Navigating The Uncharted Waters: A Deep Dive Into Refi Mortgage Rate Trends 2025

Navigating the Uncharted Waters: A Deep Dive into Refi Mortgage Rate Trends 2025

Related Articles: Navigating the Uncharted Waters: A Deep Dive into Refi Mortgage Rate Trends 2025

Introduction

With great pleasure, we will explore the intriguing topic related to Navigating the Uncharted Waters: A Deep Dive into Refi Mortgage Rate Trends 2025. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating the Uncharted Waters: A Deep Dive into Refi Mortgage Rate Trends 2025

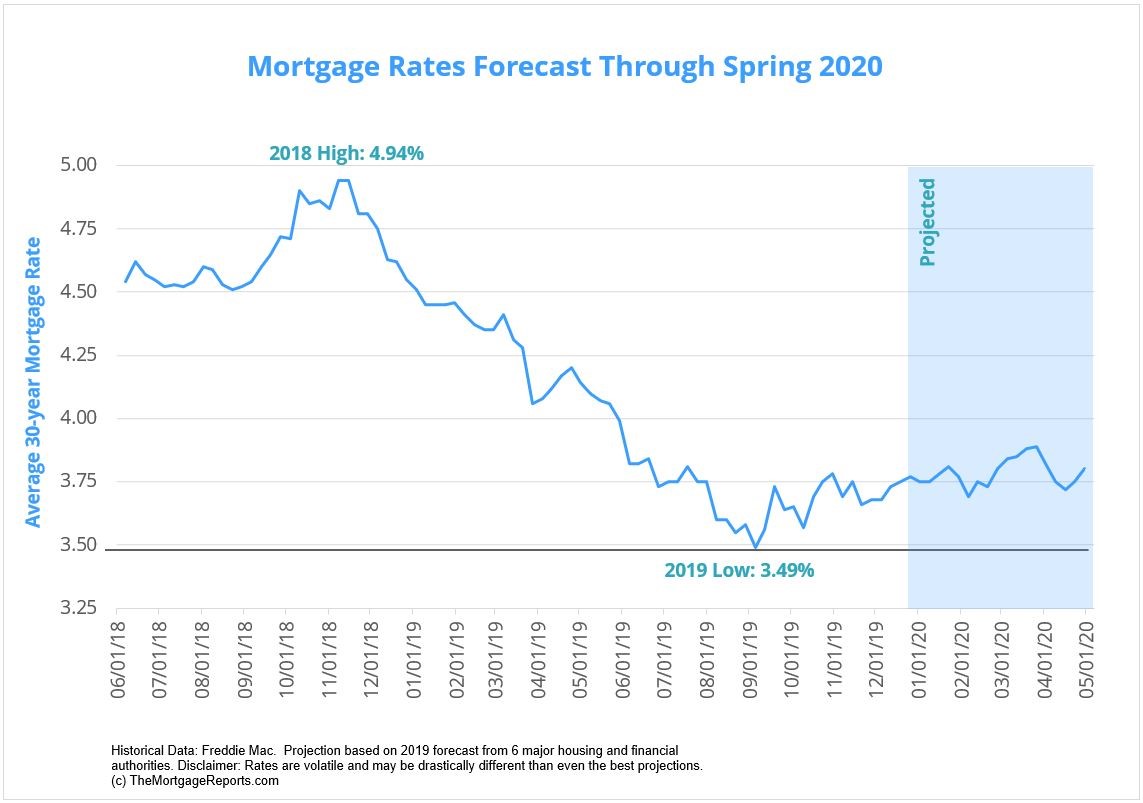

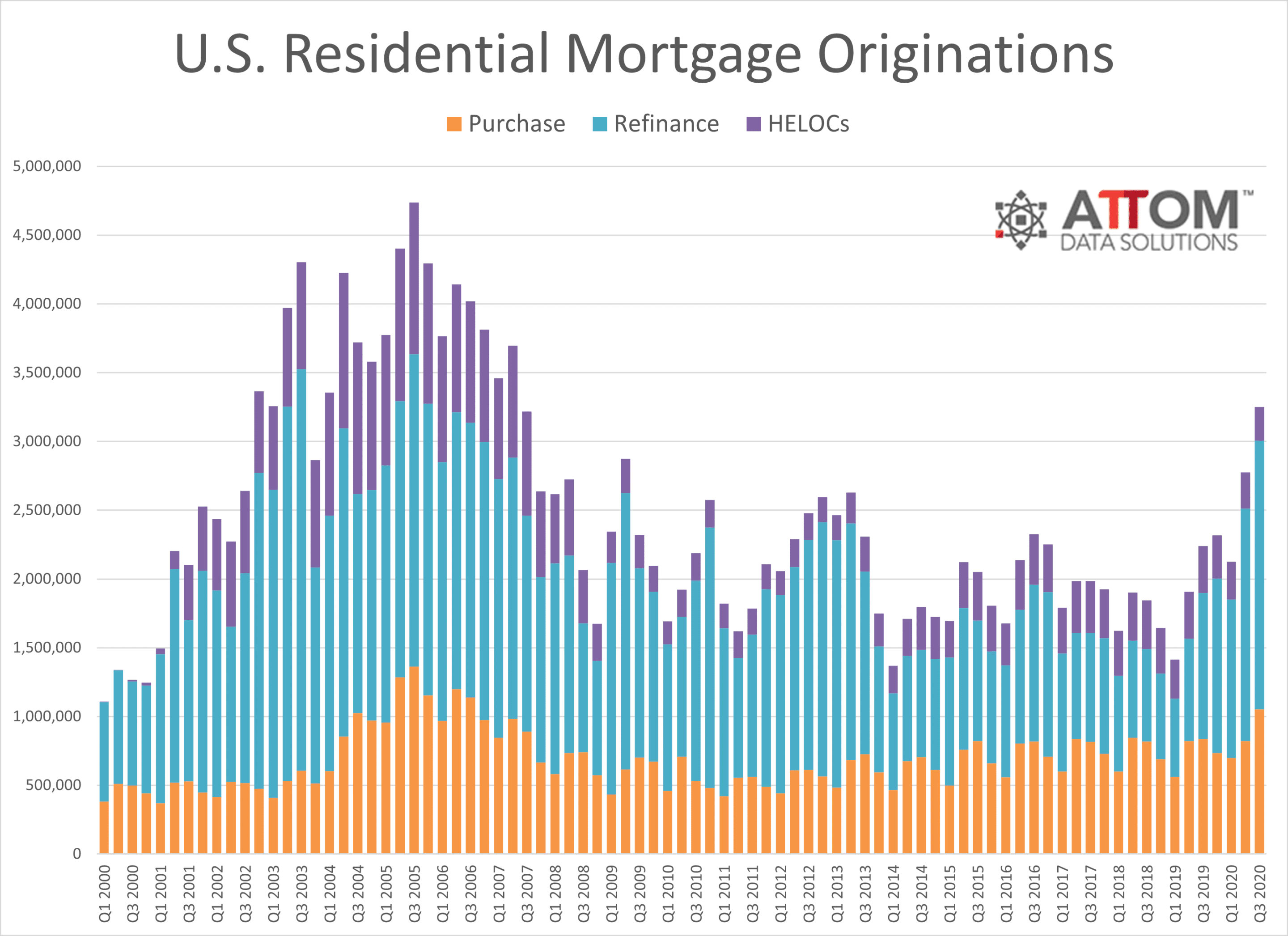

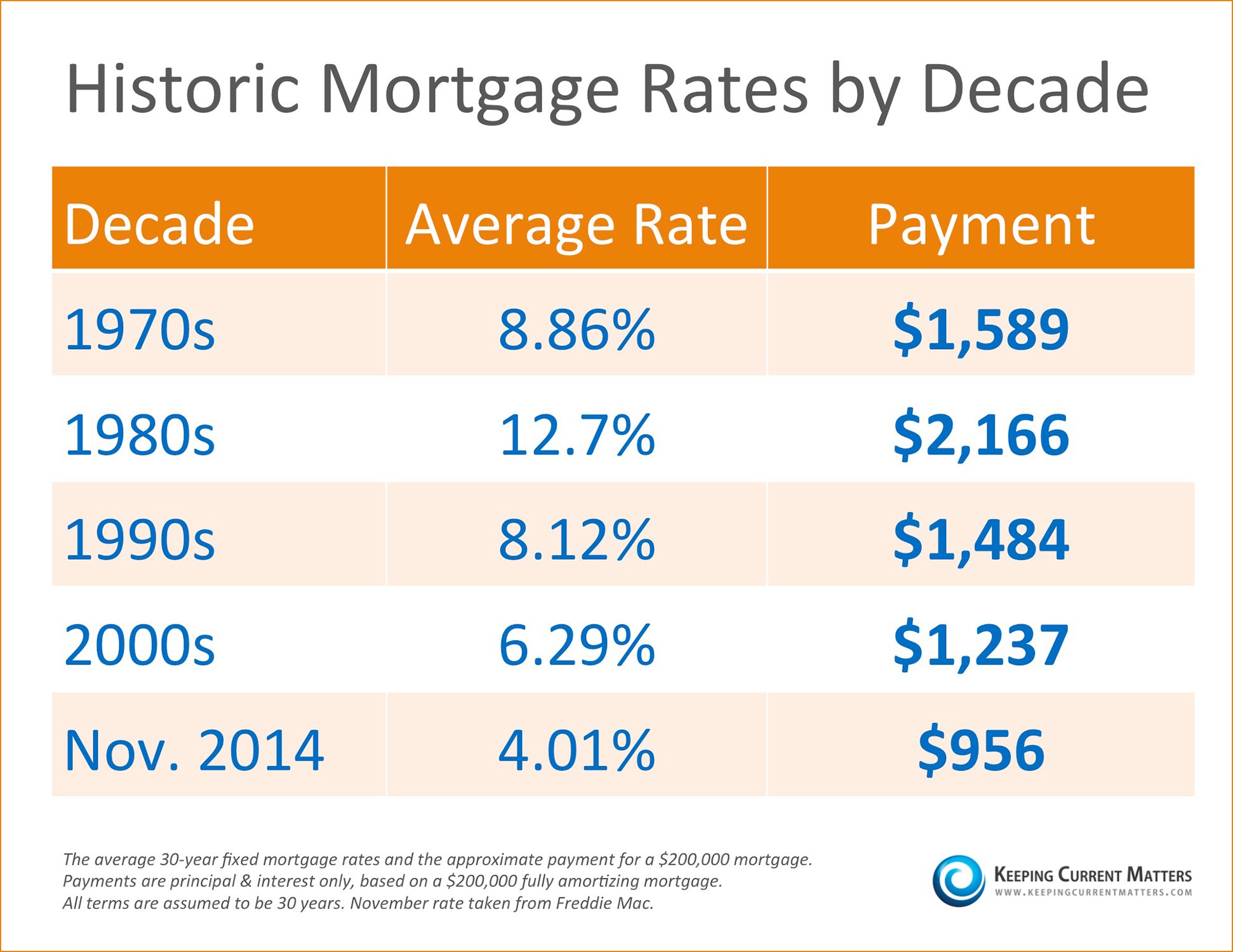

Predicting the future of interest rates, especially in the dynamic realm of mortgage refinancing, is a complex endeavor. However, by analyzing current market conditions, economic forecasts, and historical trends, we can gain valuable insights into potential refi mortgage rate trends for 2025. This comprehensive exploration will delve into the factors influencing these trends, their potential impact on homeowners, and strategies for navigating this evolving landscape.

