Navigating The Future: Home Mortgage Rate Trends In 2025

Navigating the Future: Home Mortgage Rate Trends in 2025

Related Articles: Navigating the Future: Home Mortgage Rate Trends in 2025

Introduction

With enthusiasm, let’s navigate through the intriguing topic related to Navigating the Future: Home Mortgage Rate Trends in 2025. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating the Future: Home Mortgage Rate Trends in 2025

The housing market is a dynamic entity, constantly evolving under the influence of economic factors, government policies, and investor sentiment. A key driver of this dynamism is the ever-changing landscape of home mortgage rates. Predicting these rates with pinpoint accuracy is impossible, but understanding the forces at play and analyzing current trends can provide valuable insights into what the future holds for borrowers and the housing market as a whole.

Understanding the Drivers of Home Mortgage Rates

Before delving into the potential trends for 2025, it’s crucial to grasp the factors that influence home mortgage rates. These rates are fundamentally determined by the interplay of:

- The Federal Reserve’s Monetary Policy: The Federal Reserve (Fed) plays a pivotal role in shaping interest rates through its actions, primarily by setting the federal funds rate. When the Fed raises interest rates, it generally leads to higher borrowing costs, including those for mortgages. Conversely, rate cuts tend to lower borrowing costs. The Fed’s decisions are influenced by inflation, economic growth, and employment levels.

- Inflation: Inflation erodes the purchasing power of money, forcing lenders to demand higher interest rates to compensate for the diminished value of future repayments. High inflation often leads to increased mortgage rates.

- Economic Growth: A robust economy typically encourages lending, leading to lower mortgage rates. Conversely, economic downturns can lead to tighter lending standards and higher rates.

- Government Policies: Government regulations and initiatives can influence mortgage rates. For instance, changes in mortgage insurance requirements or tax incentives for homeownership can impact borrowing costs.

- Market Demand and Supply: The balance between the supply of available homes and the demand from buyers also influences mortgage rates. A shortage of homes can drive up prices, leading to higher mortgage rates as lenders seek to offset the risk of higher loan-to-value ratios.

Forecasting Home Mortgage Rate Trends in 2025: A Multifaceted Outlook

Predicting home mortgage rates in 2025 requires considering a complex interplay of factors. While no single forecast can be considered definitive, analysts and economists generally offer a range of perspectives:

