The Future Of Banking: Digital Trends Shaping The Industry In 2025

The Future of Banking: Digital Trends Shaping the Industry in 2025

Related Articles: The Future of Banking: Digital Trends Shaping the Industry in 2025

Introduction

With enthusiasm, let’s navigate through the intriguing topic related to The Future of Banking: Digital Trends Shaping the Industry in 2025. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

- 1 Related Articles: The Future of Banking: Digital Trends Shaping the Industry in 2025

- 2 Introduction

- 3 The Future of Banking: Digital Trends Shaping the Industry in 2025

- 4 Related Searches:

- 5 FAQs about Digital Trends in Banking 2025:

- 6 Tips for Banks in Adapting to Digital Trends:

- 7 Conclusion:

- 8 Closure

The Future of Banking: Digital Trends Shaping the Industry in 2025

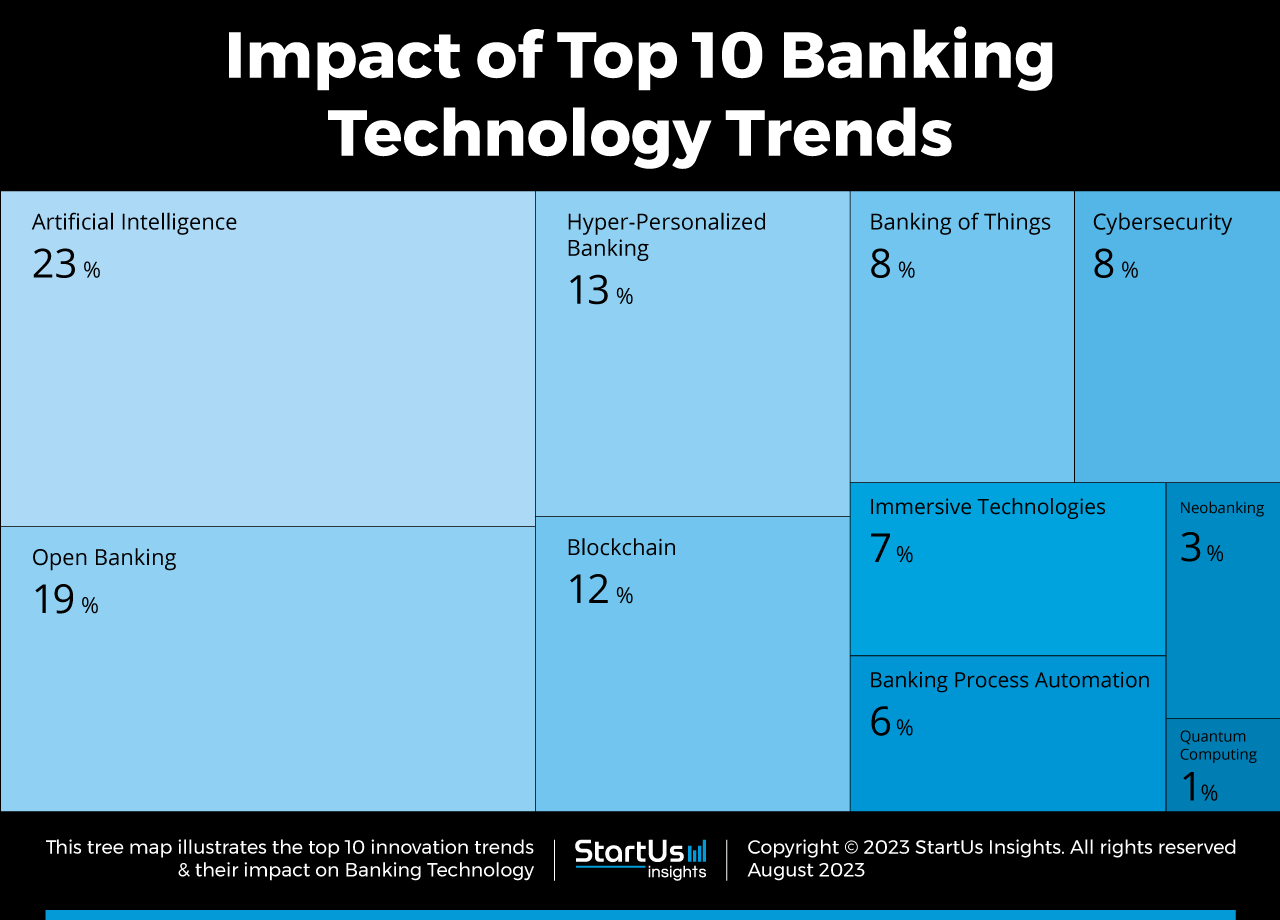

The banking industry is in a constant state of evolution, driven by technological advancements and changing customer expectations. As we approach 2025, several digital trends in banking are poised to transform the landscape, impacting both financial institutions and their customers in profound ways.

1. Hyper-Personalization and AI-Powered Banking:

- Personalized Financial Advice: Artificial intelligence (AI) will play a pivotal role in offering tailored financial advice. By analyzing customer data, AI algorithms can provide personalized recommendations for investments, budgeting, and savings strategies, catering to individual financial goals and risk profiles.

