly stringent, impacting M&A activity.

- Integration Challenges: Integrating acquired companies can be complex and challenging, requiring careful planning and execution.

- Culture Clash: Integrating the cultures of two companies can be a significant challenge, potentially hindering the success of the merger.

3. How can companies prepare for M&A activity in 2025?

Companies can prepare for M&A activity in 2025 by:

- Developing a Clear M&A Strategy: Define their M&A goals, target markets, and acquisition criteria.

- Building a Strong M&A Team: Assemble a team with expertise in M&A, due diligence, integration, and legal and regulatory matters.

- Investing in Technology: Leverage technology to enhance due diligence, valuation, and integration processes.

- Understanding the Regulatory Landscape: Stay informed about relevant regulations and their impact on M&A transactions.

- Focusing on ESG Considerations: Prioritize ESG factors in their M&A strategy, seeking to acquire businesses with strong ESG credentials.

Tips

- Conduct Thorough Due Diligence: Ensure a comprehensive understanding of the target company’s financials, operations, and regulatory environment.

- Develop a Robust Integration Plan: Plan for the integration of the acquired company, including cultural, operational, and technological aspects.

- Communicate Effectively: Maintain open and transparent communication with stakeholders throughout the M&A process.

- Seek Professional Advice: Consult with experienced M&A advisors, including lawyers, accountants, and investment bankers.

- Stay Informed about Market Trends: Monitor M&A trends and adapt their strategy accordingly.

Conclusion

The M&A landscape in 2025 is expected to be shaped by a confluence of factors, including technological advancements, evolving market dynamics, and changing investor preferences. Companies must adapt to these trends to succeed in the competitive M&A market. By understanding the key drivers, challenges, and opportunities in M&A, companies can make informed decisions and navigate the evolving landscape effectively.

Closure

Thus, we hope this article has provided valuable insights into Navigating the Evolving Landscape: M&A Trends Shaping 2025. We appreciate your attention to our article. See you in our next article!