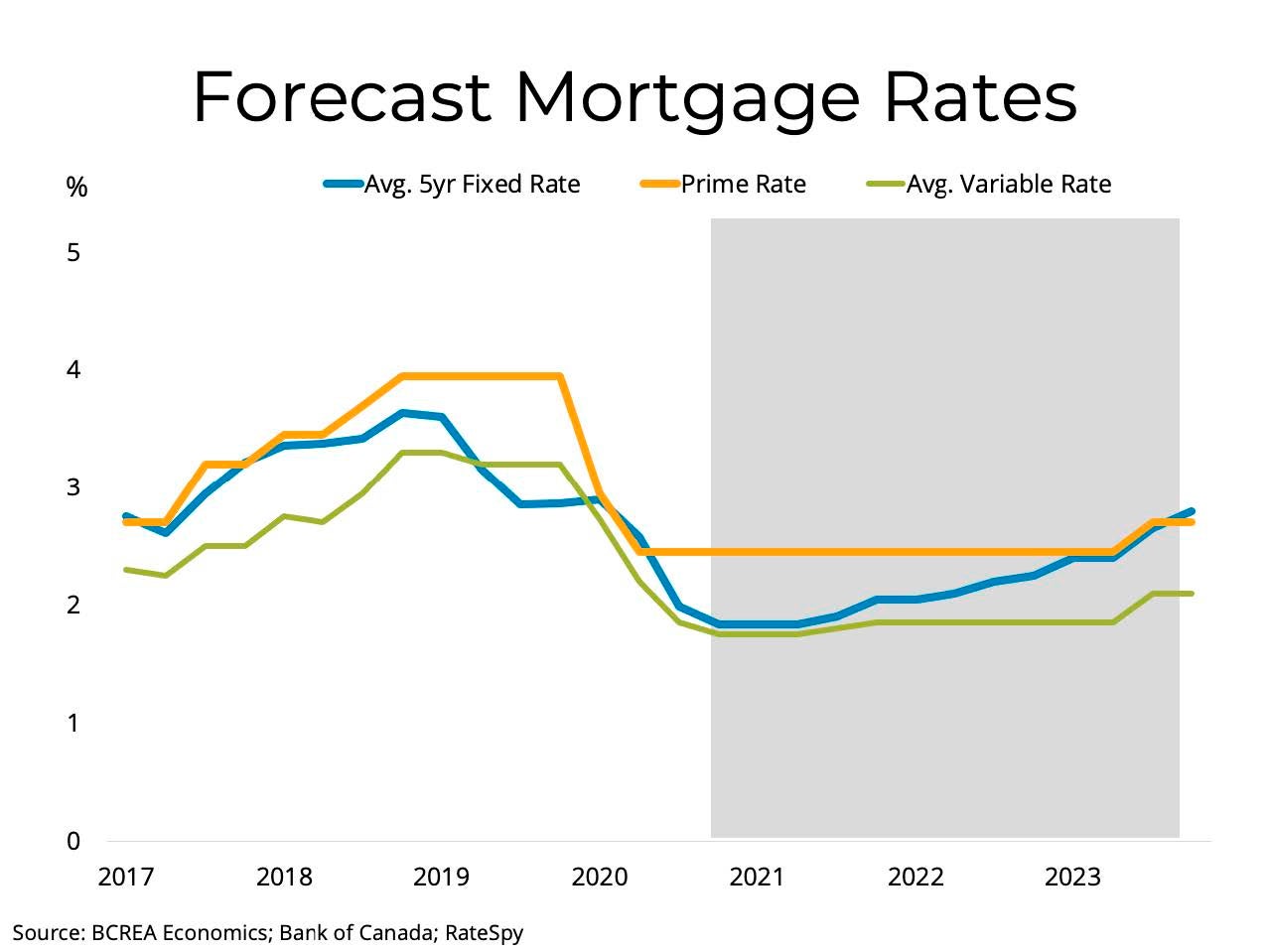

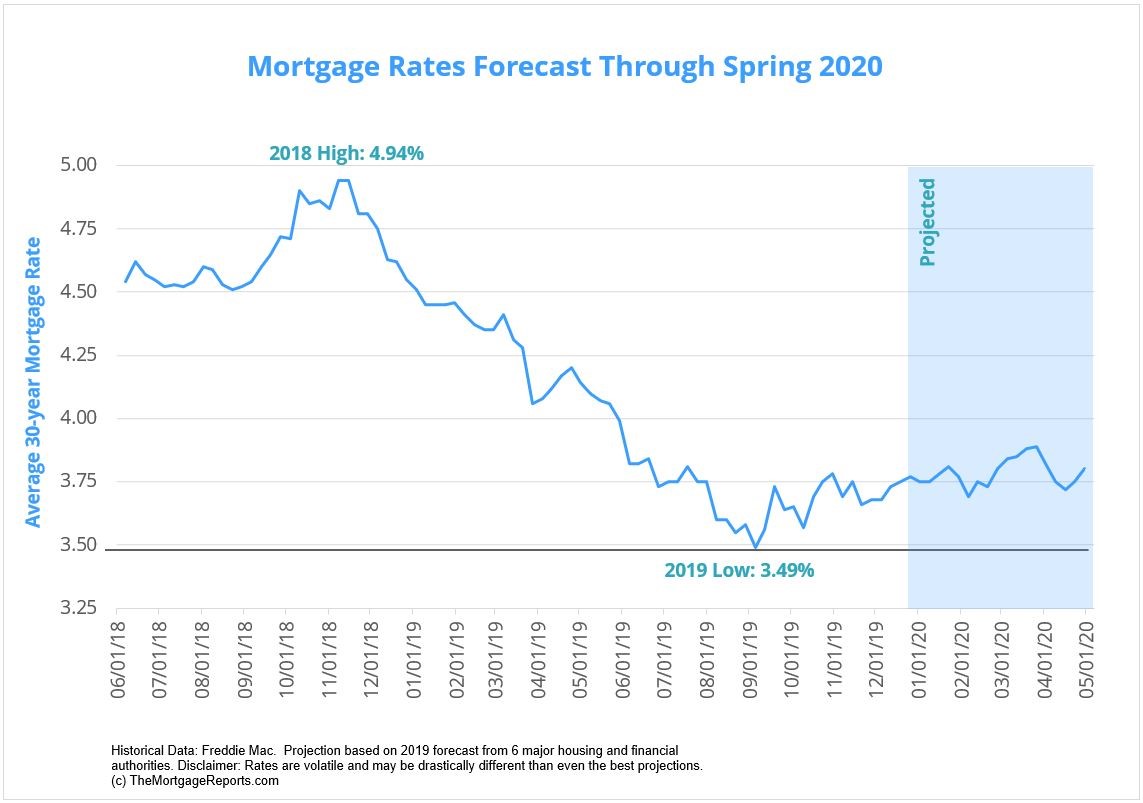

- Scenario 1: Moderate Rate Increases: This scenario assumes continued economic growth, moderate inflation, and a gradual tightening of monetary policy by the Fed. In this scenario, home mortgage rates could rise gradually throughout 2025, potentially reaching levels slightly higher than those seen in 2023.

- Scenario 2: Elevated Rates due to Persistent Inflation: If inflation remains stubbornly high, the Fed might be forced to implement more aggressive rate hikes to control it. This could lead to a more significant increase in home mortgage rates in 2025, potentially reaching levels not seen in recent years.

