Navigating The Future: Interest Rates Mortgage Trends Graph 2025

Navigating the Future: Interest Rates Mortgage Trends Graph 2025

Related Articles: Navigating the Future: Interest Rates Mortgage Trends Graph 2025

Introduction

With great pleasure, we will explore the intriguing topic related to Navigating the Future: Interest Rates Mortgage Trends Graph 2025. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

- 1 Related Articles: Navigating the Future: Interest Rates Mortgage Trends Graph 2025

- 2 Introduction

- 3 Navigating the Future: Interest Rates Mortgage Trends Graph 2025

- 3.1 Understanding the Dynamics: Interest Rates and Mortgage Trends

- 3.2 Key Factors Influencing the Interest Rates Mortgage Trends Graph 2025

- 3.3 Interpreting the Interest Rates Mortgage Trends Graph 2025

- 3.4 Interest Rates Mortgage Trends Graph 2025 and its Implications

- 3.5 Interest Rates Mortgage Trends Graph 2025 and its Role in Financial Planning

- 3.6 Interest Rates Mortgage Trends Graph 2025 and its Influence on Market Sentiment

- 3.7 Related Searches

- 3.8 FAQs about Interest Rates Mortgage Trends Graph 2025

- 3.9 Tips for Utilizing the Interest Rates Mortgage Trends Graph 2025

- 3.10 Conclusion

- 4 Closure

