Navigating The Future: Home Loan Interest Rate Trends In 2025

Navigating the Future: Home Loan Interest Rate Trends in 2025

Related Articles: Navigating the Future: Home Loan Interest Rate Trends in 2025

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to Navigating the Future: Home Loan Interest Rate Trends in 2025. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

- 1 Related Articles: Navigating the Future: Home Loan Interest Rate Trends in 2025

- 2 Introduction

- 3 Navigating the Future: Home Loan Interest Rate Trends in 2025

- 3.1 Factors Shaping Home Loan Interest Rate Trends in 2025

- 3.2 Historical Trends and Future Projections

- 3.3 Home Loan Interest Rate Trends in 2025: Implications for Homebuyers and Homeowners

- 3.4 Home Loan Interest Rate Trends in 2025: Related Searches

- 3.5 Home Loan Interest Rate Trends in 2025: FAQs

- 3.6 Home Loan Interest Rate Trends in 2025: Tips

- 3.7 Home Loan Interest Rate Trends in 2025: Conclusion

- 4 Closure

Navigating the Future: Home Loan Interest Rate Trends in 2025

The housing market is a dynamic landscape, constantly influenced by economic forces, government policies, and global events. Home loan interest rate trends are a critical factor in this landscape, shaping the affordability and accessibility of homeownership. As we look toward 2025, understanding these trends becomes crucial for both prospective homebuyers and existing homeowners.

This in-depth analysis will delve into the factors influencing home loan interest rate trends in 2025, exploring potential scenarios and their implications. We will examine key economic indicators, analyze historical trends, and consider the impact of evolving financial regulations. This comprehensive overview aims to provide valuable insights for informed decision-making in the housing market.

Factors Shaping Home Loan Interest Rate Trends in 2025

Several key factors will influence home loan interest rate trends in 2025:

- Inflation and Monetary Policy: The Federal Reserve’s monetary policy plays a pivotal role in shaping interest rates. The Fed’s efforts to control inflation through adjustments to the federal funds rate directly impact the cost of borrowing, including home loans. If inflation remains high, the Fed may need to keep interest rates elevated, potentially pushing home loan interest rates higher.

- Economic Growth and Employment: A robust economy with strong job growth typically leads to increased demand for housing, which can drive up home loan interest rates. Conversely, economic downturns can lead to lower interest rates as lenders seek to stimulate borrowing.

- Government Policies and Regulations: Government policies, such as tax incentives for homeownership or changes in mortgage regulations, can significantly impact home loan interest rates. For example, stricter lending standards may lead to higher interest rates as lenders assess risk more conservatively.

- Global Economic Conditions: Global economic events, such as trade wars or geopolitical instability, can create uncertainty in financial markets and influence home loan interest rates. These events can lead to increased risk aversion among lenders, resulting in higher interest rates.

- Supply and Demand Dynamics: The balance between housing supply and demand is a significant factor. A shortage of available homes can drive up prices and potentially lead to higher home loan interest rates. Conversely, an oversupply of housing can put downward pressure on prices and interest rates.

