Navigating The Future: Understanding Mortgage Interest Rate Trends Graph 2025

Navigating the Future: Understanding Mortgage Interest Rate Trends Graph 2025

Related Articles: Navigating the Future: Understanding Mortgage Interest Rate Trends Graph 2025

Introduction

With enthusiasm, let’s navigate through the intriguing topic related to Navigating the Future: Understanding Mortgage Interest Rate Trends Graph 2025. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating the Future: Understanding Mortgage Interest Rate Trends Graph 2025

Predicting the future of mortgage interest rates is a complex endeavor, intertwined with economic indicators, monetary policy, and global events. However, analyzing historical trends and current economic conditions can provide valuable insights into potential future scenarios. This exploration delves into the intricacies of mortgage interest rate trends graph 2025, examining the factors that influence its trajectory and offering a glimpse into potential outcomes.

Understanding the Dynamics: Factors Influencing Mortgage Interest Rates

Mortgage interest rates are not static entities but rather dynamic variables influenced by a multitude of factors. These include:

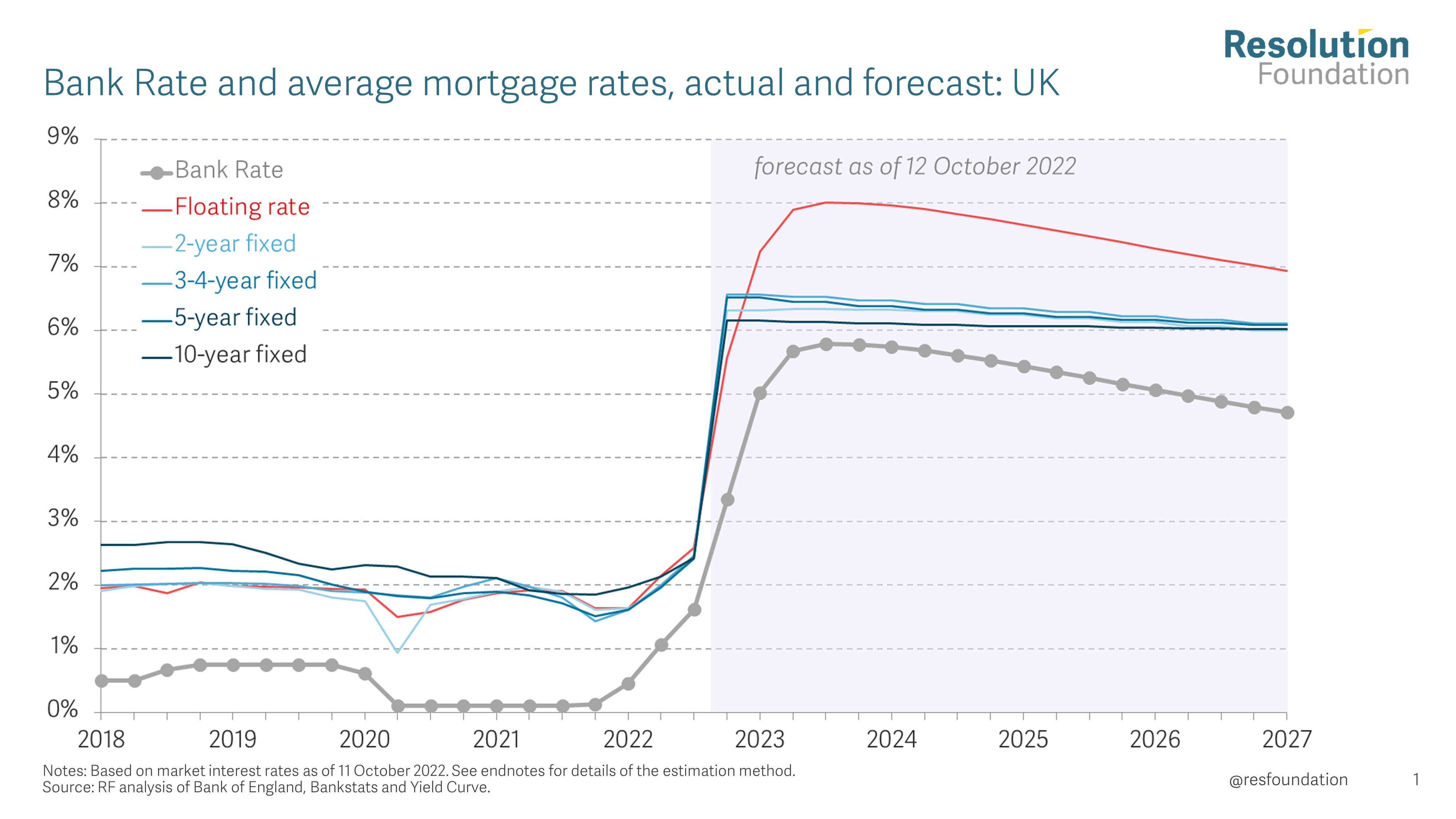

- Federal Reserve Policy: The Federal Reserve (Fed) plays a pivotal role in shaping interest rate trends. Through adjustments to the federal funds rate, the Fed influences the cost of borrowing for banks, which, in turn, impacts mortgage rates.