Navigating the Future: Interest Rates Mortgage Trends Graph 2025

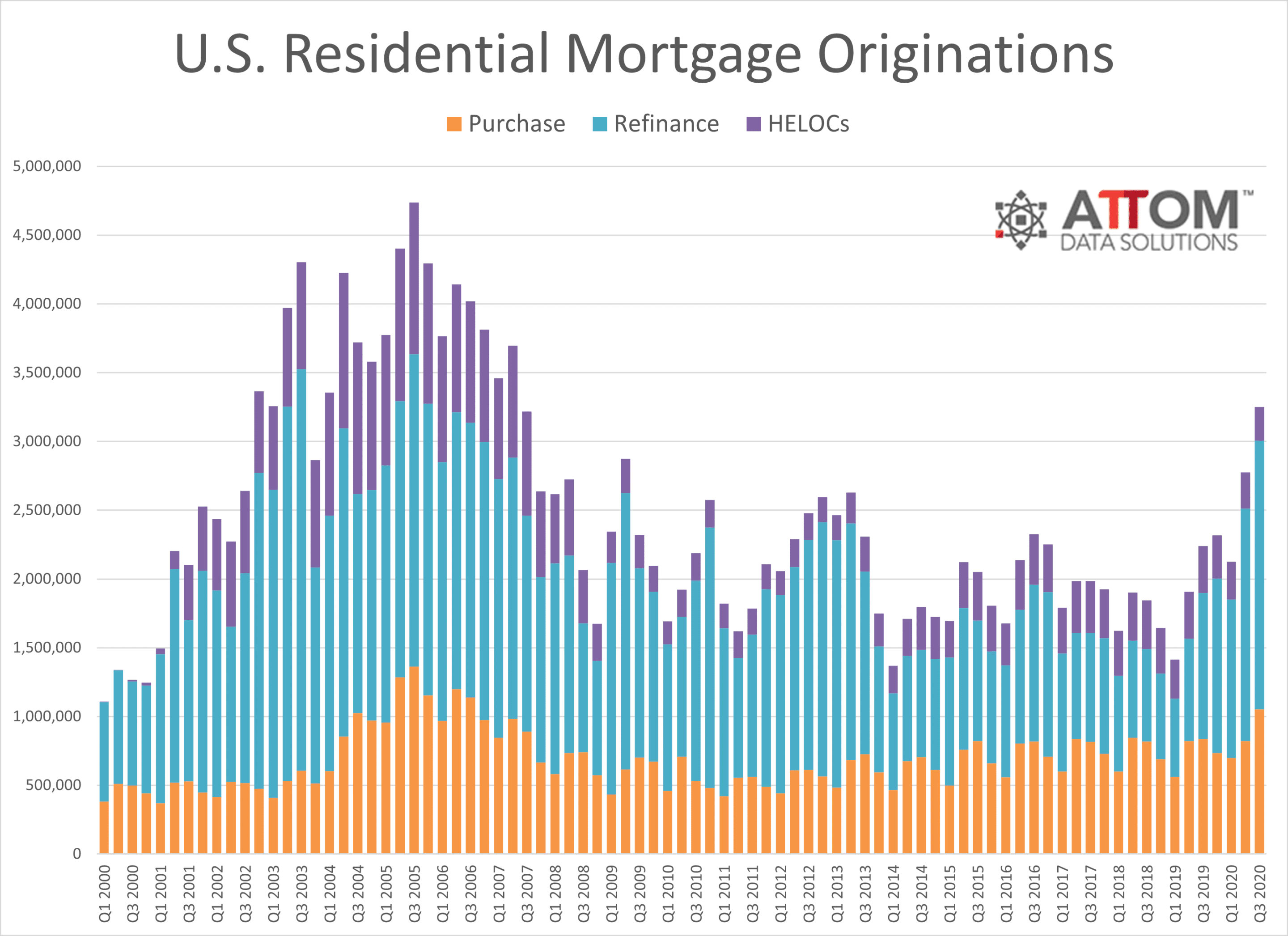

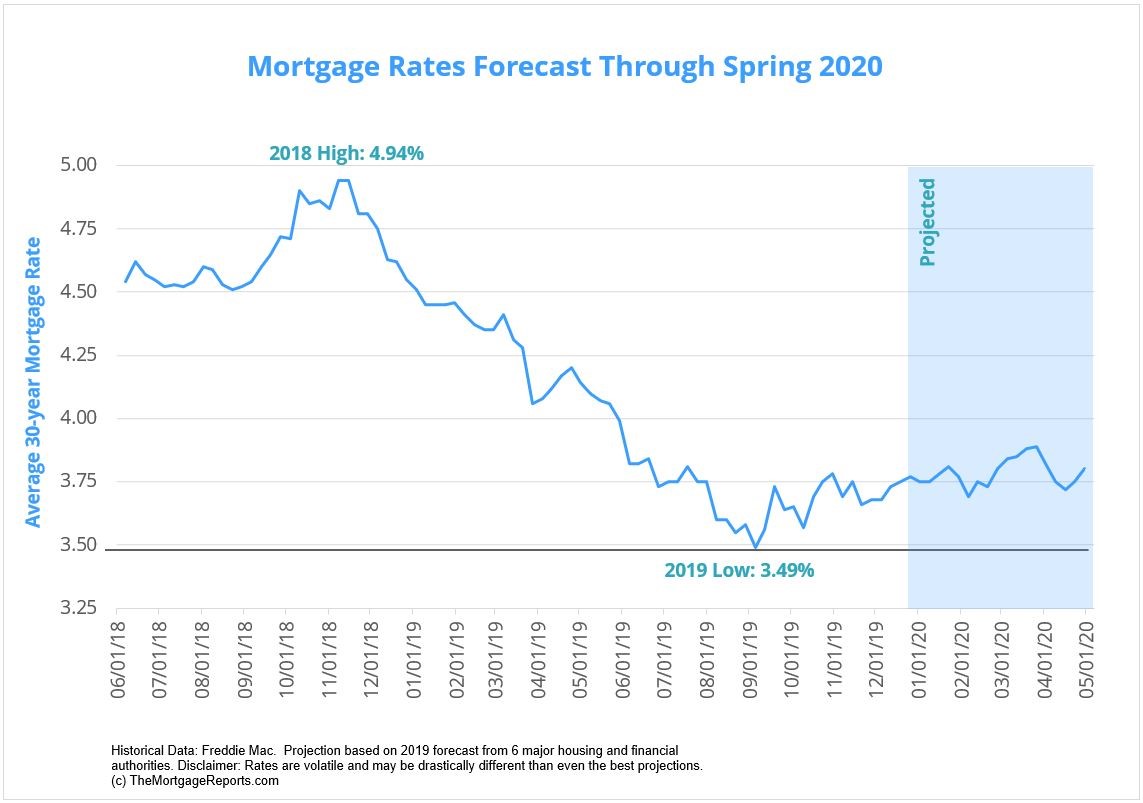

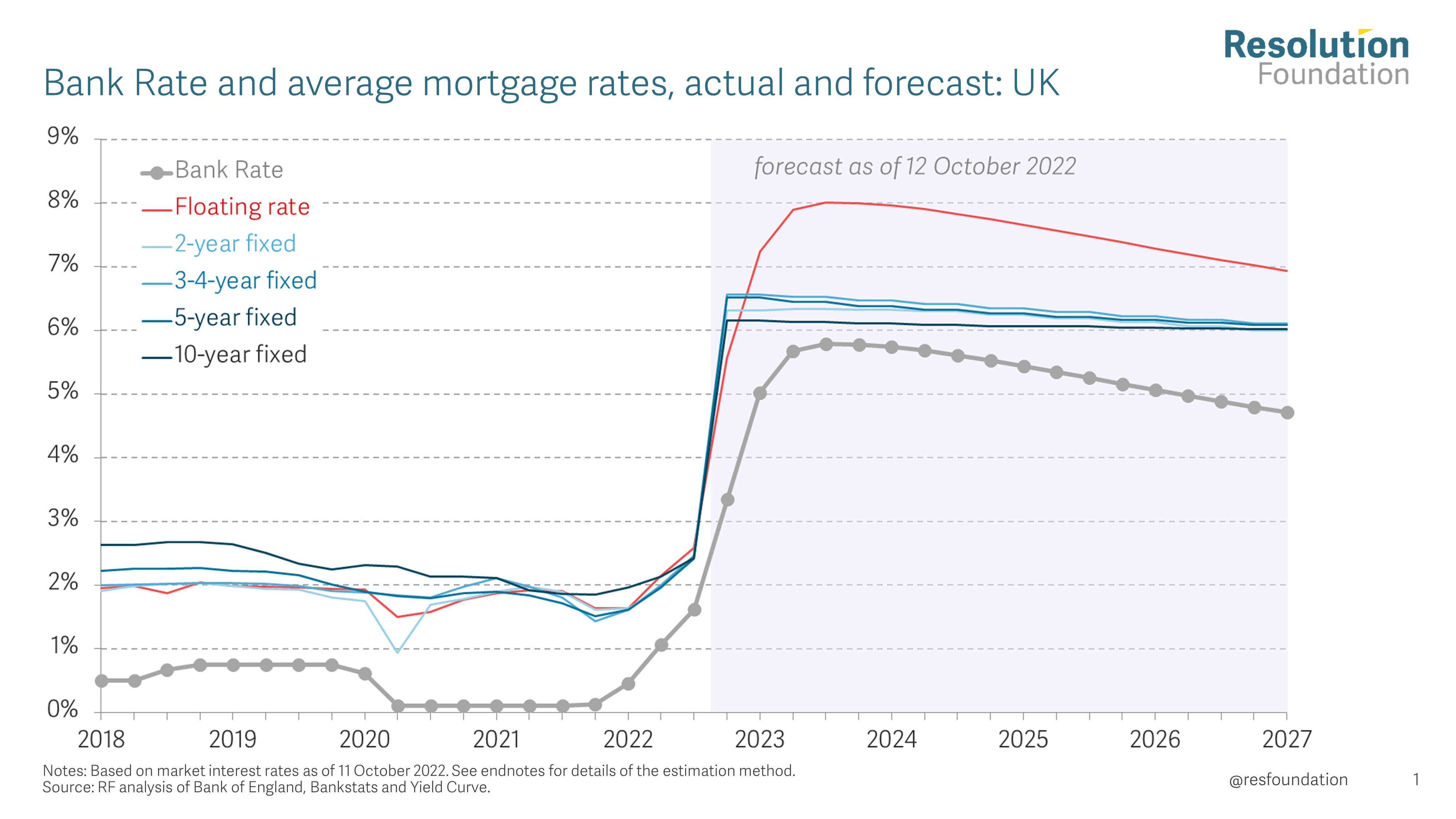

The housing market is a complex ecosystem, influenced by a multitude of factors, with interest rates playing a pivotal role in shaping mortgage trends. Understanding the trajectory of these rates is crucial for both prospective homebuyers and seasoned investors. This article delves into the projected landscape of interest rates mortgage trends graph 2025, providing a comprehensive analysis and exploring its implications for the real estate sector.