Historical Trends and Future Projections

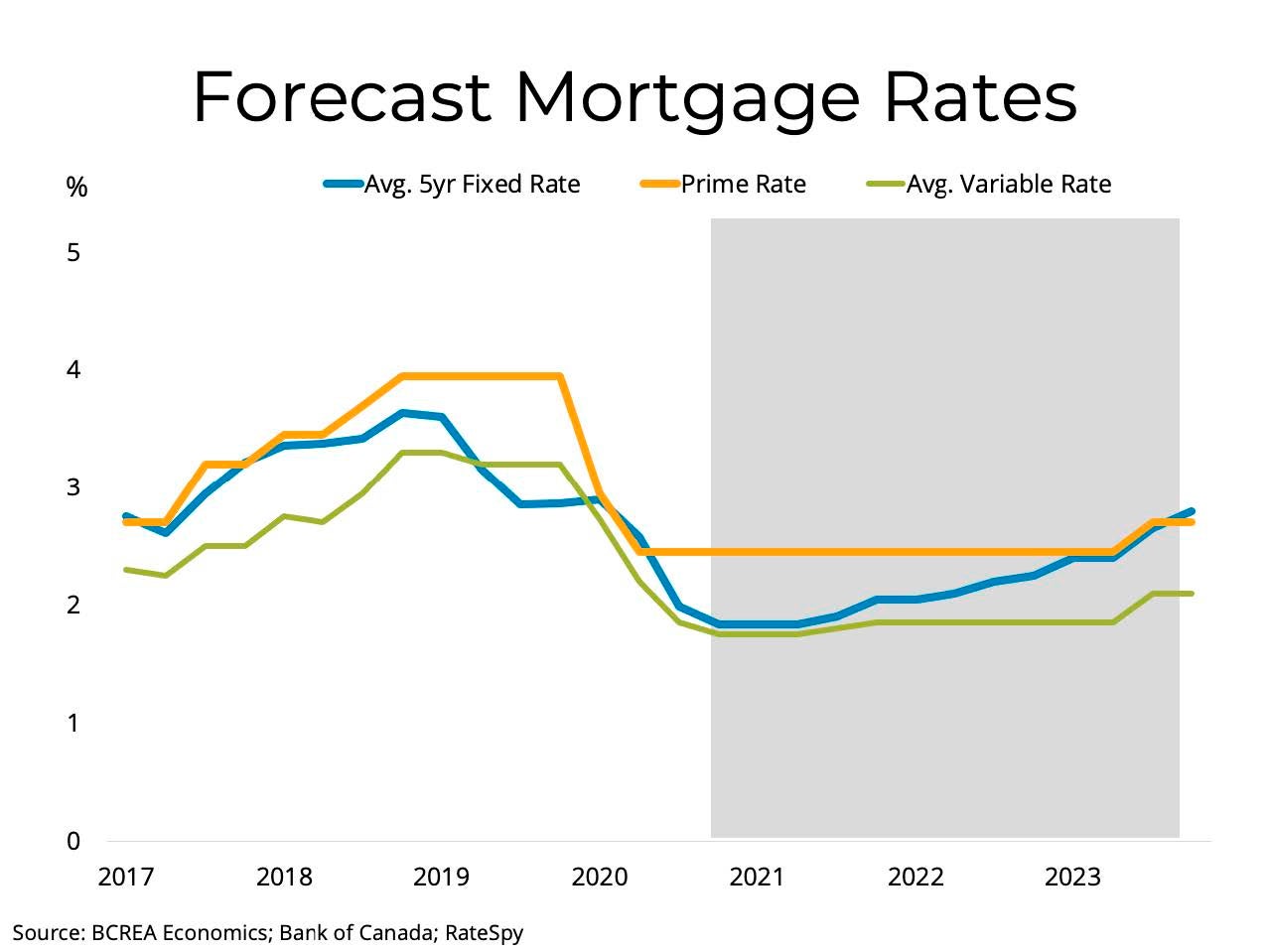

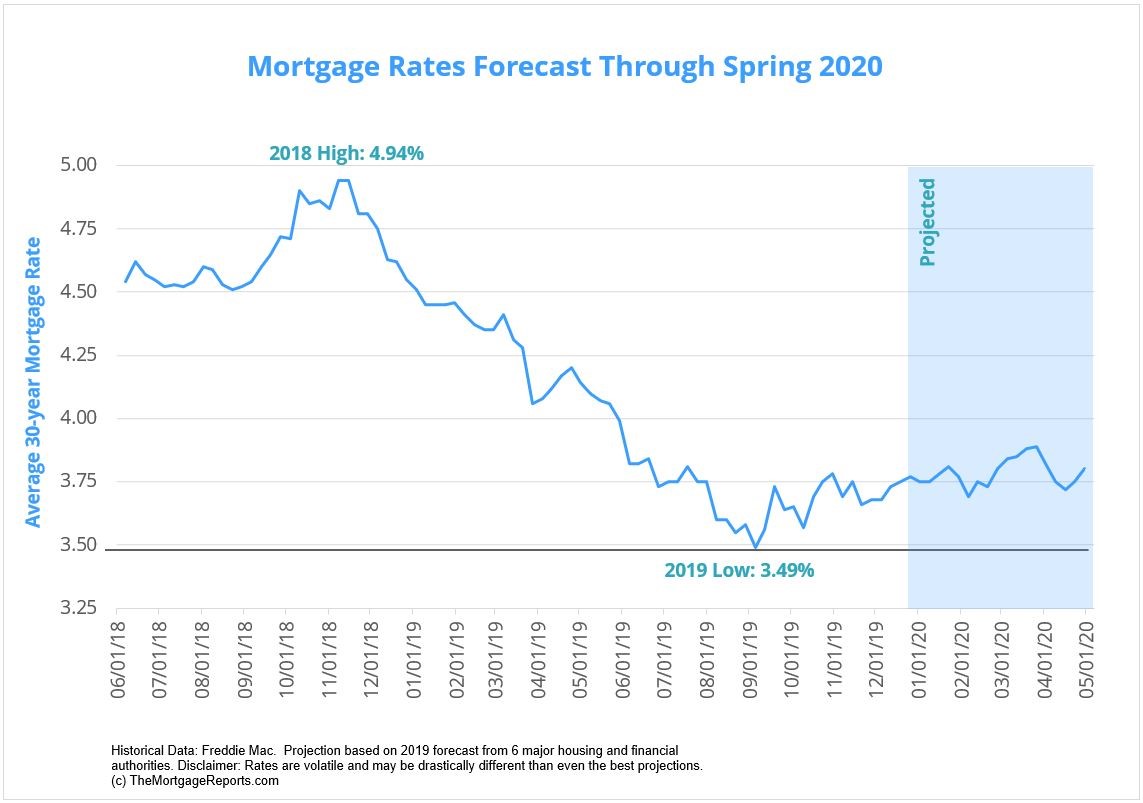

Analyzing historical trends in home loan interest rates can provide valuable insights into potential future movements. Over the past few decades, home loan interest rates have fluctuated significantly, influenced by economic cycles and policy changes.

- The 1980s: This decade saw home loan interest rates reach record highs, exceeding 18% in the early 1980s due to high inflation and aggressive monetary policy.

- The 1990s: The 1990s witnessed a decline in home loan interest rates as inflation subsided and the economy stabilized. Rates hovered around 7% to 9%.

- The 2000s: The early 2000s saw a period of historically low home loan interest rates, reaching below 5% in the mid-2000s. This was fueled by the housing bubble and loose lending practices.

- The 2010s: The aftermath of the financial crisis saw home loan interest rates gradually rise, but they remained relatively low compared to historical averages.

