SPAC Trends 2025: Navigating The Evolving Landscape Of Special Purpose Acquisition Companies

SPAC Trends 2025: Navigating the Evolving Landscape of Special Purpose Acquisition Companies

Related Articles: SPAC Trends 2025: Navigating the Evolving Landscape of Special Purpose Acquisition Companies

Introduction

With great pleasure, we will explore the intriguing topic related to SPAC Trends 2025: Navigating the Evolving Landscape of Special Purpose Acquisition Companies. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

SPAC Trends 2025: Navigating the Evolving Landscape of Special Purpose Acquisition Companies

The world of finance is constantly evolving, and one of the most significant recent developments has been the rise of Special Purpose Acquisition Companies (SPACs). These shell companies, designed to merge with private companies and take them public, have garnered significant attention in recent years. While SPACs have faced regulatory scrutiny and market volatility, their potential remains undeniable. This article delves into the anticipated SPAC trends in 2025, exploring the factors shaping the future of this innovative financial instrument.

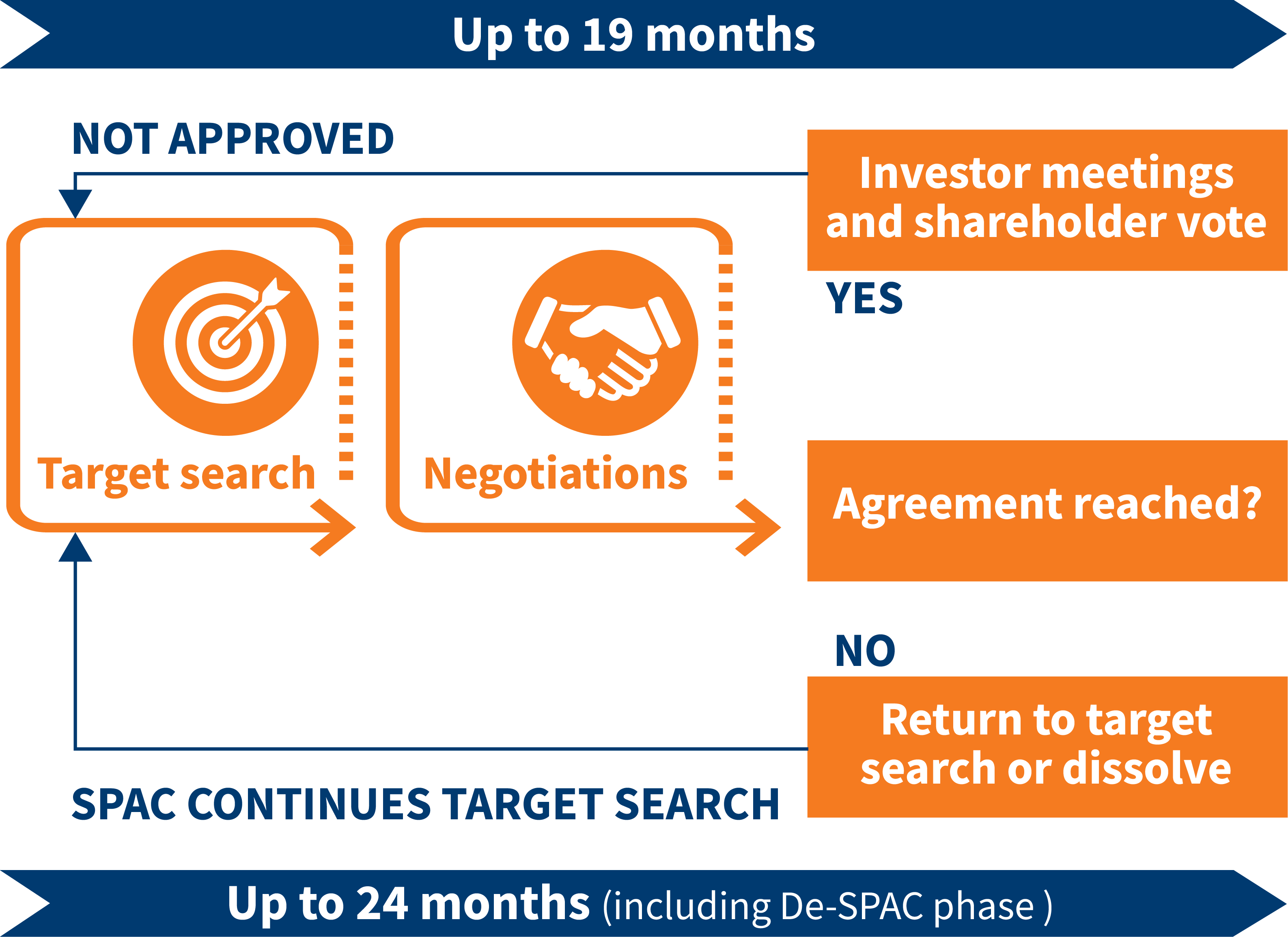

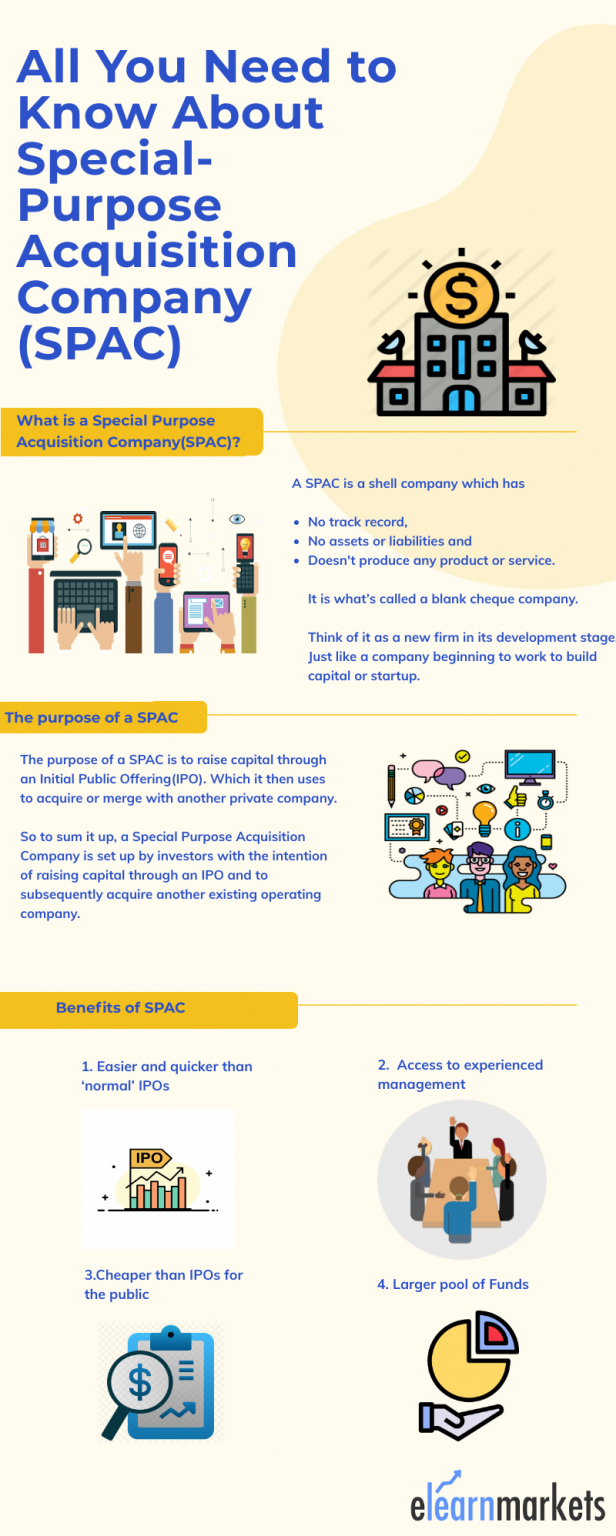

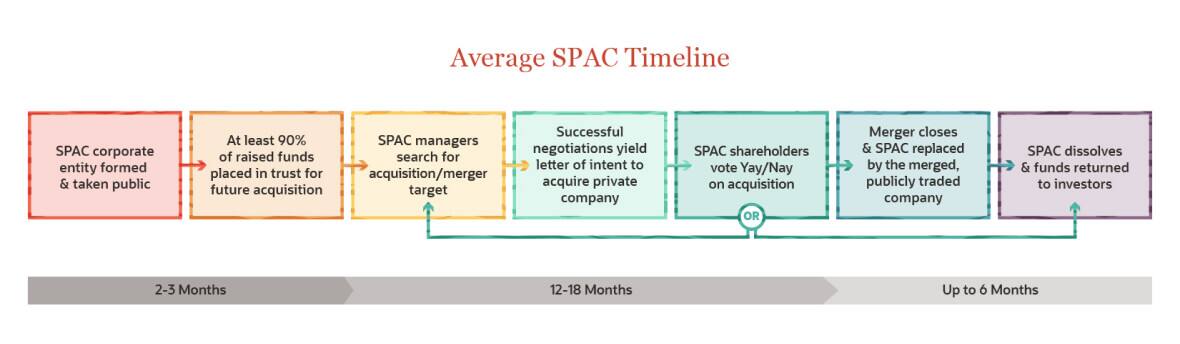

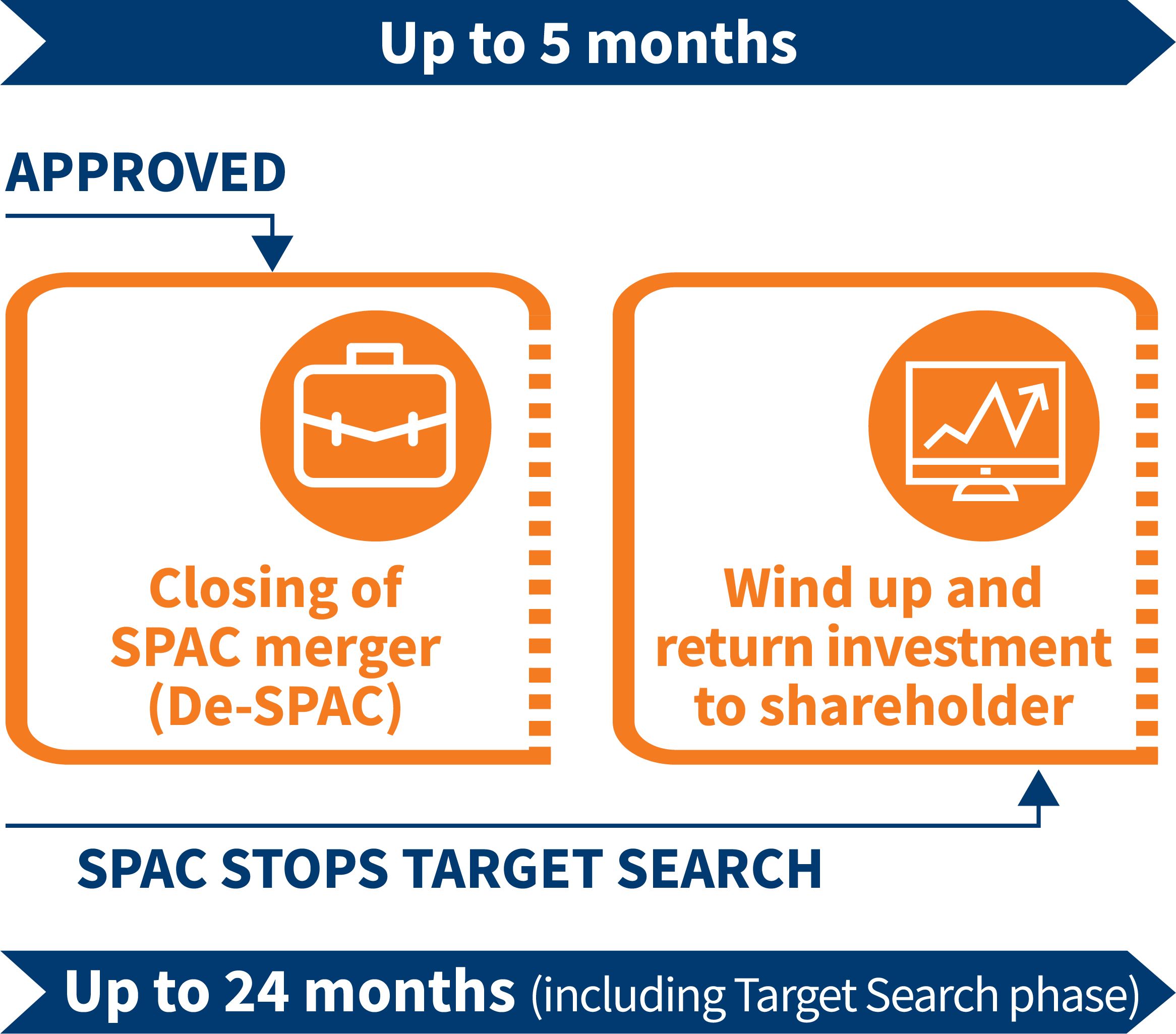

Understanding the Foundations of SPACs