Understanding the Underlying Forces

-

The Federal Reserve’s Role: The Federal Reserve (Fed) plays a pivotal role in shaping interest rate movements through its monetary policy tools. The Fed’s actions, particularly its target for the federal funds rate, directly influence the cost of borrowing for banks and ultimately impact mortgage rates. As the Fed navigates inflation and economic growth, its decisions will be a primary driver of refi mortgage rate trends in 2025.

-

Inflationary Pressures: High inflation, a persistent economic challenge, can lead to rising interest rates. To combat inflation, the Fed may raise interest rates to curb borrowing and spending, thereby slowing down economic activity. This could potentially push refi mortgage rates higher in 2025.

-

Economic Growth and Employment: A robust economy with strong employment growth typically supports higher interest rates. Conversely, a slowing economy or rising unemployment could lead to lower interest rates. The interplay between economic growth and employment will influence the Fed’s policy decisions and ultimately impact refi mortgage rate trends in 2025.

-

Global Economic Factors: Global economic events, such as geopolitical tensions or international trade disputes, can also influence interest rates. These factors can impact investor sentiment and influence the Fed’s policy decisions, ultimately affecting refi mortgage rate trends.

Potential Scenarios for Refi Mortgage Rate Trends in 2025

Given the complex interplay of these factors, several potential scenarios for refi mortgage rate trends in 2025 are possible:

-

Scenario 1: Continued Rate Increases: If inflation remains elevated and the Fed continues its aggressive rate-hiking campaign, refi mortgage rates could rise further in 2025. This scenario would likely discourage refinancing for many homeowners, as the potential savings from a lower rate might be outweighed by the higher interest payments.