- Proactive Customer Service: AI-powered chatbots and virtual assistants will become increasingly sophisticated, offering 24/7 customer support and resolving inquiries in real-time. These intelligent systems can anticipate customer needs, proactively offering relevant information and assistance, enhancing the overall banking experience.

- Fraud Detection and Prevention: AI algorithms will enhance fraud detection and prevention capabilities. By identifying unusual patterns and anomalies in transactions, AI can flag suspicious activities in real-time, safeguarding both customers and institutions from financial losses.

2. The Rise of Open Banking and Data Sharing:

- Enhanced Financial Control: Open banking allows customers to share their financial data with third-party applications, providing greater control and transparency over their finances. This enables access to a wider range of financial products and services, fostering competition and innovation within the industry.

- Seamless Integration and Aggregation: Open banking facilitates seamless integration between different financial platforms, allowing customers to manage their finances through a single interface. This simplifies financial management, providing a consolidated view of all accounts, investments, and transactions.

- Personalized Financial Solutions: By sharing their financial data, customers can benefit from personalized financial solutions tailored to their specific needs. Third-party providers can leverage this data to develop innovative products and services, catering to diverse customer segments.

3. The Growing Importance of Cybersecurity:

- Advanced Threat Detection: As digital banking services evolve, cybersecurity threats become increasingly sophisticated. Banks will need to invest in robust security measures, including advanced threat detection and prevention technologies, to protect customer data and prevent financial fraud.

- Biometric Authentication: Biometric authentication, such as fingerprint scanning and facial recognition, will become more prevalent in banking, offering a secure and convenient way to verify user identities. This will enhance security by reducing the risk of unauthorized access to accounts.

- Data Encryption and Security Protocols: Banks will adopt advanced data encryption and security protocols to safeguard sensitive customer information. This includes implementing multi-factor authentication, secure communication channels, and regular security audits to mitigate vulnerabilities.

4. The Expansion of Mobile and Digital Payments:

- Contactless Payments: Contactless payment methods, such as mobile wallets and near-field communication (NFC) technology, will become the preferred choice for transactions, offering convenience and speed. This shift will further accelerate the decline of traditional cash-based payments.

- Peer-to-Peer (P2P) Payments: Peer-to-peer payment platforms will continue to gain popularity, enabling seamless and instant money transfers between individuals. This will further disrupt traditional banking models, offering a more convenient and cost-effective alternative.

- Blockchain Technology Integration: Blockchain technology will play a growing role in digital payments, offering enhanced security, transparency, and efficiency. This will enable faster and more secure cross-border payments, reducing transaction costs and improving accessibility.

5. The Emergence of FinTech and Banking-as-a-Service (BaaS):

- Innovation and Disruption: FinTech companies are challenging traditional banking models by offering innovative products and services, such as digital lending, investment platforms, and alternative payment solutions. This competition forces banks to adapt and innovate, offering more agile and customer-centric solutions.

- Banking-as-a-Service (BaaS): BaaS platforms enable non-financial companies to offer financial services through APIs, expanding access to financial products and services beyond traditional banking channels. This trend fosters collaboration and innovation, creating new opportunities for both banks and FinTech companies.

- Faster Time to Market: BaaS platforms allow banks to develop and launch new products and services more quickly, reducing development costs and increasing their agility in a rapidly evolving market.

6. The Growth of Sustainable and Inclusive Banking:

- Environmental, Social, and Governance (ESG) Considerations: Increasingly, customers are seeking banks that prioritize sustainability and ethical practices. Banks will need to integrate ESG considerations into their operations, promoting responsible investments and supporting sustainable businesses.

- Financial Inclusion and Accessibility: Banks will focus on expanding financial inclusion, providing access to financial services for underserved communities. This includes offering mobile banking solutions, digital lending products, and financial literacy programs to cater to the diverse needs of the population.

- Digital Solutions for Financial Literacy: Digital platforms will play a vital role in promoting financial literacy, providing educational resources, and empowering individuals to make informed financial decisions. This will contribute to financial well-being and reduce financial exclusion.

7. The Importance of Data Analytics and Business Intelligence:

- Data-Driven Decision Making: Banks will leverage data analytics and business intelligence tools to gain insights into customer behavior, market trends, and operational efficiencies. This data-driven approach will enable more informed decision-making, optimizing product development, risk management, and customer service.

- Personalized Marketing and Customer Engagement: Data analytics will enable banks to tailor marketing campaigns and customer engagement strategies to individual preferences and needs. This personalized approach will enhance customer satisfaction and loyalty, fostering stronger relationships.

- Fraud Detection and Risk Management: Data analytics will play a critical role in identifying and mitigating financial risks. By analyzing transaction patterns and customer data, banks can proactively detect fraudulent activities and manage potential risks effectively.

8. The Future of the Workforce: Digital Skills and Automation:

- Upskilling and Reskilling: As the banking industry becomes more digital, the workforce will need to adapt. Banks will invest in upskilling and reskilling programs, equipping employees with the digital skills necessary to thrive in a tech-driven environment.

