The Roaring Twenties And The Great Depression: A Tale Of Boom And Bust

The Roaring Twenties and the Great Depression: A Tale of Boom and Bust

Related Articles: The Roaring Twenties and the Great Depression: A Tale of Boom and Bust

Introduction

With great pleasure, we will explore the intriguing topic related to The Roaring Twenties and the Great Depression: A Tale of Boom and Bust. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

- 1 Related Articles: The Roaring Twenties and the Great Depression: A Tale of Boom and Bust

- 2 Introduction

- 3 The Roaring Twenties and the Great Depression: A Tale of Boom and Bust

- 3.1 The Seeds of the Crash: Understanding the Economic Trends of the 1920s

- 3.2 The Great Depression: The Inevitable Consequence

- 3.3 Related Searches:

- 3.4 FAQs:

- 3.5 Tips:

- 3.6 Conclusion:

- 4 Closure

The Roaring Twenties and the Great Depression: A Tale of Boom and Bust

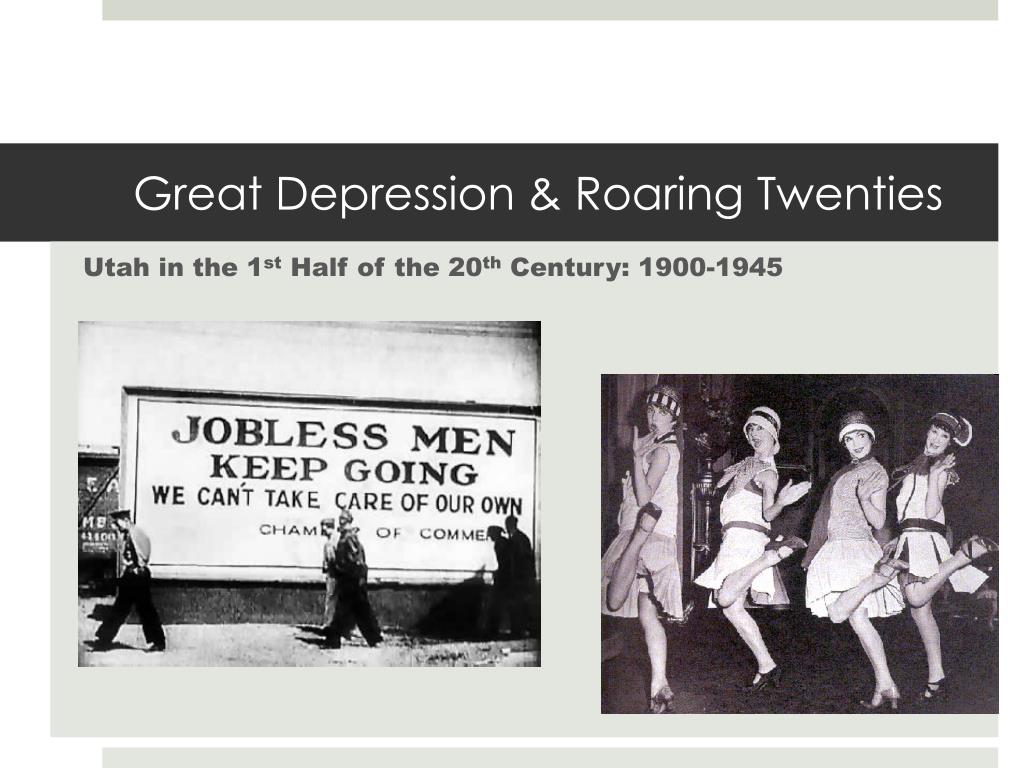

The 1920s, often referred to as the "Roaring Twenties," was a period of unprecedented economic prosperity in the United States. However, this period of boom was followed by a devastating crash, leading to the Great Depression, a global economic catastrophe that lasted throughout the 1930s. While the causes of the Great Depression were multifaceted, the economic trends of the 1920s played a crucial role in setting the stage for this catastrophic event. This essay will explore the key economic trends of the 1920s and analyze how they contributed to the subsequent economic collapse.

