Navigating The Uncertain Future: Exploring US Inflation Trends In 2025

Navigating the Uncertain Future: Exploring US Inflation Trends in 2025

Related Articles: Navigating the Uncertain Future: Exploring US Inflation Trends in 2025

Introduction

With enthusiasm, let’s navigate through the intriguing topic related to Navigating the Uncertain Future: Exploring US Inflation Trends in 2025. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating the Uncertain Future: Exploring US Inflation Trends in 2025

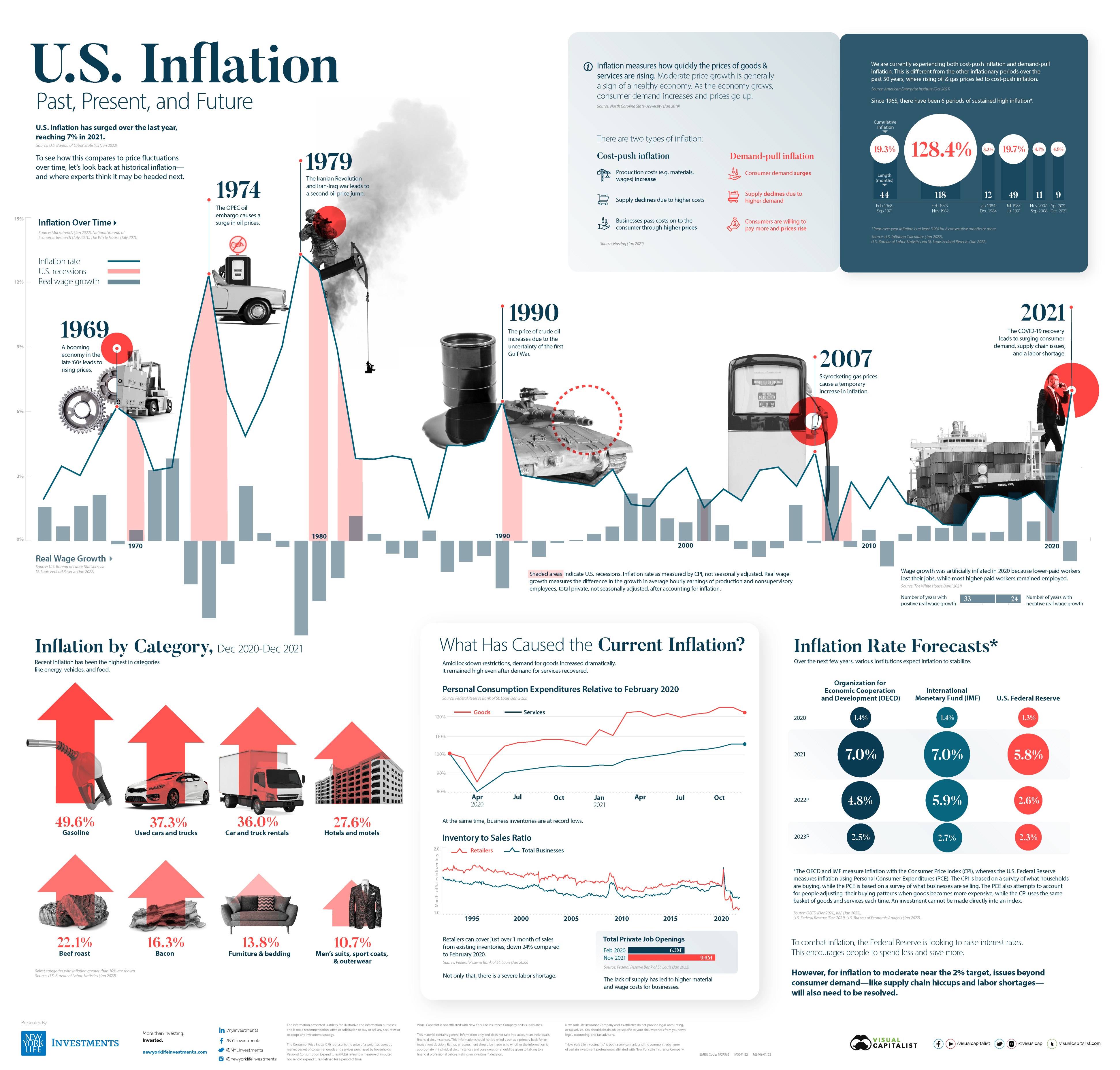

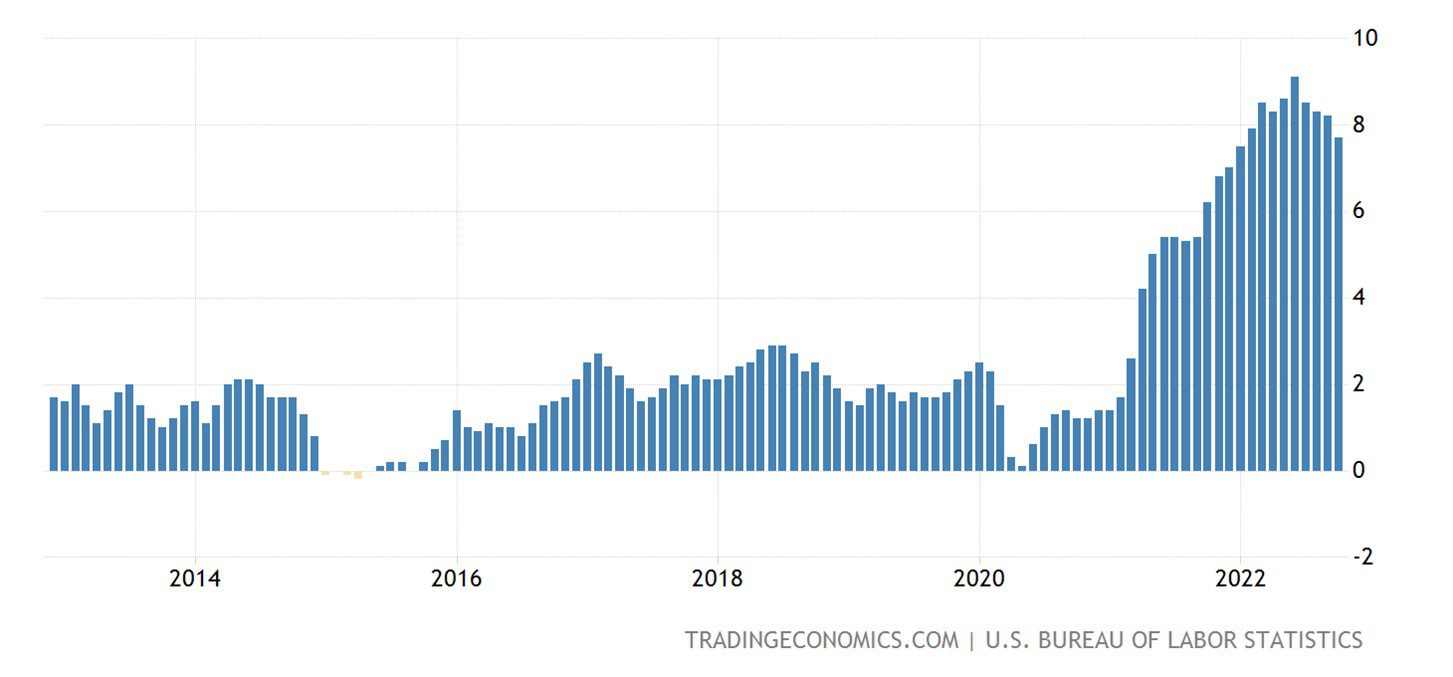

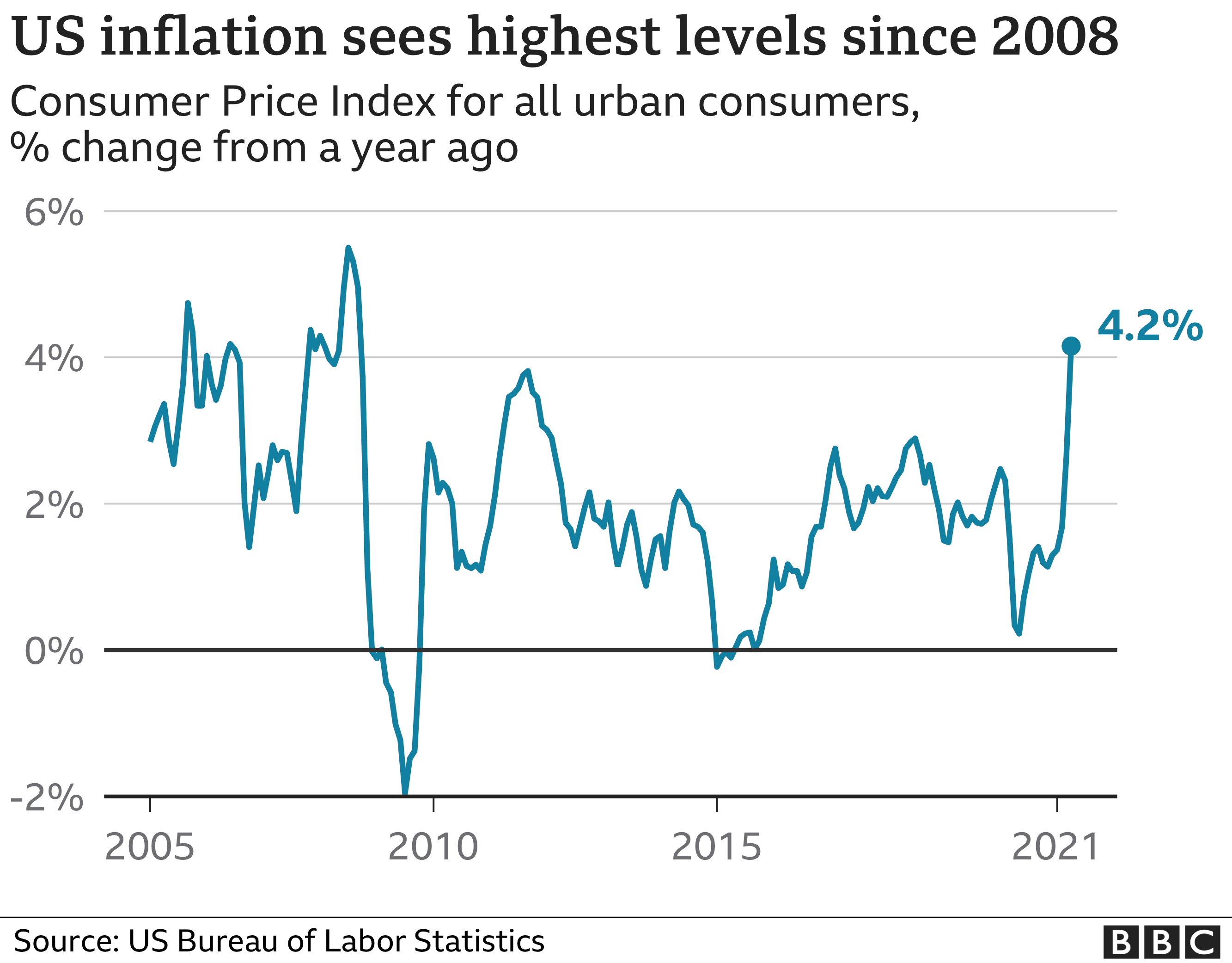

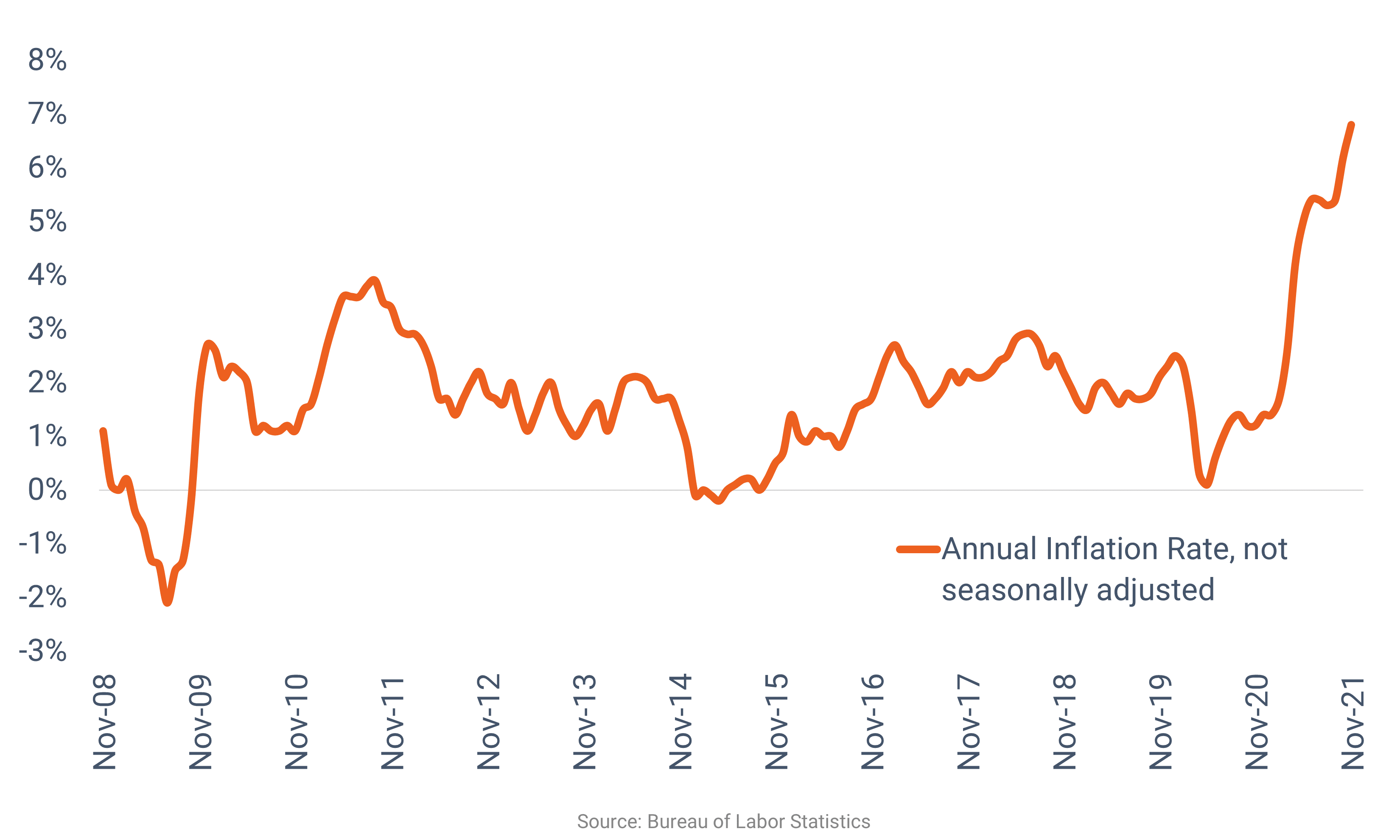

Predicting the future is inherently difficult, and economic forecasting is no exception. While pinpointing the exact inflation