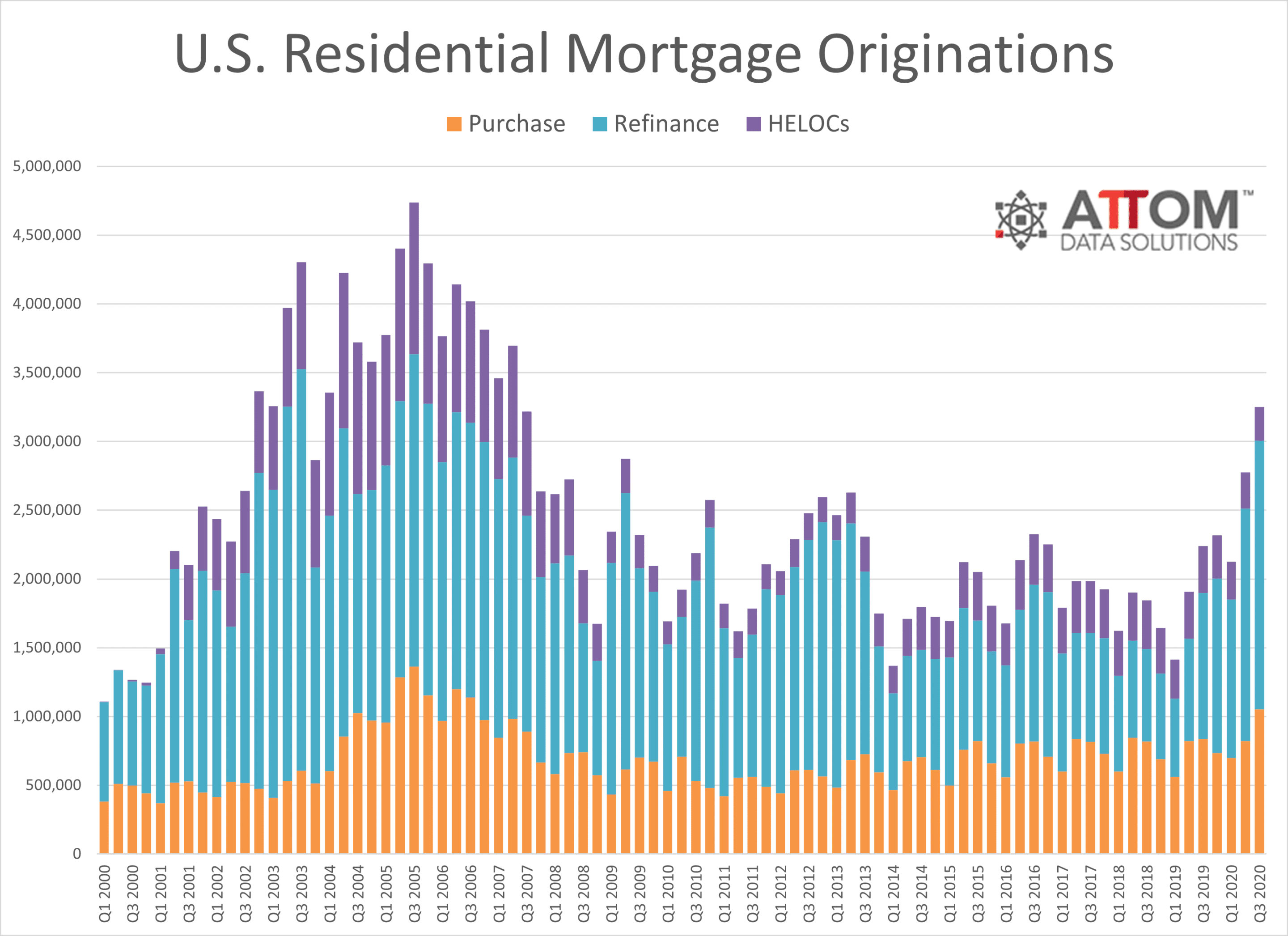

- The 2020s: The COVID-19 pandemic initially led to a sharp decline in home loan interest rates as the Fed implemented emergency measures. However, rising inflation and economic recovery spurred a rebound in rates, reaching levels not seen in years.

Looking ahead, home loan interest rate trends in 2025 are likely to be influenced by the continued interplay of economic forces and policy decisions. While predicting the future with absolute certainty is impossible, several potential scenarios are worth considering:

- Scenario 1: Continued Inflation and Rising Interest Rates: If inflation remains persistent and the Fed continues to raise interest rates to combat it, home loan interest rates in 2025 could be significantly higher than current levels. This scenario would likely lead to reduced affordability and slower housing market growth.

- Scenario 2: Controlled Inflation and Gradual Rate Increases: If inflation gradually subsides and the Fed adopts a more moderate approach to interest rate hikes, home loan interest rates in 2025 could stabilize at a slightly higher level than currently. This scenario would provide a more balanced environment for the housing market.

- Scenario 3: Economic Slowdown and Interest Rate Cuts: A significant economic slowdown could prompt the Fed to cut interest rates to stimulate borrowing and economic activity. This scenario could lead to lower home loan interest rates in 2025, potentially boosting housing demand.

Home Loan Interest Rate Trends in 2025: Implications for Homebuyers and Homeowners

Understanding home loan interest rate trends in 2025 is crucial for both prospective homebuyers and existing homeowners. Here’s how these trends might impact them:

Prospective Homebuyers:

- Affordability: Higher home loan interest rates can significantly impact affordability, making it more challenging for potential homebuyers to qualify for a mortgage or afford monthly payments.

- Market Volatility: Fluctuating interest rates can create uncertainty in the housing market, making it difficult to predict the future direction of home prices and financing costs.

- Strategic Planning: Homebuyers may need to adjust their plans and timelines based on anticipated interest rate movements. For example, if interest rates are expected to rise, it may be advantageous to purchase a home sooner rather than later.

Existing Homeowners:

- Refinancing Opportunities: Lower home loan interest rates can present opportunities for refinancing existing mortgages to secure a lower interest rate and potentially save on monthly payments.

- Equity Building: Rising home values and lower interest rates can contribute to faster equity building, allowing homeowners to access more cash through home equity lines of credit or refinancing.