- Scenario 3: Rate Stabilization or Slight Decreases: This scenario hinges on the Fed’s ability to effectively manage inflation and achieve a "soft landing" for the economy. If inflation cools and economic growth remains steady, home mortgage rates could stabilize or even decrease slightly in 2025.

Impact of Home Mortgage Rate Trends on the Housing Market

The trajectory of home mortgage rates significantly impacts the housing market in several ways:

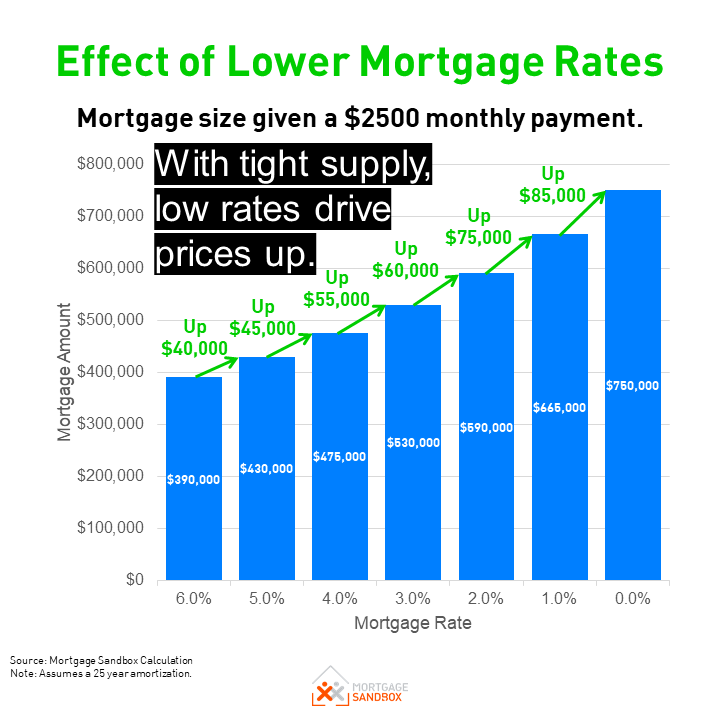

- Affordability: Higher mortgage rates make homeownership less affordable, potentially reducing demand and slowing down price growth. Conversely, lower rates can boost affordability, leading to increased demand and potentially driving up prices.

