Navigating The Market’s Rhythms: Exploring Stock Market Seasonal Trends In 2025

Navigating the Market’s Rhythms: Exploring Stock Market Seasonal Trends in 2025

Related Articles: Navigating the Market’s Rhythms: Exploring Stock Market Seasonal Trends in 2025

Introduction

With great pleasure, we will explore the intriguing topic related to Navigating the Market’s Rhythms: Exploring Stock Market Seasonal Trends in 2025. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

- 1 Related Articles: Navigating the Market’s Rhythms: Exploring Stock Market Seasonal Trends in 2025

- 2 Introduction

- 3 Navigating the Market’s Rhythms: Exploring Stock Market Seasonal Trends in 2025

- 3.1 The Seasonal Dance of the Market: Unveiling Historical Trends

- 3.2 Factors Shaping Stock Market Seasonal Trends in 2025

- 3.3 Exploring Related Searches: Expanding the Scope of Understanding

- 3.4 FAQs: Addressing Common Questions about Stock Market Seasonal Trends

- 3.5 Tips for Navigating Stock Market Seasonal Trends in 2025

- 3.6 Conclusion: Navigating the Market’s Rhythms with Informed Decisions

- 4 Closure

Navigating the Market’s Rhythms: Exploring Stock Market Seasonal Trends in 2025

The stock market, a complex and dynamic ecosystem, is often perceived as a chaotic realm of unpredictable fluctuations. However, beneath the surface of apparent randomness, discernible patterns and trends emerge, influenced by a multitude of factors, including seasonal cycles. While past performance is not indicative of future results, understanding these historical tendencies can provide valuable insights for investors seeking to optimize their strategies. This exploration delves into the stock market seasonal trends anticipated for 2025, examining their potential impact and the considerations investors should keep in mind.