Understanding the Dynamics: Interest Rates and Mortgage Trends

Interest rates are the cost of borrowing money. When rates rise, borrowing becomes more expensive, impacting the affordability of mortgages and influencing the demand for housing. Conversely, when rates fall, borrowing becomes cheaper, making mortgages more accessible and potentially stimulating housing market activity.

The interest rates mortgage trends graph 2025 is a powerful tool for visualizing these dynamics. It plots projected interest rate movements over time, providing insights into potential changes in mortgage affordability and their impact on the housing market.

Key Factors Influencing the Interest Rates Mortgage Trends Graph 2025

Several key factors contribute to the shape of the interest rates mortgage trends graph 2025, including:

- Inflation: Rising inflation typically prompts central banks to increase interest rates to control price increases. This can lead to higher mortgage rates.

- Economic Growth: Strong economic growth often leads to higher interest rates as investors demand higher returns on their investments.

- Federal Reserve Policy: The Federal Reserve’s monetary policy decisions, such as adjusting the federal funds rate, directly impact short-term interest rates, which in turn influence mortgage rates.

- Government Policies: Government policies, such as tax incentives for homeownership, can impact demand for housing and indirectly influence mortgage rates.

- Global Economic Conditions: Global economic events, such as trade wars or recessions, can affect investor sentiment and impact interest rates.

Interpreting the Interest Rates Mortgage Trends Graph 2025

The interest rates mortgage trends graph 2025 can provide valuable insights for various stakeholders:

- Homebuyers: Understanding projected interest rate trends can help buyers make informed decisions about timing their purchase. If rates are expected to rise, it might be advantageous to purchase sooner, while a projected decline might suggest waiting for more favorable conditions.

- Sellers: The graph can help sellers anticipate potential changes in demand and adjust their pricing strategies accordingly. A projected increase in interest rates could lead to a decline in buyer demand, prompting sellers to consider price adjustments.

- Investors: Real estate investors can use the graph to identify potential opportunities and risks. For example, a projected decline in interest rates could signal a favorable time to invest in rental properties.

Interest Rates Mortgage Trends Graph 2025 and its Implications

While predictions are inherently uncertain, the interest rates mortgage trends graph 2025 can provide valuable insights into potential scenarios.

Scenario 1: Rising Interest Rates

If the graph indicates a trend of rising interest rates, the housing market might experience:

- Decreased Affordability: Higher mortgage rates make it more expensive to borrow money, leading to a decline in affordability for potential homebuyers.

- Slower Demand: As borrowing becomes more costly, demand for housing might slow down, potentially leading to a cooling of the market.

- Price Stabilization: Rising interest rates could help stabilize housing prices, preventing excessive price increases.

Scenario 2: Stable Interest Rates

If the graph suggests stable interest rates, the housing market might experience:

- Continued Demand: Stable interest rates might maintain a steady level of demand for housing, supporting market activity.

- Moderate Price Growth: Stable interest rates could contribute to moderate price growth, creating a balanced market.

- Predictability: Stable rates provide more predictability for both buyers and sellers, fostering confidence in the market.

Scenario 3: Falling Interest Rates

If the graph indicates a trend of falling interest rates, the housing market might experience:

- Increased Affordability: Lower mortgage rates make it easier and more affordable to borrow money, potentially leading to an increase in demand.

- Booming Market: Lower rates can stimulate housing market activity, leading to increased sales and price appreciation.

- Potential Bubbles: Rapidly falling interest rates could lead to an overheated market and potential bubbles, creating risks for future stability.

Interest Rates Mortgage Trends Graph 2025 and its Role in Financial Planning

The interest rates mortgage trends graph 2025 can be a valuable tool for financial planning, particularly for those planning to purchase a home or invest in real estate:

- Mortgage Planning: The graph can help individuals determine the optimal time to secure a mortgage, taking into account projected interest rate movements.

- Investment Strategies: Real estate investors can use the graph to assess potential risks and opportunities associated with different investment strategies, such as buying, selling, or holding properties.