rate in 2025 is impossible, examining current trends, economic factors, and expert projections can shed light on the potential trajectory of US inflation trends in 2025. This analysis is crucial for individuals, businesses, and policymakers alike, as it informs financial decisions, investment strategies, and economic policy.

Understanding the Current Landscape

The US economy has experienced a period of elevated inflation since the onset of the COVID-19 pandemic. Several factors have contributed to this rise, including:

- Supply Chain Disruptions: Global supply chains were severely disrupted by pandemic-related lockdowns and labor shortages, leading to shortages of goods and increased prices.

- Strong Consumer Demand: Government stimulus measures and pent-up demand fueled a surge in consumer spending, further straining supply chains and pushing prices upward.

- Energy Price Volatility: The war in Ukraine has significantly impacted global energy markets, leading to increased prices for oil and gas, which have ripple effects throughout the economy.

- Labor Market Tightness: A robust labor market with low unemployment has given workers more bargaining power, leading to wage increases that can contribute to inflationary pressures.

Factors Shaping Inflation in 2025

The future of US inflation will depend on a complex interplay of economic forces. Here are some key factors that will likely influence the trajectory of inflation in 2025:

- Monetary Policy: The Federal Reserve’s aggressive interest rate hikes aim to cool the economy and curb inflation. The effectiveness of these measures will be a significant determinant of inflation in 2025.

- Global Economic Growth: The global economic outlook remains uncertain, with potential for recession in some major economies. A global slowdown could impact US exports and contribute to deflationary pressures.

- Energy Prices: The outlook for energy prices is highly uncertain, influenced by geopolitical events, global demand, and the transition to renewable energy sources.

- Supply Chain Resilience: The extent to which supply chains recover from pandemic-related disruptions will impact the availability of goods and prices.

- Technological Advancements: Technological advancements can create new efficiencies and potentially lower prices in some sectors. However, the impact on overall inflation is difficult to predict.

