Shaping The Future: Trends In Financial Services 2025

Shaping the Future: Trends in Financial Services 2025

Related Articles: Shaping the Future: Trends in Financial Services 2025

Introduction

With enthusiasm, let’s navigate through the intriguing topic related to Shaping the Future: Trends in Financial Services 2025. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Shaping the Future: Trends in Financial Services 2025

The financial services industry is undergoing a rapid transformation, driven by technological advancements, evolving consumer expectations, and shifting regulatory landscapes. As we approach 2025, several key trends will continue to shape the industry, creating both opportunities and challenges for financial institutions and their customers.

Understanding the Landscape: Key Trends in Financial Services 2025

1. Hyper-Personalization and Data-Driven Insights:

The availability of vast amounts of data coupled with advanced analytics capabilities will enable financial institutions to offer highly personalized financial services. This includes tailored investment advice, customized loan products, and personalized risk management solutions. By leveraging data-driven insights, institutions can better understand customer needs, preferences, and financial behaviors, leading to more relevant and impactful interactions.

Benefits:

- Enhanced Customer Experience: Personalized services foster customer loyalty and satisfaction by meeting individual needs and expectations.

- Improved Risk Management: Data-driven insights allow for more accurate risk assessments, leading to better loan approvals and more effective fraud detection.

- Increased Efficiency: Personalization can streamline processes, reducing operational costs and improving service delivery.

2. The Rise of Open Finance and APIs:

Open finance, driven by application programming interfaces (APIs), allows consumers to share their financial data securely with third-party applications and services. This creates a more interconnected financial ecosystem, enabling innovative financial solutions and empowering consumers to take control of their finances.

Benefits:

- Enhanced Financial Management: Consumers can access a wider range of financial tools and services, including budgeting apps, investment platforms, and financial planning tools.

- Improved Financial Inclusion: Open finance can expand access to financial services for underserved populations by offering alternative solutions and facilitating financial literacy.

- Innovation and Competition: The open finance ecosystem encourages competition and innovation, leading to new financial products and services.

3. The Growing Influence of Artificial Intelligence (AI):

AI is transforming financial services across various aspects, including customer service, fraud detection, risk assessment, and investment management. AI-powered chatbots provide instant customer support, while machine learning algorithms can identify fraudulent transactions and optimize investment strategies.

Benefits:

- Automated Processes: AI can automate repetitive tasks, freeing up human resources for more complex activities.

- Enhanced Accuracy: AI algorithms can analyze data with greater precision than humans, leading to more accurate decisions and predictions.

- Improved Efficiency: AI-powered solutions can optimize processes, reducing operational costs and improving service delivery.

4. The Integration of Blockchain Technology:

Blockchain technology is revolutionizing financial services by offering a secure, transparent, and efficient platform for transactions. This technology can be used for various applications, including cross-border payments, trade finance, and digital asset management.

Benefits:

- Increased Security: Blockchain’s decentralized nature makes it resistant to hacking and fraud.

- Improved Transparency: All transactions on the blockchain are publicly auditable, increasing transparency and trust.

- Reduced Costs: Blockchain can streamline processes, reducing transaction costs and improving efficiency.

5. The Importance of Cybersecurity and Data Privacy:

As financial services increasingly rely on technology, cybersecurity and data privacy become paramount. Financial institutions must invest in robust security measures to protect sensitive customer data from cyber threats and ensure compliance with evolving data privacy regulations.

Benefits:

- Protecting Customer Data: Strong cybersecurity measures protect sensitive customer information from unauthorized access and data breaches.

- Maintaining Trust: Protecting customer data builds trust and confidence in financial institutions.

- Compliance with Regulations: Compliance with data privacy regulations minimizes legal risks and ensures responsible data handling.