-

Scenario 2: Stabilization and Moderate Rates: If inflation cools down and the Fed adopts a more cautious approach, refi mortgage rates could stabilize or even experience a slight decline in 2025. This scenario would create opportunities for homeowners to refinance and potentially lock in lower interest rates.

-

Scenario 3: Unexpected Market Volatility: Unforeseen events, such as a global economic downturn or a geopolitical crisis, could lead to significant volatility in refi mortgage rates in 2025. This scenario would create uncertainty for homeowners considering refinancing, as rates could fluctuate rapidly.

The Importance of Monitoring Refi Mortgage Rate Trends

Staying informed about refi mortgage rate trends is crucial for homeowners seeking to refinance their mortgages. By monitoring interest rate movements, homeowners can:

- Identify Potential Opportunities: When rates decline, it presents an opportunity to refinance and potentially lower monthly payments.

- Avoid Unfavorable Conditions: If rates are expected to rise, refinancing might be less attractive, and homeowners could consider delaying their decision.

- Make Informed Decisions: Understanding the factors influencing refi mortgage rate trends empowers homeowners to make informed decisions about whether to refinance or hold off.

Related Searches and FAQs

Related Searches:

- Mortgage rates forecast 2025: This search explores predictions for overall mortgage rates, providing insights into the broader market environment.

- Average mortgage rates 2025: This search focuses on the average interest rates expected for mortgages in 2025, offering a benchmark for comparison.

- Refinance calculator 2025: This tool allows homeowners to estimate potential savings from refinancing based on current rates and their loan details.

- Best refinance lenders 2025: This search helps homeowners find reputable mortgage lenders offering competitive rates and terms for refinancing.

- Refinancing eligibility 2025: This search provides information on the requirements and qualifications for refinancing a mortgage in 2025.

- Refinance vs. home equity loan 2025: This search compares refinancing with home equity loans, highlighting their pros and cons for different financial goals.

- Mortgage rates history 2025: This search provides historical data on mortgage rates, allowing homeowners to understand long-term trends and potential future scenarios.

- Refinancing impact on taxes 2025: This search explains how refinancing can affect tax deductions and other financial implications.

FAQs:

-

Q: When will mortgage rates start to fall?

- A: Predicting the exact timing of rate declines is challenging. However, factors such as inflation cooling down, a slowdown in the Fed’s rate hikes, and economic uncertainty could potentially lead to rate decreases.

-

Q: How long will mortgage rates stay high?

- A: The duration of high mortgage rates depends on several factors, including the Fed’s policy stance, inflation trajectory, and economic growth. It’s difficult to predict with certainty, but monitoring economic indicators can provide insights.

-

Q: What are the benefits of refinancing a mortgage?

- A: Refinancing can offer potential benefits such as lower monthly payments, reduced interest costs over the life of the loan, and the ability to switch to a different loan type.

-

Q: Is it worth refinancing with a small rate decrease?

- A: The benefits of refinancing with a small rate decrease depend on the specific loan details, the remaining loan term, and the closing costs associated with refinancing. A refinance calculator can help assess the potential savings.

-

Q: What are the risks associated with refinancing?

- A: Refinancing risks include closing costs, potential rate increases in the future, and the possibility of extending the loan term, which could lead to higher overall interest payments.

Tips for Navigating Refi Mortgage Rate Trends

- Monitor Rate Movements: Stay informed about current and projected refi mortgage rate trends by checking financial news sources and using online mortgage rate calculators.

- Evaluate Your Financial Situation: Analyze your current mortgage, your financial goals, and your ability to handle potential rate changes before making a refinancing decision.

- Seek Professional Advice: Consult with a qualified mortgage broker or financial advisor to get personalized guidance on refinancing strategies.

- Compare Lenders and Rates: Shop around for the best rates and terms from different lenders before making a decision.

- Consider the Long-Term Impact: Evaluate the potential benefits and risks of refinancing over the entire loan term, not just the short-term savings.

Conclusion

The future of refi mortgage rate trends in 2025 is uncertain, influenced by a complex interplay of economic factors. By understanding the forces shaping these trends, homeowners can make informed decisions about refinancing, maximizing their potential savings and navigating the evolving mortgage market effectively. Staying informed, seeking professional advice, and carefully evaluating their financial situation are crucial steps in making the best choices for their individual circumstances.

Closure

Thus, we hope this article has provided valuable insights into Navigating the Uncharted Waters: A Deep Dive into Refi Mortgage Rate Trends 2025. We thank you for taking the time to read this article. See you in our next article!