- Government Policies: Fiscal policies, such as infrastructure spending or tax cuts, can influence aggregate demand and therefore inflation.

Expert Projections and Consensus

While there is no single definitive prediction, economists and analysts offer a range of projections for US inflation in 2025:

- The Federal Reserve: The Federal Reserve’s median projection for the Personal Consumption Expenditures (PCE) price index, its preferred inflation gauge, is 2.0% in 2025.

- International Monetary Fund (IMF): The IMF projects US inflation to moderate to 2.5% in 2025.

- Private Sector Economists: Forecasts from private sector economists vary, with some projecting inflation to remain above 2%, while others see it falling closer to the Fed’s target of 2%.

The Importance of Monitoring Inflation

Understanding US inflation trends in 2025 is crucial for several reasons:

- Consumer Spending: High inflation erodes purchasing power, making it more expensive for consumers to buy goods and services.

- Investment Decisions: Inflation can impact investment returns, as rising prices can erode the value of assets.

- Economic Policy: Central banks and policymakers need to monitor inflation to adjust monetary and fiscal policies to achieve economic stability.

- Business Planning: Businesses need to factor in inflation when setting prices, negotiating contracts, and making investment decisions.

Related Searches

The following related searches offer deeper insights into the dynamics of US inflation:

1. Inflation Rate History: Analyzing historical inflation data provides context for current trends and helps identify potential patterns.

2. Core Inflation: Examining core inflation, which excludes volatile food and energy prices, provides a more stable measure of underlying price pressures.

3. Inflation Expectations: Understanding how consumers and businesses anticipate future inflation can provide insights into their spending and investment decisions.

4. Inflation Impact on Interest Rates: The relationship between inflation and interest rates is crucial for understanding how monetary policy influences economic activity.

5. Inflation and the Stock Market: Inflation can impact stock market valuations and returns, making it essential to understand its influence on investment strategies.

6. Inflation and Housing Market: Inflation plays a significant role in housing prices and affordability, impacting both buyers and sellers.

7. Inflation and Wages: The relationship between inflation and wages is crucial for understanding the real purchasing power of workers and the potential for wage-price spirals.

8. Inflation and the Federal Reserve: The Federal Reserve’s role in controlling inflation is paramount, and understanding its policies and actions is crucial for navigating economic uncertainty.

FAQs about US Inflation Trends in 2025

Q: What are the main drivers of inflation in the US?

A: The main drivers of inflation in the US include supply chain disruptions, strong consumer demand, energy price volatility, and a tight labor market.

Q: How does the Federal Reserve try to control inflation?

A: The Federal Reserve primarily uses monetary policy tools, such as interest rate hikes and quantitative tightening, to control inflation.

Q: What is the Fed’s target inflation rate?

A: The Fed’s target inflation rate is 2%, as measured by the PCE price index.

Q: How can individuals and businesses prepare for inflation?

A: Individuals can protect themselves from inflation by diversifying investments, increasing savings, and negotiating salary increases. Businesses can adjust pricing strategies, manage inventory effectively, and explore cost-saving measures.

Q: What are the potential risks of high inflation?

A: High inflation can lead to a decline in purchasing power, economic uncertainty, and potential social unrest.

Tips for Navigating US Inflation Trends in 2025

- Stay informed: Stay updated on economic news, inflation reports, and expert analysis to understand the current economic landscape.

- Diversify investments: Spread your investments across different asset classes to mitigate inflation risks.

- Increase savings: Build a financial cushion to protect yourself from unexpected price increases.

- Negotiate salary increases: Advocate for salary adjustments to keep pace with inflation.

- Shop smart: Compare prices, look for discounts, and consider alternative products to save money.

- Consider alternative investments: Explore investments that may offer protection against inflation, such as commodities or real estate.

Conclusion

Predicting US inflation trends in 2025 is a challenging task. While there is no definitive answer, understanding the current economic landscape, key drivers of inflation, and expert projections provides a framework for navigating the uncertain future. By staying informed, making informed financial decisions, and adapting to changing economic conditions, individuals, businesses, and policymakers can better manage the potential impacts of inflation.

Closure

Thus, we hope this article has provided valuable insights into Navigating the Uncertain Future: Exploring US Inflation Trends in 2025. We hope you find this article informative and beneficial. See you in our next article!