- Market Sensitivity: Homeowners should be aware of how rising interest rates might impact their property value and refinancing options.

Home Loan Interest Rate Trends in 2025: Related Searches

Exploring related searches can provide a more comprehensive understanding of home loan interest rate trends in 2025. Here are some key areas to consider:

- Mortgage Rates Forecast 2025: Examining forecasts from reputable sources, such as financial institutions and economic analysts, can provide insights into potential interest rate trajectories.

- Average Mortgage Rates 2025: Understanding the average home loan interest rates projected for 2025 can help gauge the overall cost of borrowing.

- Fixed vs. Variable Mortgage Rates 2025: Analyzing the differences between fixed and variable mortgage rates and their potential impact on affordability in 2025 can inform informed decision-making.

- Mortgage Rates by State 2025: Examining regional variations in home loan interest rates can provide insights into potential affordability differences across the country.

- Mortgage Rate Calculator 2025: Using a mortgage rate calculator can help estimate monthly payments and the total cost of a mortgage based on various interest rate scenarios.

- Impact of Inflation on Mortgage Rates: Understanding the direct relationship between inflation and home loan interest rates can help predict future trends.

- Federal Reserve Interest Rate Projections: Monitoring the Federal Reserve’s projections for interest rate adjustments can provide clues about the potential direction of home loan interest rates.

- Housing Market Outlook 2025: Analyzing the broader housing market outlook, including factors like home price trends and inventory levels, can provide context for understanding home loan interest rate trends.

Home Loan Interest Rate Trends in 2025: FAQs

Q: What are the main factors that will influence home loan interest rates in 2025?

A: Home loan interest rates in 2025 will be primarily influenced by inflation, the Federal Reserve’s monetary policy, economic growth, government policies, and global economic conditions.

Q: How can I predict home loan interest rates in 2025?

A: Predicting home loan interest rates with certainty is impossible. However, you can stay informed by monitoring economic indicators, analyzing historical trends, and following forecasts from reputable sources.

Q: What should I do if interest rates are expected to rise in 2025?

A: If interest rates are expected to rise, it may be advantageous for prospective homebuyers to purchase a home sooner rather than later to lock in a lower rate.

Q: What are the implications of higher home loan interest rates for existing homeowners?

A: Higher interest rates can make it more challenging for existing homeowners to refinance their mortgages to secure a lower rate. However, it can also lead to faster equity building due to rising home values.

Q: How can I prepare for potential changes in home loan interest rates?

A: Staying informed about economic trends and policy changes is essential. Consider consulting with a financial advisor to develop a plan that addresses your individual circumstances.

Home Loan Interest Rate Trends in 2025: Tips

- Monitor Economic Indicators: Keep abreast of inflation rates, unemployment figures, and other key economic indicators that can influence interest rate movements.

- Follow Financial News: Stay informed about the Federal Reserve’s monetary policy decisions and projections for interest rate adjustments.

- Consult with Financial Experts: Seek advice from a financial advisor or mortgage broker to understand your options and develop a strategy for navigating potential interest rate changes.

- Consider Fixed-Rate Mortgages: If you are concerned about rising interest rates, a fixed-rate mortgage can provide certainty and protection against future rate increases.

- Explore Refinancing Opportunities: If interest rates decline, explore refinancing options to secure a lower rate and potentially save on monthly payments.

- Build a Strong Credit Score: A good credit score can qualify you for lower interest rates and make you a more attractive borrower.

- Save for a Down Payment: A larger down payment can reduce the amount of your mortgage and potentially lower your interest rate.

- Shop Around for Rates: Compare rates from multiple lenders to find the best deal.

Home Loan Interest Rate Trends in 2025: Conclusion

Home loan interest rate trends will continue to play a significant role in the housing market in 2025 and beyond. While predicting the future with certainty is impossible, understanding the factors that influence these trends is essential for informed decision-making. By staying informed, monitoring economic indicators, and consulting with financial experts, both prospective homebuyers and existing homeowners can navigate the ever-changing landscape of home loan interest rate trends and make informed choices that align with their financial goals.

Closure

Thus, we hope this article has provided valuable insights into Navigating the Future: Home Loan Interest Rate Trends in 2025. We appreciate your attention to our article. See you in our next article!