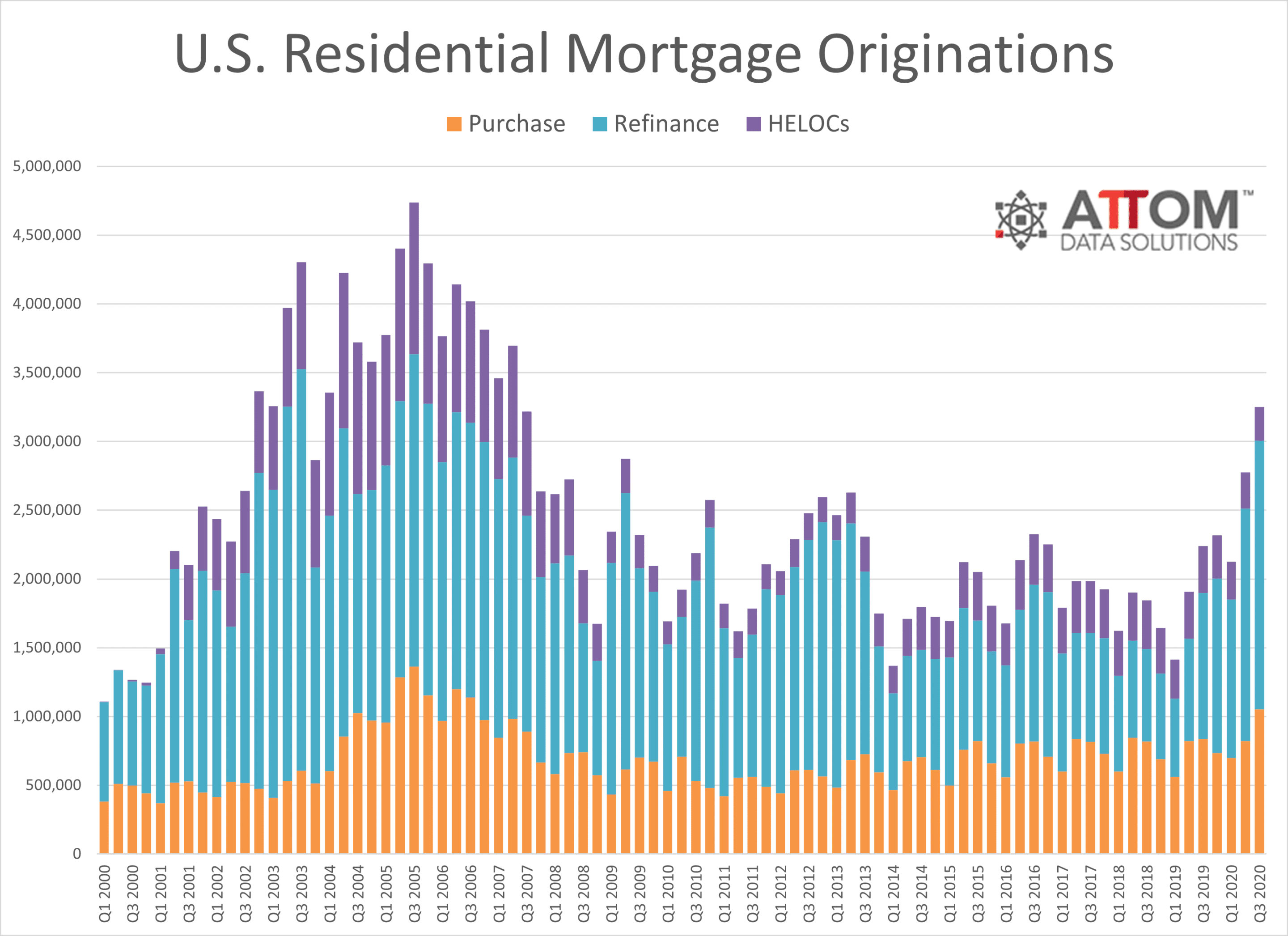

- Inventory Levels: Mortgage rates can influence the availability of homes for sale. High rates can discourage sellers from listing their properties, leading to lower inventory levels. Conversely, lower rates can encourage more sellers to enter the market, increasing inventory.

- Market Volatility: Fluctuations in mortgage rates can create uncertainty and volatility in the housing market. Rapid rate increases can lead to market corrections, while steady rates tend to foster stability.

Related Searches:

1. Average Home Mortgage Rates in 2025:

Predicting the average home mortgage rate for 2025 is challenging due to the dynamic nature of the market. However, analysts and economists often provide forecasts based on their interpretation of current trends and economic conditions. These forecasts typically range from a few percentage points above current levels to a more significant increase, depending on the assumed scenario for inflation and the Fed’s monetary policy.

2. Home Mortgage Rate Predictions for 2025:

Numerous financial institutions, economic research firms, and individual analysts offer predictions for home mortgage rates in 2025. These predictions often vary depending on the assumptions made about economic growth, inflation, and the Fed’s actions. It’s essential to consider the source of the prediction and the underlying assumptions before relying on any single forecast.

3. Will Home Mortgage Rates Go Up in 2025?:

The direction of home mortgage rates in 2025 is a subject of ongoing debate among economists and analysts. While there is no definitive answer, the prevailing consensus suggests that rates will likely rise to some degree. However, the extent of the increase will depend on the factors outlined above, including inflation, economic growth, and the Fed’s monetary policy.

4. What Are the Factors Affecting Home Mortgage Rates in 2025?:

As discussed earlier, home mortgage rates are influenced by a complex interplay of factors, including:

- The Federal Reserve’s Monetary Policy: The Fed’s actions in setting interest rates play a crucial role.