The Seasonal Dance of the Market: Unveiling Historical Trends

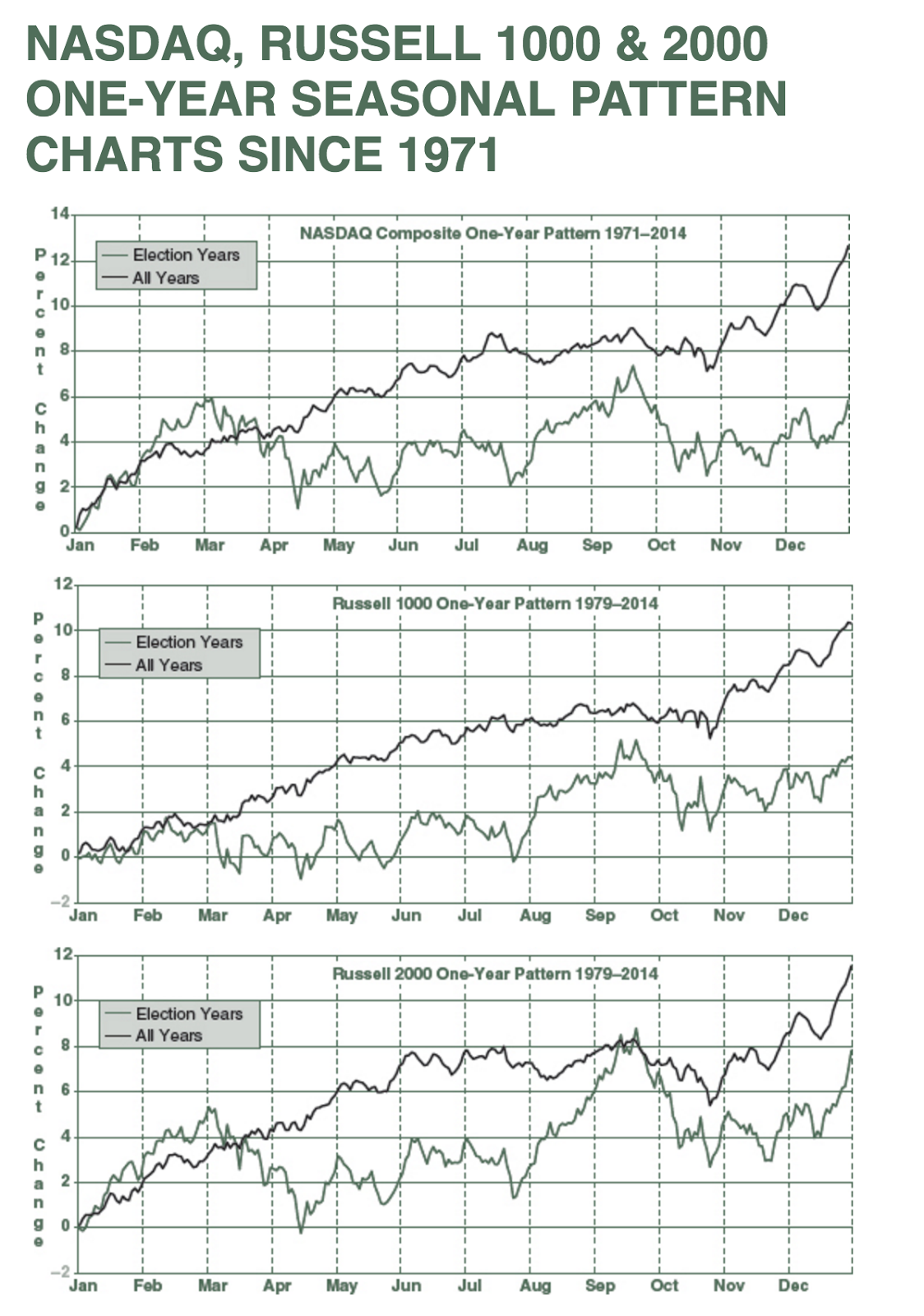

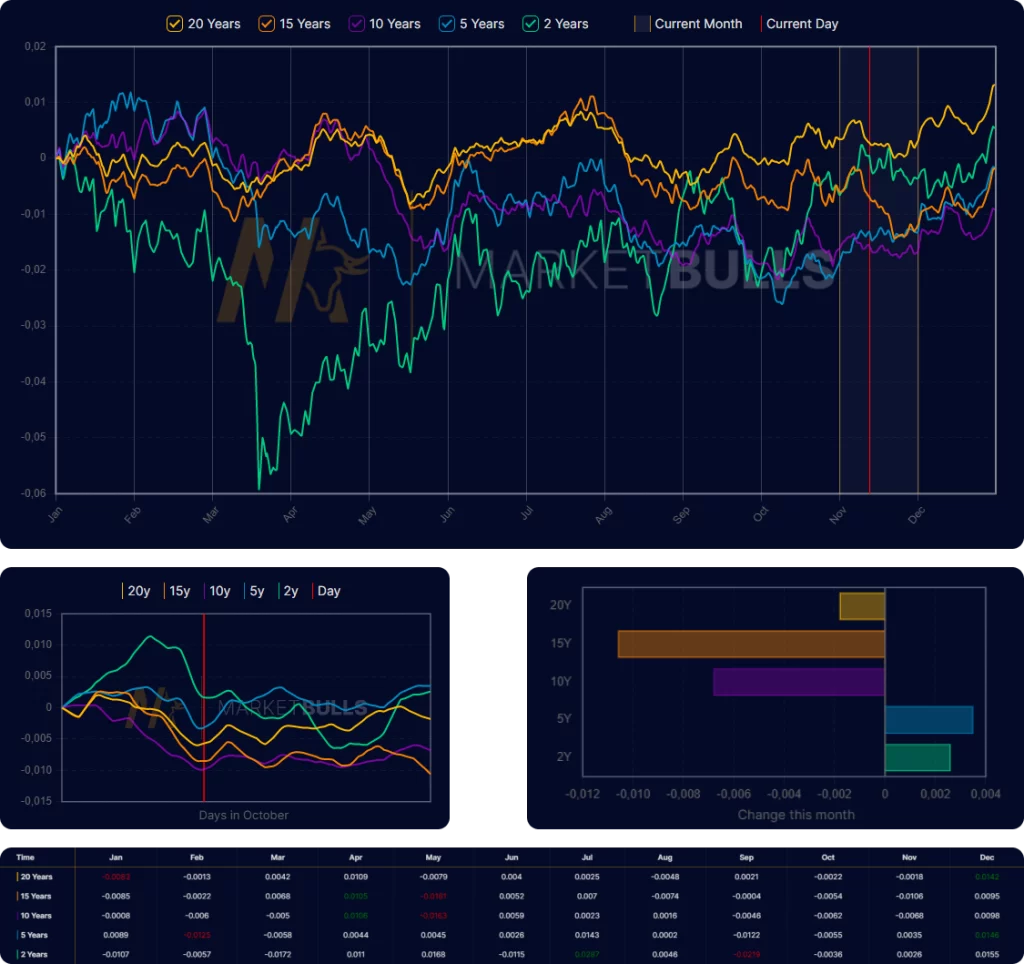

Historically, certain periods of the year have exhibited tendencies toward stronger market performance compared to others. These trends are not absolute guarantees, but they offer a framework for understanding the potential influences shaping market behavior.

-

January Effect: This phenomenon, observed since the 1940s, suggests a tendency for stocks to experience higher returns in January. This is attributed to several factors:

- Tax-loss selling: Investors often sell underperforming stocks in December to realize tax losses, creating a buying opportunity in January.

- Year-end bonuses: Individuals and institutions receive year-end bonuses, leading to increased investment activity.

- Investor optimism: A fresh start to the year often fuels investor optimism, driving increased demand.

-

Sell in May and Go Away: This adage, while not universally true, reflects a historical tendency for the stock market to perform better in the first half of the year compared to the second.