- Inflation: Rising inflation erodes the purchasing power of money, prompting the Fed to raise interest rates to combat inflationary pressures. Consequently, higher inflation tends to push mortgage rates upward.

- Economic Growth: A robust economy with strong job creation and consumer spending typically leads to higher demand for loans, potentially driving up interest rates.

- Government Policies: Fiscal policies, such as government spending or tax cuts, can influence economic growth and, consequently, mortgage rates.

- Global Events: Global economic shocks, geopolitical tensions, or natural disasters can create uncertainty in financial markets, impacting interest rate movements.

- Supply and Demand of Mortgage Capital: The availability of mortgage capital and the demand for home loans can influence interest rate fluctuations.

Historical Perspective: Tracing the Path of Mortgage Interest Rates

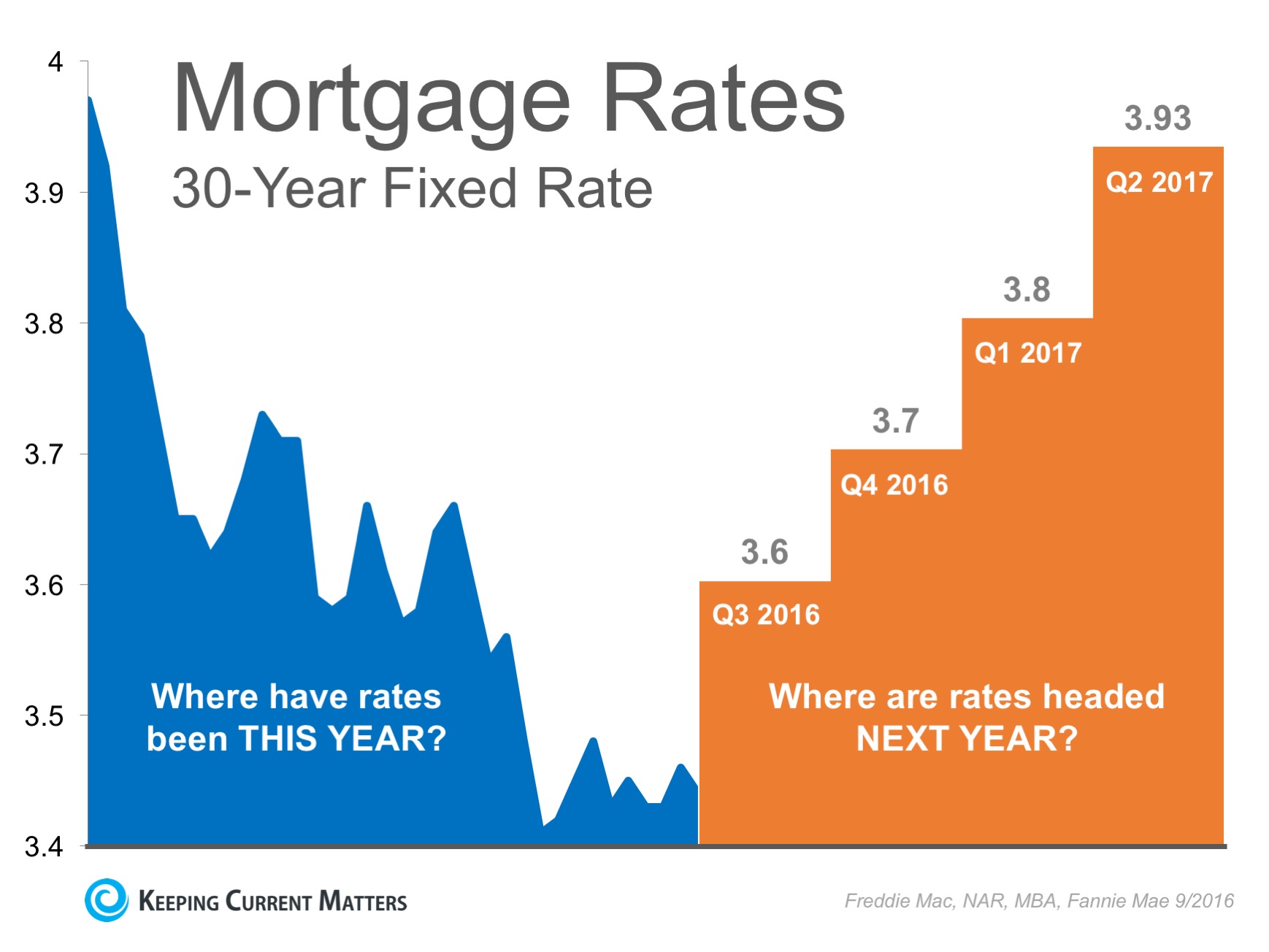

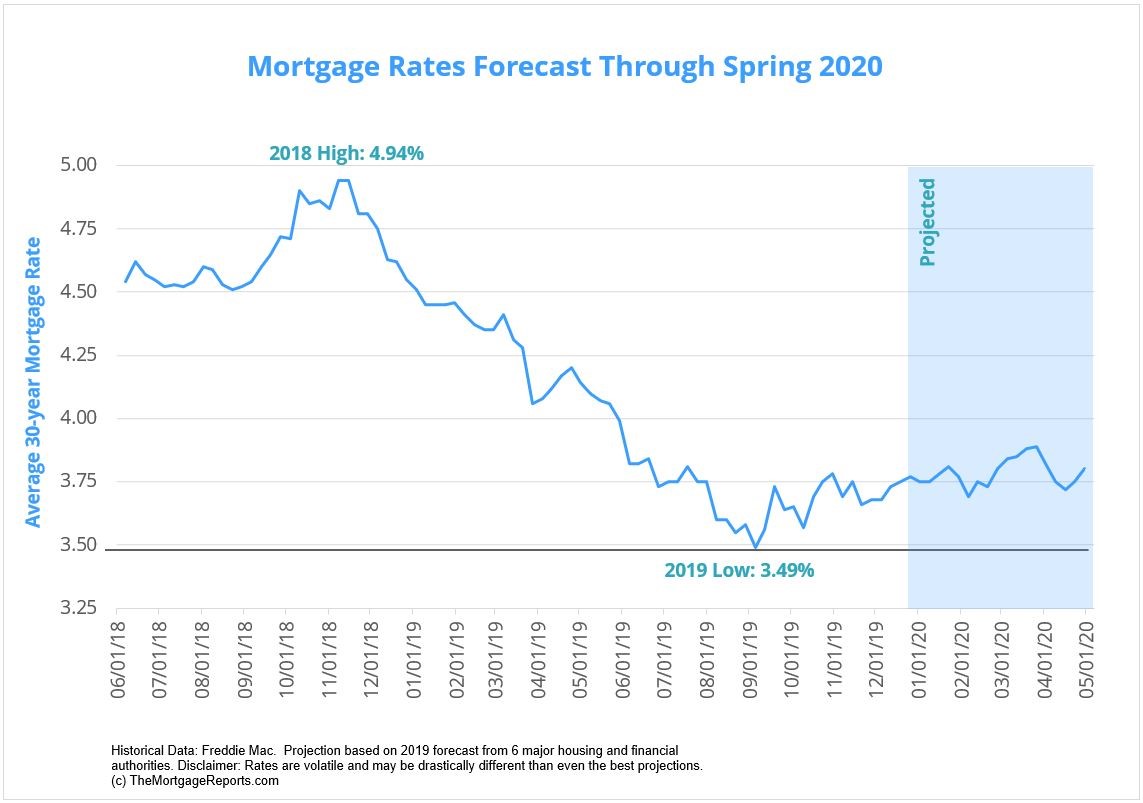

To understand the potential trajectory of mortgage interest rate trends graph 2025, it is crucial to examine historical trends. Over the past few decades, mortgage rates have exhibited cyclical patterns, influenced by economic cycles and policy decisions.

- 1980s and 1990s: This period witnessed a gradual decline in mortgage rates, driven by declining inflation and accommodative monetary policies.

- 2000s: The early 2000s saw a period of relatively low interest rates, contributing to a housing boom. However, the housing bubble burst in the mid-2000s, leading to a surge in mortgage rates and a subsequent recession.

- 2010s: The aftermath of the financial crisis saw the Fed implement near-zero interest rates to stimulate economic recovery. This period saw a prolonged period of historically low mortgage rates.

- 2020s: The COVID-19 pandemic and subsequent economic recovery led to a surge in inflation and a series of interest rate hikes by the Fed, causing a sharp increase in mortgage rates.

Forecasting the Future: Potential Scenarios for Mortgage Interest Rate Trends Graph 2025

Predicting the future of mortgage rates is inherently uncertain, but analyzing current economic conditions and expert forecasts can offer insights into potential scenarios:

- Scenario 1: Continued Rate Hikes: The Fed may continue raising interest rates to combat inflation, leading to higher mortgage rates throughout 2025. This scenario could dampen homebuyer demand and slow down the housing market.

- Scenario 2: Stabilization and Gradual Decline: The Fed could pause or slow down its rate hikes as inflation cools down, potentially leading to a stabilization or even a gradual decline in mortgage rates in 2025. This scenario could support continued homebuyer activity.