- Inflation: High inflation tends to push rates higher.

- Economic Growth: A strong economy generally leads to lower rates, while economic downturns can increase them.

- Government Policies: Regulations and initiatives related to housing can impact mortgage rates.

- Market Demand and Supply: The balance between the supply of homes and buyer demand also influences rates.

5. How to Prepare for Rising Home Mortgage Rates in 2025:

Preparing for potentially rising home mortgage rates involves taking proactive steps to manage your finances and explore options for securing a favorable rate:

- Improve Your Credit Score: A higher credit score can qualify you for lower interest rates.

- Save for a Larger Down Payment: A larger down payment reduces the loan amount and can help you qualify for a better rate.

- Shop Around for the Best Rates: Compare offers from multiple lenders to secure the most competitive rate.

- Consider a Fixed-Rate Mortgage: A fixed-rate mortgage locks in your interest rate, protecting you from future rate increases.

6. What Happens If Home Mortgage Rates Go Down in 2025?:

If home mortgage rates decrease in 2025, it could benefit both existing homeowners and potential buyers:

- Existing Homeowners: Lower rates could make it more attractive to refinance their existing mortgages, potentially reducing their monthly payments.

- Potential Buyers: Lower rates can boost affordability, increasing demand and potentially driving up home prices.

7. How Do Home Mortgage Rates Impact the Economy?:

Home mortgage rates have a significant impact on the economy, affecting several key aspects:

- Consumer Spending: Higher mortgage rates can reduce disposable income for homeowners, leading to decreased consumer spending.

- Housing Construction: Lower rates can stimulate housing construction, creating jobs and boosting economic growth.

- Inflation: Rising mortgage rates can contribute to inflation by increasing the cost of housing, which is a significant component of the consumer price index.