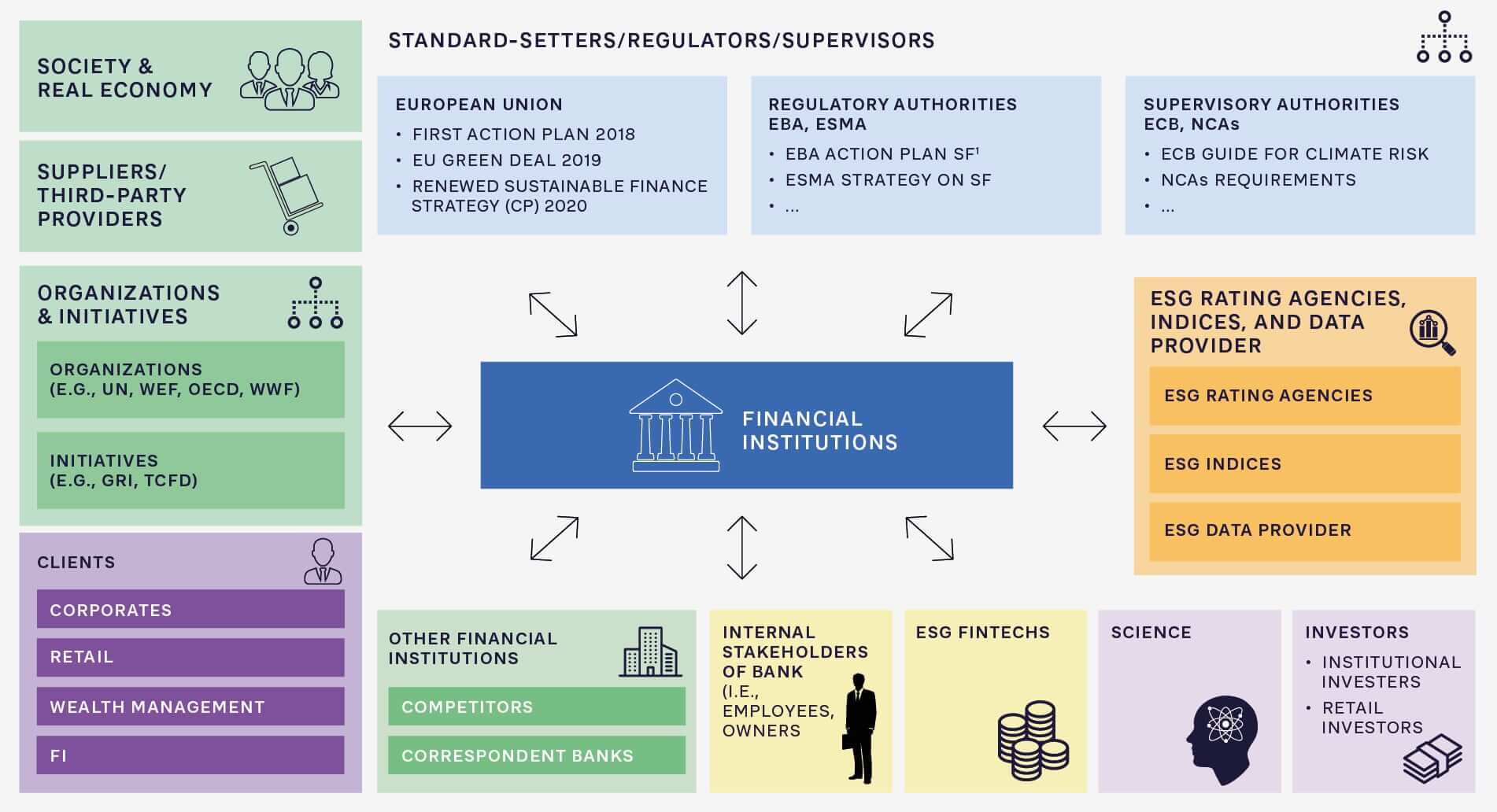

6. The Rise of Sustainable Finance:

Investors and consumers are increasingly demanding financial products and services that align with environmental, social, and governance (ESG) principles. Financial institutions are responding by offering sustainable investment options, ethical banking products, and responsible lending practices.

Benefits:

- Positive Social Impact: Sustainable finance promotes investments that contribute to environmental protection, social justice, and good governance.

- Attracting Investors: ESG-focused investments appeal to socially conscious investors and can generate higher returns.

- Building a Sustainable Future: Sustainable finance practices contribute to a more sustainable and equitable future.

7. The Importance of Financial Literacy and Education:

Financial literacy is crucial for consumers to make informed financial decisions and navigate the complexities of the modern financial landscape. Financial institutions play a vital role in promoting financial education and providing accessible resources to empower individuals.

Benefits:

- Empowered Consumers: Financially literate consumers make better financial decisions, leading to improved financial well-being.

- Reduced Financial Risk: Financial literacy helps consumers avoid financial scams and make responsible borrowing decisions.

- Enhanced Economic Growth: A financially literate population contributes to a more stable and prosperous economy.

8. The Growing Role of Fintech and Regtech:

Fintech companies are disrupting the financial services industry by offering innovative solutions and challenging traditional business models. Regtech companies are developing technologies to streamline regulatory compliance and enhance financial stability.

Benefits:

- Increased Efficiency: Fintech and Regtech solutions automate processes, reduce costs, and improve operational efficiency.

- Enhanced Innovation: Fintech companies introduce new products and services, driving innovation in the financial services sector.

- Improved Regulation: Regtech solutions help financial institutions comply with regulations more effectively.

Related Searches: Expanding the Exploration

These trends in financial services are interconnected and influence each other. Exploring related searches provides a deeper understanding of the evolving landscape:

1. Future of Banking: This search delves into the transformation of traditional banking models, exploring the rise of digital banking, neobanks, and the impact of technology on banking services.

2. Fintech Trends: This search focuses on the latest innovations and disruptions in the fintech sector, including advancements in payments, lending, and investment platforms.

