The Evolving Landscape Of Insurance: Trends Shaping The Industry In 2025

The Evolving Landscape of Insurance: Trends Shaping the Industry in 2025

Related Articles: The Evolving Landscape of Insurance: Trends Shaping the Industry in 2025

Introduction

With great pleasure, we will explore the intriguing topic related to The Evolving Landscape of Insurance: Trends Shaping the Industry in 2025. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

The Evolving Landscape of Insurance: Trends Shaping the Industry in 2025

The insurance industry, traditionally known for its conservative approach, is undergoing a rapid transformation. Driven by technological advancements, changing consumer expectations, and evolving risk landscapes, the industry is poised for significant shifts in the coming years. Trends insurance 2025 will redefine how insurance is bought, sold, and experienced, impacting both insurers and policyholders alike.

This article delves into the key trends shaping the future of insurance, exploring their potential implications and highlighting the opportunities and challenges they present.

1. The Rise of Insurtech and Digital Transformation

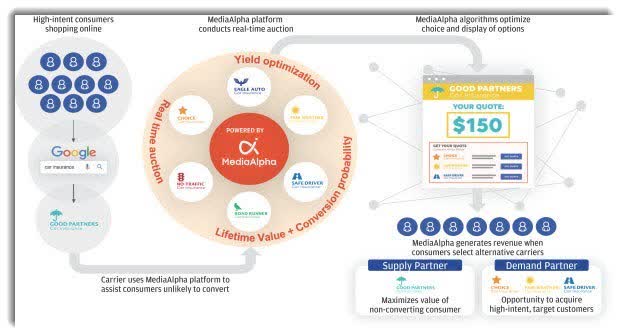

Insurtech, the intersection of insurance and technology, is revolutionizing the industry. Startups are disrupting traditional models by leveraging technology to provide more personalized, efficient, and accessible insurance solutions. This includes:

- Digital-First Platforms: Insurers are moving away from traditional, paper-based processes and adopting digital platforms for everything from policy acquisition to claims management. This fosters greater customer engagement and efficiency.

- Artificial Intelligence (AI): AI is playing a crucial role in underwriting, claims processing, and fraud detection. AI algorithms can analyze vast amounts of data to assess risk more accurately and efficiently, leading to more personalized pricing and faster claims resolutions.

- Internet of Things (IoT): Connected devices are generating unprecedented amounts of data, providing insurers with real-time insights into risk factors. This data can be used to personalize premiums, offer preventative measures, and optimize claims management.

- Blockchain Technology: Blockchain offers a secure and transparent platform for managing insurance data and transactions. This can streamline processes, reduce fraud, and improve trust between insurers and policyholders.

2. Personalized and On-Demand Insurance

Consumers are demanding more personalized and flexible insurance solutions. Trends insurance 2025 will see a surge in:

- Micro-Insurance: Smaller, more affordable insurance policies tailored to specific needs, such as covering a single device or a short-term event. This offers greater flexibility and caters to the needs of the gig economy and the increasingly fragmented nature of life.

- Pay-Per-Use Insurance: Consumers pay only for the coverage they need, based on actual usage. This model is particularly attractive for car insurance, where usage-based pricing can significantly reduce premiums for low-mileage drivers.

- Data-Driven Personalization: Insurers are using customer data to offer personalized insurance plans, pricing, and services. This can lead to more relevant coverage and improved customer satisfaction.

3. The Growing Importance of Sustainability and Social Responsibility

Consumers are increasingly conscious of environmental and social issues. Insurers are responding by:

- Developing Sustainable Insurance Products: Offering insurance solutions that promote sustainability, such as green building insurance or renewable energy coverage. This aligns with the growing demand for environmentally conscious products and services.

- Investing in Socially Responsible Initiatives: Insurers are supporting social causes and promoting social good through their operations and investments. This enhances their brand image and attracts socially conscious consumers.

- Adopting Sustainable Practices: Insurers are adopting sustainable practices within their own operations, reducing their environmental footprint and contributing to a more sustainable future.

4. The Rise of Insurtech Ecosystems

The insurance industry is moving towards interconnected ecosystems where insurers collaborate with other businesses, including technology providers, data analytics companies, and fintech firms. This fosters innovation and allows insurers to access new capabilities and reach wider audiences.

5. The Growing Impact of Cybersecurity

Cybersecurity is becoming increasingly important as insurance companies rely more heavily on digital systems. Trends insurance 2025 will see insurers:

- Investing in Robust Cybersecurity Measures: Implementing advanced cybersecurity protocols and technologies to protect sensitive data and systems from cyberattacks.

- Adopting Data Privacy Regulations: Complying with data privacy regulations like GDPR and CCPA to ensure responsible data handling and protect customer privacy.

- Educating Customers on Cybersecurity: Raising awareness about cyber risks and providing resources to help customers protect themselves from cyberattacks.

6. The Role of Artificial Intelligence (AI) in Claims Management

AI is transforming claims management, leading to faster, more efficient, and more accurate claims processing. This includes:

- Automated Claims Assessment: AI algorithms can analyze data from various sources, including accident reports, medical records, and social media, to assess the validity of claims and determine payouts.

- Fraud Detection: AI can identify patterns and anomalies in claims data to detect fraudulent claims and prevent losses for insurers.

- Personalized Claims Experience: AI can provide personalized communication and support to claimants, streamlining the claims process and improving customer satisfaction.