Before delving into the trends, it’s essential to understand the fundamentals of SPACs. A SPAC is essentially a blank-check company that raises capital through an initial public offering (IPO) with the sole purpose of acquiring a private company within a specific timeframe. The SPAC’s management team, often comprised of experienced industry veterans, uses the raised funds to identify and acquire a target company, typically within 18-24 months. This process allows private companies to go public without the traditional IPO process, offering them a quicker and potentially less demanding route to accessing capital markets.

SPAC Trends in 2025: A Comprehensive Outlook

While the SPAC market experienced a boom in 2020 and 2021, followed by a subsequent slowdown, the trend is far from over. The year 2025 promises to be a pivotal year for SPACs, characterized by several key trends:

1. Regulatory Landscape:

- Increased Scrutiny: The Securities and Exchange Commission (SEC) has intensified its scrutiny of SPACs, focusing on areas such as disclosure requirements, conflicts of interest, and investor protection. This heightened scrutiny is expected to continue in 2025, driving greater transparency and accountability within the SPAC ecosystem.

- New Regulations: The SEC is actively exploring new regulations to address potential vulnerabilities in the SPAC process, such as the "de-SPAC" process where a SPAC merges with a target company and becomes a public entity. These regulations could impact the speed and cost of SPAC transactions, potentially influencing the attractiveness of SPACs for both sponsors and target companies.