8. What Are the Alternatives to a Traditional Home Mortgage in 2025?:

The traditional 30-year fixed-rate mortgage remains a popular option, but alternative financing options are also available, including:

- Adjustable-Rate Mortgages (ARMs): ARMs offer lower initial interest rates than fixed-rate mortgages but have rates that adjust periodically based on market conditions.

- Government-Backed Mortgages: The Federal Housing Administration (FHA), the Department of Veterans Affairs (VA), and the USDA offer government-backed mortgages with more lenient qualifying requirements and lower down payments.

- Jumbo Mortgages: Jumbo mortgages are larger loans that exceed the conforming loan limits set by Fannie Mae and Freddie Mac. They typically have higher interest rates than conforming loans.

FAQs about Home Mortgage Rate Trends in 2025:

1. What are the current home mortgage rates in 2023?

As of November 2023, average mortgage rates for 30-year fixed-rate mortgages are around 7.00%. However, rates can vary depending on factors such as credit score, loan amount, and lender.

2. What are the factors that could lead to higher home mortgage rates in 2025?

The primary factors that could drive higher mortgage rates in 2025 include:

- Persistent inflation: If inflation remains high, the Fed may need to increase interest rates more aggressively, leading to higher mortgage rates.

- Strong economic growth: While strong economic growth is generally positive, it can also lead to higher inflation and potentially higher mortgage rates.

- Increased demand for housing: If demand for housing continues to exceed supply, it can put upward pressure on prices and mortgage rates.

3. What are the factors that could lead to lower home mortgage rates in 2025?

Factors that could potentially lead to lower mortgage rates in 2025 include:

- Cooling inflation: If inflation subsides, the Fed may be able to ease its monetary policy, potentially lowering mortgage rates.

- Economic slowdown: A slowdown in economic growth could lead to lower inflation and potentially lower mortgage rates.

- Increased housing supply: An increase in housing supply could ease pressure on prices and potentially lead to lower mortgage rates.

4. How can I get the best possible home mortgage rate in 2025?

To secure the best possible mortgage rate in 2025, consider the following:

- Improve your credit score: A higher credit score can qualify you for lower interest rates.

- Save for a larger down payment: A larger down payment reduces the loan amount and can make you more attractive to lenders.

- Shop around for the best rates: Compare offers from multiple lenders to find the most competitive rate.

- Consider a fixed-rate mortgage: A fixed-rate mortgage locks in your interest rate, protecting you from future rate increases.

5. What are the risks of taking out a mortgage with a variable interest rate in 2025?

Variable-rate mortgages (ARMs) offer lower initial interest rates but have rates that adjust periodically based on market conditions. The risk with ARMs is that your monthly payments could increase significantly if interest rates rise.

Tips for Navigating Home Mortgage Rate Trends in 2025:

- Stay Informed: Monitor economic news and industry reports to stay informed about potential changes in mortgage rates.

- Plan Ahead: If you anticipate buying a home in the near future, plan your finances and get pre-approved for a mortgage to be prepared for potential rate fluctuations.

- Consider Your Financial Situation: Evaluate your financial situation and determine how much of a monthly payment you can comfortably afford.

- Shop Around for the Best Rates: Compare offers from multiple lenders to secure the most competitive rate.

- Consider a Fixed-Rate Mortgage: A fixed-rate mortgage locks in your interest rate, providing stability and predictability.

Conclusion:

Predicting home mortgage rates with certainty is an impossible task, but understanding the underlying factors and analyzing current trends can provide valuable insights into potential scenarios for 2025. The future of home mortgage rates will likely be shaped by the interplay of inflation, economic growth, the Fed’s monetary policy, and other factors. By staying informed, planning ahead, and seeking expert advice, borrowers can navigate the dynamic housing market and make informed decisions about their mortgage financing.

Closure

Thus, we hope this article has provided valuable insights into Navigating the Future: Home Mortgage Rate Trends in 2025. We thank you for taking the time to read this article. See you in our next article!