- Automation and Robotic Process Automation (RPA): Automation and RPA technologies will streamline repetitive tasks, freeing up employees to focus on more complex and value-adding activities. This will enhance efficiency and productivity, enabling banks to operate more effectively.

- Collaboration and Innovation: The digital transformation of banking will require a collaborative approach, involving employees, technology experts, and external partners. This collaborative environment will foster innovation and drive the development of new products and services.

Related Searches:

1. Digital Transformation in Banking: This encompasses the broader shift towards digital technologies and processes within the banking industry, including the adoption of cloud computing, mobile banking, and data analytics.

2. Future of Banking Technology: This explores emerging technologies that are shaping the future of banking, such as blockchain, artificial intelligence, and quantum computing.

3. Digital Banking Trends: This provides a more general overview of the key trends driving digitalization in the banking sector, including mobile banking, online payments, and personalized financial services.

4. Impact of Technology on Banking: This examines the profound influence of technology on the banking industry, including the rise of FinTech, the decline of traditional branches, and the changing nature of customer relationships.

5. Digital Banking Strategy: This focuses on the strategic planning and implementation of digital initiatives within banking institutions, including the development of digital products, services, and customer experiences.

6. Digital Banking Security: This delves into the critical importance of cybersecurity in the digital banking environment, including measures to protect customer data, prevent fraud, and ensure the integrity of transactions.

7. Digital Banking Adoption: This examines the rate of adoption of digital banking services by customers, including factors influencing the shift towards online and mobile banking, and the challenges faced by banks in reaching new customer segments.

8. Digital Banking Innovation: This highlights the role of innovation in the digital banking sector, including the development of new products and services, the adoption of emerging technologies, and the creation of unique customer experiences.

FAQs about Digital Trends in Banking 2025:

Q: What are the key benefits of digital trends in banking for customers?

A: Digital trends in banking offer numerous benefits for customers, including enhanced convenience, personalized financial advice, greater control over finances, improved security, and access to a wider range of financial products and services.

Q: How will digital trends in banking impact the banking workforce?

A: The digital transformation of banking will require upskilling and reskilling of the workforce, with a focus on digital skills and automation. While some roles may become automated, new opportunities will arise in areas like data analytics, cybersecurity, and customer experience management.

Q: What are the biggest challenges facing banks in adapting to digital trends?

A: Banks face challenges in adapting to digital trends, including the need for significant investments in technology, cybersecurity, and employee training. They must also navigate regulatory changes, address data privacy concerns, and compete with emerging FinTech companies.

Q: How can banks prepare for the digital future of banking?

A: Banks can prepare for the digital future by investing in technology, developing a robust cybersecurity strategy, embracing open banking initiatives, fostering innovation, and focusing on customer-centric solutions.

Q: What are the potential risks associated with digital trends in banking?

A: Digital trends in banking also present potential risks, including data breaches, cybersecurity threats, and increased competition from FinTech companies. Banks need to mitigate these risks by implementing robust security measures, staying ahead of technological advancements, and adapting to the evolving needs of customers.

Tips for Banks in Adapting to Digital Trends:

- Invest in Technology: Banks must prioritize investments in cutting-edge technology, including cloud computing, artificial intelligence, and blockchain, to stay competitive in the digital landscape.

- Focus on Customer Experience: Banks need to prioritize customer experience, offering personalized financial advice, seamless digital interactions, and convenient mobile banking solutions.

- Embrace Open Banking: Open banking offers opportunities to collaborate with FinTech companies and offer customers a wider range of financial services. Banks should embrace this trend and explore partnerships to enhance their offerings.

- Enhance Cybersecurity: Cybersecurity is paramount in the digital banking environment. Banks must invest in robust security measures, including multi-factor authentication, data encryption, and regular security audits.

- Upskill the Workforce: Banks need to invest in upskilling and reskilling programs to equip their workforce with the digital skills necessary to thrive in a tech-driven environment.

- Embrace Innovation: Banks must foster a culture of innovation, exploring new technologies and business models to stay ahead of the competition and meet the evolving needs of customers.

- Prioritize Data Analytics: Banks should leverage data analytics to gain insights into customer behavior, market trends, and operational efficiencies, enabling data-driven decision-making and personalized customer experiences.

- Promote Financial Inclusion: Banks should focus on expanding financial inclusion, providing access to financial services for underserved communities through digital solutions, mobile banking, and financial literacy programs.

Conclusion:

The digital transformation of the banking industry is an ongoing process, driven by technological advancements, changing customer expectations, and the emergence of new competitors. As we approach 2025, banks need to embrace these digital trends in banking to remain relevant, competitive, and customer-centric. By investing in technology, focusing on customer experience, embracing open banking, prioritizing cybersecurity, upskilling the workforce, and fostering innovation, banks can navigate the digital landscape and thrive in the future of banking. The banks that adapt effectively will not only survive but also thrive, shaping the future of finance and delivering innovative solutions that meet the evolving needs of customers in a rapidly changing world.

Closure

Thus, we hope this article has provided valuable insights into The Future of Banking: Digital Trends Shaping the Industry in 2025. We thank you for taking the time to read this article. See you in our next article!