2. Target Company Selection:

- Focus on Profitability: In the early days of SPACs, the emphasis was often on growth and potential, even if a target company wasn’t yet profitable. However, with increased scrutiny from regulators and investors, the focus is shifting towards profitability and sustainable business models. Companies with proven track records and strong earnings potential will be more attractive to SPAC sponsors in 2025.

- Industry Diversification: While technology and healthcare sectors were initially dominant in SPAC mergers, the landscape is diversifying. Expect to see more SPACs targeting companies in industries like energy, consumer goods, and even traditional manufacturing. This broader focus will reflect the evolving economic landscape and the search for compelling investment opportunities across various sectors.

3. SPAC Sponsor Landscape:

- Experienced Sponsors: The SPAC landscape is becoming increasingly competitive, with more experienced and well-established financial institutions and industry leaders joining the fray. These sponsors bring a wealth of expertise and resources, enhancing the credibility and attractiveness of SPAC transactions.

- Focus on Value Creation: SPAC sponsors are increasingly emphasizing their ability to add value to target companies beyond simply taking them public. This includes providing strategic guidance, operational expertise, and access to capital markets, thereby enhancing the long-term growth potential of the merged entity.

4. Investor Sentiment and Market Dynamics:

- Investor Sophistication: Investors are becoming more sophisticated in their understanding of SPACs, recognizing both the potential benefits and associated risks. This increased awareness will lead to more discerning investment decisions, demanding greater transparency and accountability from SPAC sponsors.

- Market Volatility: The overall market environment will continue to influence SPAC activity. Periods of economic uncertainty or market volatility could lead to a decline in SPAC transactions, while favorable market conditions could spur increased activity. Investors and sponsors will need to remain agile and adaptable to navigate the ever-changing market dynamics.

5. Innovation and Future Trends:

- Direct Listings: While SPACs have been a popular alternative to traditional IPOs, direct listings are gaining traction. This alternative method allows companies to go public without the need for underwriters or a traditional IPO process, offering greater control and potentially lower costs. The rise of direct listings could impact the future of SPACs, influencing their role in the capital markets.