- Financial Forecasting: The graph can provide a framework for forecasting future housing market conditions and their impact on personal finances.

Interest Rates Mortgage Trends Graph 2025 and its Influence on Market Sentiment

The interest rates mortgage trends graph 2025 plays a significant role in shaping market sentiment.

- Investor Confidence: A projected decline in interest rates can boost investor confidence, leading to increased investment activity in the real estate market.

- Buyer Behavior: Projected rising interest rates can cause some buyers to delay their purchase decisions, potentially leading to a slowdown in demand.

- Market Volatility: Uncertainty about future interest rate movements can introduce volatility into the housing market, making it challenging for buyers and sellers to predict future trends.

Related Searches

The interest rates mortgage trends graph 2025 is a valuable resource for understanding the housing market, and it is often used in conjunction with other related searches:

- Mortgage Rate Forecast 2025: Provides specific predictions for mortgage rates in 2025, offering a more focused view on potential rate changes.

- Housing Market Predictions 2025: Offers a broader perspective on the overall housing market, including factors beyond interest rates, such as supply and demand, demographic trends, and economic growth.

- Interest Rate Projections 2025: Explores projections for interest rates across different asset classes, providing a broader context for understanding the potential impact of interest rate changes.

- Federal Reserve Interest Rate Projections: Provides insights into the Federal Reserve’s plans for managing interest rates, offering valuable information for understanding potential rate changes.

- Inflation Forecast 2025: Examines projections for inflation, a key factor influencing interest rate movements.

- Economic Outlook 2025: Provides a broader analysis of the economic landscape, including factors that could impact interest rates and the housing market.

- Mortgage Refinance Rates 2025: Focuses specifically on potential changes in refinance rates, which can impact homeowners considering refinancing their existing mortgages.

- Home Value Predictions 2025: Offers projections for home values, providing a comprehensive view of the potential impact of interest rates on home prices.

FAQs about Interest Rates Mortgage Trends Graph 2025

Q: What are the limitations of the interest rates mortgage trends graph 2025?

A: The graph is based on projections, which are inherently uncertain. Actual interest rate movements can be influenced by unforeseen events, such as global crises or unexpected policy changes.

Q: How accurate are the projections used in the interest rates mortgage trends graph 2025?

A: The accuracy of projections depends on the methodology used and the quality of data available. Different sources might provide varying projections based on their assumptions and models.

Q: What are some alternative sources for understanding interest rate trends?

A: In addition to the interest rates mortgage trends graph 2025, you can consult financial news outlets, economic reports, and publications from reputable financial institutions for insights into interest rate trends.

Q: How can I use the interest rates mortgage trends graph 2025 to make informed financial decisions?

A: The graph can serve as a starting point for understanding potential interest rate movements, but it’s essential to consider other factors, such as your individual financial situation, market conditions, and long-term goals. Consulting with a financial advisor can provide personalized guidance.

Tips for Utilizing the Interest Rates Mortgage Trends Graph 2025

- Cross-Reference Data: Compare projections from multiple sources to gain a more comprehensive understanding of potential trends.

- Consider Economic Indicators: Pay attention to economic indicators, such as inflation, GDP growth, and unemployment rates, which can provide insights into the factors influencing interest rates.

- Seek Professional Advice: Consult with a financial advisor or mortgage broker to discuss your specific financial situation and develop a strategy based on projected interest rate trends.

- Stay Informed: Monitor news and financial publications for updates on interest rate forecasts and economic conditions.

- Maintain Flexibility: Be prepared to adjust your plans based on changes in market conditions and interest rate movements.

Conclusion

The interest rates mortgage trends graph 2025 is a valuable tool for understanding the dynamics of the housing market and its potential impact on individual financial decisions. While projections are subject to uncertainty, the graph provides a framework for anticipating potential changes in interest rates and their implications for homebuyers, sellers, investors, and financial planners. By understanding these trends and making informed decisions, individuals can navigate the housing market with greater confidence and achieve their financial goals.

Closure

Thus, we hope this article has provided valuable insights into Navigating the Future: Interest Rates Mortgage Trends Graph 2025. We hope you find this article informative and beneficial. See you in our next article!