3. Financial Technology: This search explores the broader impact of technology on financial services, encompassing areas like blockchain, artificial intelligence, and big data analytics.

4. Digital Finance: This search examines the growing adoption of digital channels for financial services, including online banking, mobile payments, and digital wealth management.

5. Financial Inclusion: This search investigates how technology and innovation can expand access to financial services for underserved populations, promoting financial inclusion and economic empowerment.

6. Cybersecurity in Financial Services: This search focuses on the growing importance of cybersecurity in protecting sensitive customer data and mitigating cyber threats in the financial services industry.

7. Regulation of Fintech: This search examines the evolving regulatory landscape for fintech companies, exploring how regulators are adapting to new technologies and business models.

8. Sustainable Investing: This search explores the growing trend of sustainable investing, examining ESG principles, impact investing, and the role of financial institutions in promoting responsible investment practices.

FAQs by Trends in Financial Services 2025

1. How will hyper-personalization impact customer experience?

Hyper-personalization will enhance the customer experience by providing tailored financial services that meet individual needs and preferences. This includes personalized investment advice, customized loan products, and proactive financial guidance.

2. What are the benefits of open finance for consumers?

Open finance empowers consumers by giving them control over their financial data and access to a wider range of financial tools and services. This includes budgeting apps, investment platforms, and financial planning tools, enabling better financial management and decision-making.

3. How can AI improve fraud detection in financial services?

AI-powered algorithms can analyze vast amounts of data to identify patterns and anomalies that indicate fraudulent activity. This enables faster and more accurate fraud detection, protecting financial institutions and customers from financial losses.

4. What are the potential applications of blockchain technology in financial services?

Blockchain technology can revolutionize financial services by offering a secure, transparent, and efficient platform for transactions. This includes applications like cross-border payments, trade finance, digital asset management, and identity verification.

5. Why is cybersecurity crucial in the digital age of financial services?

As financial services increasingly rely on technology, protecting sensitive customer data from cyber threats becomes paramount. Robust cybersecurity measures are essential to maintain trust, prevent data breaches, and ensure compliance with data privacy regulations.

6. How can financial institutions promote financial literacy?

Financial institutions can promote financial literacy by providing accessible resources, offering educational workshops, and partnering with community organizations to empower individuals with the knowledge and skills to make informed financial decisions.

7. What are the challenges of integrating fintech and regtech into the financial services industry?

Integrating fintech and regtech into the financial services industry presents challenges related to data security, regulatory compliance, and ensuring interoperability between different platforms and systems.

8. How can financial institutions align their operations with ESG principles?

Financial institutions can align their operations with ESG principles by offering sustainable investment options, promoting ethical banking practices, and engaging in responsible lending practices that contribute to environmental protection, social justice, and good governance.

Tips by Trends in Financial Services 2025

1. Embrace Data-Driven Insights: Financial institutions should invest in data analytics capabilities to gain a deeper understanding of customer needs and behaviors, enabling personalized service offerings and improved risk management.

2. Leverage Open Finance APIs: Financial institutions should embrace open finance by developing APIs that allow third-party applications to access customer data securely, fostering innovation and creating new revenue streams.

3. Adopt AI-Powered Solutions: Financial institutions should explore AI-powered solutions to automate processes, enhance accuracy, and improve efficiency across various aspects of their operations.

4. Explore Blockchain Technology: Financial institutions should investigate the potential applications of blockchain technology to improve security, transparency, and efficiency in their transactions and operations.

5. Prioritize Cybersecurity: Financial institutions must invest in robust cybersecurity measures to protect sensitive customer data from cyber threats and ensure compliance with data privacy regulations.

6. Promote Financial Literacy: Financial institutions should actively promote financial literacy by providing educational resources, offering workshops, and partnering with community organizations to empower individuals with financial knowledge.

7. Engage with Fintech and Regtech: Financial institutions should collaborate with fintech and regtech companies to explore innovative solutions, improve efficiency, and enhance regulatory compliance.

8. Integrate Sustainability Principles: Financial institutions should integrate ESG principles into their operations by offering sustainable investment options, promoting ethical banking practices, and engaging in responsible lending practices.

Conclusion by Trends in Financial Services 2025

The financial services industry is at a pivotal juncture, driven by technological advancements, evolving consumer expectations, and shifting regulatory landscapes. The trends outlined above will continue to shape the industry in the coming years, creating both opportunities and challenges for financial institutions and their customers.

By embracing innovation, prioritizing customer experience, and adapting to the changing environment, financial institutions can thrive in this dynamic landscape. The future of financial services will be characterized by a more personalized, interconnected, and digitally enabled ecosystem, offering a wider range of solutions and opportunities for both individuals and businesses.

Closure

Thus, we hope this article has provided valuable insights into Shaping the Future: Trends in Financial Services 2025. We appreciate your attention to our article. See you in our next article!