- Sustainability and ESG Focus: Investors are increasingly prioritizing environmental, social, and governance (ESG) factors in their investment decisions. SPAC sponsors are expected to align their target company selection and investment strategies with these principles, reflecting the growing importance of sustainability in the financial world.

Related Searches: SPAC Trends 2025

1. SPAC Mergers & Acquisitions:

- Merger Arbitrage Opportunities: The merger process between a SPAC and a target company can create arbitrage opportunities for investors. Understanding the intricacies of merger arbitrage and its associated risks is crucial for investors seeking to capitalize on SPAC transactions.

- Post-Merger Performance: The performance of SPACs after the merger is a key factor for investors. Analyzing historical data and assessing the long-term growth potential of the merged entity are essential for making informed investment decisions.

- Deal Structure and Valuation: The structure of SPAC mergers, including the valuation of the target company and the allocation of equity, can significantly impact investor returns. Understanding these intricacies is crucial for investors seeking to navigate the complexities of SPAC transactions.

2. SPAC Regulation and Compliance:

- SEC Guidance and Regulations: Staying abreast of the latest SEC guidance and regulations pertaining to SPACs is essential for both sponsors and investors. Understanding the evolving regulatory landscape is crucial for ensuring compliance and mitigating legal risks.

- Disclosure Requirements: SPACs are subject to specific disclosure requirements designed to provide investors with essential information about the transaction. Understanding these requirements and ensuring accurate and transparent disclosure is paramount for maintaining investor confidence.

- Conflicts of Interest: Potential conflicts of interest can arise in SPAC transactions, particularly between the SPAC sponsor and the target company. Identifying and addressing these conflicts is essential for preserving the integrity of the transaction and safeguarding investor interests.

3. SPAC Market Trends:

- SPAC IPO Activity: Monitoring the volume and characteristics of SPAC IPOs is crucial for understanding the overall health of the SPAC market. Analyzing trends in SPAC IPO activity can provide insights into investor sentiment and the attractiveness of SPACs as a fundraising tool.

- SPAC Redemption Rates: Redemption rates, which reflect the percentage of SPAC investors who choose to redeem their shares before the merger, are a key indicator of investor confidence. High redemption rates can signal a lack of investor confidence in the SPAC sponsor or the target company.

- SPAC Valuation and Performance: Analyzing SPAC valuation metrics and comparing their performance to traditional IPOs or other investment options is crucial for understanding the relative attractiveness of SPACs.

4. SPAC Investment Strategies:

- Diversification and Portfolio Allocation: SPACs should be considered as part of a diversified investment portfolio, alongside other asset classes. Determining the appropriate allocation of capital to SPACs depends on individual risk tolerance and investment goals.

- Due Diligence and Risk Management: Thorough due diligence is essential before investing in SPACs. Investors should carefully evaluate the SPAC sponsor’s track record, the target company’s business model, and the overall risk profile of the transaction.

- Exit Strategies: Understanding the potential exit strategies for SPAC investments is crucial for investors. This includes considering the possibility of selling shares after the merger, participating in the long-term growth of the merged entity, or redeeming shares before the merger.

5. SPAC Industry Landscape:

- SPAC Sponsor Competition: The competitive landscape among SPAC sponsors is evolving rapidly, with new entrants and established players vying for attractive target companies. Understanding the key players and their competitive strategies is important for investors seeking to identify promising SPAC opportunities.

- SPAC Research and Analysis: Access to reliable research and analysis on SPACs is crucial for making informed investment decisions. This includes evaluating the financial performance of SPACs, assessing the quality of their target companies, and understanding the potential risks and rewards of SPAC investments.

- Industry Events and Conferences: Attending industry events and conferences related to SPACs can provide valuable insights into the latest trends, regulatory developments, and investment opportunities.

6. SPAC Technology and Innovation:

- Blockchain and Decentralized Finance (DeFi): The intersection of SPACs with blockchain and DeFi technologies is an emerging area of interest. Exploring the potential applications of these technologies within the SPAC ecosystem could revolutionize the way SPACs are structured and operated.

- Artificial Intelligence (AI) and Data Analytics: AI and data analytics are increasingly being used to identify promising target companies and assess the risks and rewards of SPAC transactions. These technologies can enhance the efficiency and effectiveness of the SPAC process.