7. The Importance of Customer Experience

Customer experience is becoming a key differentiator in the insurance industry. Trends insurance 2025 will see insurers:

- Investing in Customer-Centric Technologies: Implementing technologies that enhance the customer experience, such as chatbots, virtual assistants, and personalized online portals.

- Building Strong Customer Relationships: Focusing on building long-term relationships with customers through personalized communication, proactive support, and loyalty programs.

- Prioritizing Customer Feedback: Actively seeking and responding to customer feedback to identify areas for improvement and enhance the overall customer experience.

8. The Impact of Climate Change

Climate change is posing new challenges for the insurance industry. Trends insurance 2025 will see insurers:

- Developing Climate-Resilient Insurance Products: Offering insurance solutions that address the risks associated with climate change, such as flood insurance, drought insurance, and extreme weather coverage.

- Investing in Climate Change Mitigation: Supporting initiatives that reduce greenhouse gas emissions and mitigate the impacts of climate change.

- Adapting to Climate Change Risks: Developing strategies to adapt to the changing climate and manage the risks associated with extreme weather events.

Related Searches

Trends insurance 2025 is a broad topic with many sub-categories that are important to explore. Here are some related searches and their relevance to the overarching theme:

- Insurance Technology Trends 2025: This search focuses on the specific technological advancements shaping the insurance industry. It explores the impact of emerging technologies like AI, blockchain, and IoT on insurance products, processes, and customer experience.

- Digital Insurance Trends 2025: This search explores the shift towards digital insurance models, including online platforms, mobile apps, and digital distribution channels. It examines how digital transformation is changing the way insurance is bought, sold, and managed.

- Future of Insurance 2025: This search looks at the broader future of the insurance industry, considering the impact of evolving consumer expectations, technological advancements, and global trends on the industry’s landscape.

- Insurance Industry Outlook 2025: This search provides an overview of the current state of the insurance industry and forecasts its future trajectory. It analyzes market trends, growth opportunities, and potential challenges facing the industry.

- Insurance Market Trends 2025: This search focuses on the specific market trends shaping the insurance industry, including changes in consumer behavior, competitive dynamics, and regulatory landscape.

- Insurance Innovation Trends 2025: This search explores the latest innovations in the insurance industry, including new products, services, and business models. It highlights the role of startups, technology providers, and established insurers in driving innovation.

- Insurance Industry Predictions 2025: This search provides predictions and forecasts for the future of the insurance industry, based on current trends and expert analysis. It explores potential disruptions, opportunities, and challenges facing the industry.

- Insurance Trends 2025: What Insurers Need to Know: This search focuses on the specific trends that insurers need to be aware of to remain competitive and successful in the future. It provides insights into the changing landscape of the insurance market and the strategies insurers can adopt to thrive.

FAQs

Q: How will Trends insurance 2025 impact insurance premiums?

A: Trends insurance 2025 will likely lead to more personalized and dynamic pricing models. Insurers will utilize data from various sources, including IoT devices, social media, and personal driving habits, to assess risk more accurately. This can lead to lower premiums for those who demonstrate lower risk profiles and higher premiums for those with higher risk profiles.

Q: Will Trends insurance 2025 make insurance more accessible?

A: Trends insurance 2025 has the potential to make insurance more accessible to a wider range of consumers. The rise of micro-insurance and pay-per-use models can offer more affordable and flexible options, catering to the needs of individuals and businesses with diverse risk profiles and financial situations.

Q: What are the biggest challenges facing the insurance industry in 2025?

A: The biggest challenges facing the insurance industry in 2025 include:

- Keeping up with rapid technological advancements: The industry needs to adapt to new technologies and develop innovative solutions to remain competitive.

- Meeting evolving customer expectations: Insurers need to provide personalized, efficient, and digital-first experiences to meet the demands of modern consumers.

- Managing cybersecurity risks: Protecting sensitive customer data and systems from cyberattacks is crucial for maintaining trust and protecting the industry’s reputation.

- Adapting to climate change: Insurers need to develop climate-resilient insurance products and strategies to address the risks associated with climate change.

Tips

- Embrace Digital Transformation: Insurers should invest in digital technologies and platforms to streamline processes, enhance customer experience, and improve efficiency.

- Prioritize Customer Experience: Focus on building strong customer relationships through personalized communication, proactive support, and loyalty programs.

- Invest in Cybersecurity: Implement robust cybersecurity measures to protect sensitive data and systems from cyberattacks.

- Embrace Sustainability: Develop sustainable insurance products and adopt environmentally friendly practices within the organization.

- Collaborate with Insurtech Startups: Partner with insurtech startups to access new technologies and innovative solutions.

- Stay Informed about Emerging Trends: Continuously monitor industry trends and adapt strategies to stay ahead of the curve.

Conclusion

Trends insurance 2025 will be a transformative period for the insurance industry. The adoption of technology, the changing consumer landscape, and the evolving risk environment will shape the future of insurance, presenting both opportunities and challenges for insurers. By embracing innovation, adapting to changing customer expectations, and managing evolving risks, insurers can position themselves for success in this dynamic and evolving market.

Closure

Thus, we hope this article has provided valuable insights into The Evolving Landscape of Insurance: Trends Shaping the Industry in 2025. We appreciate your attention to our article. See you in our next article!