- Scenario 3: Unexpected Economic Shocks: Unforeseen economic events, such as a global recession or geopolitical tensions, could significantly impact interest rate trends. These shocks could lead to volatility and uncertainty in the housing market.

Navigating the Unpredictable: Strategies for Borrowers and Homebuyers

Given the inherent uncertainty surrounding future mortgage rate trends, it is crucial for borrowers and homebuyers to adopt a strategic approach:

- Monitor Economic Indicators: Stay informed about key economic indicators, such as inflation, unemployment, and GDP growth, to gauge potential shifts in interest rate trends.

- Consult Financial Professionals: Seek advice from mortgage brokers or financial advisors to understand the current mortgage landscape and develop a personalized plan based on your financial situation and goals.

- Consider Locking in Rates: If you anticipate rising interest rates, consider locking in a fixed-rate mortgage to secure a lower interest rate for the duration of your loan term.

- Explore Alternative Loan Options: Explore alternative loan options, such as adjustable-rate mortgages (ARMs), which may offer lower initial rates but carry the risk of rate adjustments in the future.

- Build a Strong Credit Score: A higher credit score can qualify you for lower interest rates. Take steps to improve your credit score by managing your debt, paying bills on time, and avoiding unnecessary credit inquiries.

Related Searches: Exploring the Broader Context

Understanding mortgage interest rate trends graph 2025 requires examining related searches that provide a broader context and deeper insights:

- Mortgage Rates Forecast 2025: This search explores expert forecasts and predictions for mortgage rate trends in 2025, providing a glimpse into potential scenarios.

- Average Mortgage Interest Rates 2025: This search seeks information about average mortgage rates expected in 2025, offering a benchmark for potential borrowing costs.

- Mortgage Rates History Graph: Analyzing historical mortgage rate data provides valuable insights into past trends and potential future patterns.

- Mortgage Rates by State 2025: This search explores regional variations in mortgage rates, highlighting potential differences in borrowing costs across different states.

- Factors Affecting Mortgage Rates: This search delves into the various economic and policy factors that influence mortgage rate fluctuations.

- Mortgage Rate Calculator 2025: This tool allows borrowers to estimate their potential monthly mortgage payments based on various interest rate scenarios.

- Mortgage Rate Trends 2025: This search explores the overall trajectory of mortgage rates in 2025, analyzing potential upswings, downturns, or stabilization.

- Mortgage Rate Predictions 2025: This search focuses on predictions and forecasts from economists and financial analysts regarding future mortgage rate movements.

FAQs: Addressing Common Queries

1. What is the current mortgage rate trend?

Current mortgage rates have been volatile, experiencing a sharp increase in recent months due to the Fed’s interest rate hikes. However, there are signs that inflation may be cooling down, potentially leading to a stabilization or even a slight decline in rates in the near future.

2. How are mortgage rates determined?

Mortgage rates are determined by a complex interplay of factors, including the Fed’s monetary policy, inflation, economic growth, government policies, global events, and the supply and demand of mortgage capital.

3. What are the potential risks of rising mortgage rates?

Rising mortgage rates can lead to higher borrowing costs for homebuyers, potentially dampening demand and slowing down the housing market. It can also make refinancing existing mortgages more expensive.

4. What are the potential benefits of falling mortgage rates?

Falling mortgage rates can make homeownership more affordable, potentially boosting demand and stimulating the housing market. It can also make refinancing existing mortgages more attractive, potentially lowering monthly payments.

5. How can I protect myself from rising mortgage rates?

Consider locking in a fixed-rate mortgage if you anticipate rising interest rates. Explore alternative loan options, such as ARMs, which may offer lower initial rates but carry the risk of rate adjustments. Build a strong credit score to qualify for lower interest rates.

Tips for Navigating Mortgage Rate Trends:

- Stay informed: Monitor economic indicators and news about interest rate trends.

- Seek professional advice: Consult with mortgage brokers or financial advisors to understand your options.

- Consider locking in rates: If you anticipate rising rates, lock in a fixed-rate mortgage.

- Explore alternative loan options: Consider ARMs or other loan products.

- Improve your credit score: A higher credit score can qualify you for better rates.

Conclusion:

Mortgage interest rate trends graph 2025 remains a subject of ongoing analysis and speculation. While predicting the future is inherently uncertain, understanding the factors that influence interest rate trends and adopting a strategic approach can help borrowers and homebuyers navigate the market effectively. By staying informed, seeking professional advice, and exploring various loan options, individuals can make informed decisions to achieve their financial goals.

Closure

Thus, we hope this article has provided valuable insights into Navigating the Future: Understanding Mortgage Interest Rate Trends Graph 2025. We appreciate your attention to our article. See you in our next article!