- ESG Integration: The integration of ESG principles into SPAC transactions is gaining momentum. Exploring the impact of ESG factors on SPAC valuations and investor preferences can provide insights into the future of responsible investing within the SPAC ecosystem.

7. SPAC Global Expansion:

- International SPAC Activity: The SPAC phenomenon is expanding beyond the United States, with growing activity in Europe, Asia, and other regions. Understanding the regulatory environment and market dynamics in these regions is crucial for investors seeking to capitalize on global SPAC opportunities.

- Cross-Border Mergers: Cross-border mergers involving SPACs are becoming more common. Navigating the complexities of legal and regulatory frameworks across different jurisdictions is essential for successfully executing these transactions.

- Emerging Markets: SPACs are increasingly being used as a tool for accessing capital markets in emerging markets. Exploring the potential for SPACs to drive economic growth and development in these regions is a topic of growing interest.

8. SPAC Future Outlook:

- Long-Term Viability: While the future of SPACs remains uncertain, their potential to disrupt the traditional IPO process and provide a faster and more efficient route to public markets is undeniable. The long-term viability of SPACs will depend on their ability to adapt to evolving market conditions and regulatory landscapes.

- Innovation and Evolution: SPACs are a relatively new financial instrument, and their evolution is ongoing. Expect to see further innovation and development in the coming years, driven by technological advancements, changing investor preferences, and the desire to enhance the efficiency and transparency of the SPAC process.

- Impact on Capital Markets: The rise of SPACs has had a significant impact on the capital markets, providing new avenues for companies to go public and for investors to access growth opportunities. The future of SPACs will continue to shape the landscape of capital markets and influence the way companies access financing and investors seek returns.

FAQs: SPAC Trends 2025

1. What are the key risks associated with SPAC investments?

- Lack of Track Record: SPACs often target companies with limited operating histories, making it difficult to assess their long-term viability.

- Sponsor Conflicts of Interest: Potential conflicts of interest can arise between the SPAC sponsor and the target company, potentially affecting the fairness of the transaction.

- Market Volatility: SPACs are susceptible to market volatility, which can impact their valuations and investor returns.

2. How can investors mitigate the risks of SPAC investments?

- Thorough Due Diligence: Investors should conduct thorough due diligence on both the SPAC sponsor and the target company, examining their track records, business models, and financial performance.

- Diversification: SPACs should be considered as part of a diversified investment portfolio, alongside other asset classes.

- Understanding the Redemption Process: Investors should familiarize themselves with the redemption process, which allows them to sell their shares back to the SPAC before the merger.

3. What is the future of SPACs?

- Continued Evolution: SPACs are a relatively new financial instrument, and their evolution is ongoing. Expect to see further innovation and development in the coming years.

- Regulatory Impact: The regulatory landscape for SPACs is evolving, and new rules and regulations could impact their future.

- Competition from Other Investment Options: SPACs will continue to face competition from traditional IPOs, direct listings, and other alternative investment options.

Tips: SPAC Trends 2025

- Stay Informed: Keep abreast of the latest trends, regulations, and developments in the SPAC market.

- Seek Professional Advice: Consult with a financial advisor to discuss your investment goals and risk tolerance before investing in SPACs.

- Understand the Risks: Recognize the risks associated with SPAC investments and be prepared to manage those risks.

Conclusion: SPAC Trends 2025

The year 2025 promises to be a pivotal year for SPACs, with the landscape shaped by regulatory scrutiny, evolving investor preferences, and a shift towards profitability and sustainable business models. While challenges and uncertainties remain, the potential of SPACs to disrupt the traditional IPO process and provide a faster route to public markets is undeniable. By understanding the key trends, navigating the regulatory landscape, and conducting thorough due diligence, investors can capitalize on the opportunities and mitigate the risks associated with this dynamic financial instrument. As SPACs continue to evolve, their impact on the capital markets and the broader financial landscape will be a fascinating story to watch unfold.

:max_bytes(150000):strip_icc()/Spac-6b76535412b54c91b1e91ed54698ed24.png)

Closure

Thus, we hope this article has provided valuable insights into SPAC Trends 2025: Navigating the Evolving Landscape of Special Purpose Acquisition Companies. We appreciate your attention to our article. See you in our next article!