- Summer doldrums: Reduced trading activity and investor focus during the summer months can lead to lower market volatility and returns.

- Earnings season: The second half of the year often brings a flurry of earnings reports, which can impact stock prices.

-

Santa Claus Rally: This phenomenon, observed in the last few trading days of the year and the first few days of January, suggests a potential for positive market performance.

- Holiday cheer: Increased retail investor activity and a general sense of optimism often drive market sentiment.

- Year-end portfolio adjustments: Institutional investors may adjust their portfolios to reflect year-end performance targets.

Factors Shaping Stock Market Seasonal Trends in 2025

While historical trends offer valuable insights, understanding the factors that could influence these patterns in 2025 is crucial for informed investment decisions.

- Economic Outlook: The global economic landscape, characterized by inflation, interest rate hikes, and geopolitical uncertainty, will play a significant role in shaping market sentiment and volatility.

- Monetary Policy: Central bank decisions on interest rates and quantitative easing will impact borrowing costs and overall market liquidity, influencing investor behavior.

- Geopolitical Events: International conflicts, trade tensions, and political instability can create market volatility and disrupt traditional seasonal trends.

- Technological Advancements: Emerging technologies, such as artificial intelligence and automation, can create new investment opportunities and reshape industry dynamics, potentially influencing market performance.

- Consumer Spending: Consumer confidence and spending patterns will impact corporate earnings and overall economic growth, influencing stock market trends.

Exploring Related Searches: Expanding the Scope of Understanding

Understanding the broader context surrounding stock market seasonal trends requires exploring related searches, gaining a comprehensive perspective on the factors influencing market behavior.

1. Stock Market Seasonality: This search delves into the historical patterns and trends associated with specific periods of the year, providing insights into the cyclical nature of market performance.

2. Best Months to Invest in the Stock Market: This search explores the months historically associated with higher market returns, allowing investors to identify potential opportunities for investment.

3. Stock Market Calendar 2025: This search provides a detailed calendar of key economic events, earnings releases, and holidays that can impact market sentiment and volatility.

4. Stock Market Predictions 2025: This search explores various market forecasts and predictions for the year, offering insights into the potential trajectory of the market.

5. Stock Market Volatility 2025: This search examines the anticipated level of market volatility in 2025, helping investors understand the potential risks and rewards associated with investing.

6. Stock Market Strategies for 2025: This search explores different investment strategies and approaches tailored to the anticipated market conditions in 2025.

7. Stock Market Performance by Industry: This search analyzes the historical performance of different industry sectors across different seasons, allowing investors to identify potential investment opportunities.

8. Stock Market Seasonality Research: This search explores academic research and studies on stock market seasonal trends, providing evidence-based insights into the validity and significance of these patterns.

FAQs: Addressing Common Questions about Stock Market Seasonal Trends

Understanding the nuances of stock market seasonal trends often involves addressing common questions and concerns. Here are some frequently asked questions:

1. Are stock market seasonal trends reliable?

- While historical trends offer insights, they are not absolute guarantees. Market conditions, economic factors, and unforeseen events can influence actual performance.

2. How can I use stock market seasonal trends in my investment strategy?

- Investors can use these trends as a guide for timing investments, potentially increasing their chances of capitalizing on periods of historical strength.

3. Should I sell in May?

- The "Sell in May" adage is not a definitive rule. Investors should consider their individual investment goals, risk tolerance, and market conditions before making any decisions.

4. What are the risks associated with stock market seasonal trends?

- Relying solely on these trends can lead to missed opportunities and potentially detrimental investment decisions.

5. Do stock market seasonal trends apply to all markets?

- While some trends are observed globally, regional differences and specific market dynamics can influence the applicability of these patterns.

Tips for Navigating Stock Market Seasonal Trends in 2025

- Stay informed: Regularly monitor market conditions, economic indicators, and geopolitical events to understand their impact on seasonal trends.

- Diversify your portfolio: Spread your investments across different asset classes, sectors, and regions to mitigate risk and potentially enhance returns.

- Consider your investment goals: Align your investment strategies with your long-term goals and risk tolerance, avoiding impulsive decisions based solely on seasonal trends.

- Seek professional advice: Consult with a qualified financial advisor to develop a personalized investment plan that aligns with your individual needs and circumstances.

Conclusion: Navigating the Market’s Rhythms with Informed Decisions

While stock market seasonal trends offer valuable insights into the potential influence of time on market behavior, they should not be treated as definitive predictors. Investors must remain vigilant, adapting their strategies to the ever-changing dynamics of the market. By understanding the underlying factors shaping these trends, considering related searches, and seeking professional guidance, investors can navigate the market’s rhythms with informed decisions, potentially maximizing their investment potential.

Closure

Thus, we hope this article has provided valuable insights into Navigating the Market’s Rhythms: Exploring Stock Market Seasonal Trends in 2025. We hope you find this article informative and beneficial. See you in our next article!