The Seeds of the Crash: Understanding the Economic Trends of the 1920s

The 1920s witnessed a surge in economic activity, driven by several factors:

- Technological Advancements: The era saw rapid technological innovation, particularly in the automobile industry. This led to increased production, employment, and consumer spending. The rise of mass production techniques, fueled by the assembly line, also contributed to the economic boom.

- Consumerism and Credit: The widespread adoption of credit, particularly through installment plans, allowed consumers to purchase goods they otherwise couldn’t afford. This fueled a culture of consumerism, further boosting economic activity.

- Stock Market Boom: The stock market experienced a significant surge during the 1920s. Speculative investments and a general optimism about the future fueled this boom, leading to inflated stock prices.

- Agricultural Depression: While the rest of the economy flourished, the agricultural sector faced challenges. Overproduction and falling prices led to a decline in farm income, creating a disparity in economic prosperity.

- Uneven Distribution of Wealth: Despite the economic boom, the wealth generated during the 1920s was unevenly distributed. The majority of the population did not benefit from the economic growth, leading to a widening gap between the rich and the poor.

- Overproduction and Inventory Glut: The focus on mass production led to an oversupply of goods in various sectors. This created an inventory glut, leading to falling prices and reduced profits for businesses.

- Weak Regulatory Framework: The government’s laissez-faire approach to the economy, combined with limited regulations, allowed unchecked speculation and risky lending practices. This lack of oversight contributed to the vulnerability of the financial system.

The Great Depression: The Inevitable Consequence

The economic trends of the 1920s, while seemingly positive at the time, laid the foundation for the Great Depression. The unsustainable boom, fueled by speculation and credit, was bound to collapse.

- The Stock Market Crash of 1929: The stock market crash of 1929, often referred to as "Black Tuesday," marked the beginning of the Great Depression. The inflated stock prices, based on speculation rather than real value, plummeted, wiping out billions of dollars in wealth and shaking investor confidence.

- Bank Failures and Credit Crunch: The stock market crash triggered a wave of bank failures. Investors withdrew their deposits, leading to a liquidity crisis. This led to a credit crunch, making it difficult for businesses to secure loans, further hindering economic activity.

- Decline in Consumer Spending: With the loss of jobs and savings, consumers reduced spending, leading to a further decline in demand. This vicious cycle of reduced spending and job losses perpetuated the Depression.

- Global Economic Fallout: The Great Depression was not confined to the United States. It spread globally, as countries relied on international trade and investments. The collapse of the US economy had a ripple effect, leading to widespread economic hardship around the world.

Related Searches:

1. The Role of Speculation in the Great Depression:

The 1920s saw a surge in speculation, particularly in the stock market. Investors bought stocks based on the belief that prices would continue to rise, not on the actual value of the companies. This speculative bubble eventually burst, leading to the crash of 1929. The speculative nature of the stock market during the 1920s significantly contributed to the vulnerability of the financial system and the severity of the subsequent Depression.

2. The Impact of the Agricultural Depression on the Great Depression:

While the industrial sector flourished in the 1920s, the agricultural sector faced challenges. Overproduction and falling prices led to a decline in farm income. This agricultural depression, coupled with the decline in consumer spending during the Great Depression, further exacerbated the economic downturn.

3. The Impact of the Smoot-Hawley Tariff Act on the Great Depression:

The Smoot-Hawley Tariff Act of 1930, designed to protect American industries from foreign competition, had unintended consequences. It led to retaliatory tariffs from other countries, further hindering international trade and deepening the global economic depression.

4. The Role of Government Policy in the Great Depression:

The government’s laissez-faire approach to the economy during the 1920s, characterized by minimal regulation and intervention, contributed to the economic instability that led to the Great Depression. The lack of government oversight allowed for unchecked speculation and risky lending practices, ultimately contributing to the financial collapse.

5. The Social Impact of the Great Depression:

The Great Depression had a profound impact on society. Millions of people lost their jobs, homes, and savings. The social fabric was strained, leading to widespread poverty, homelessness, and social unrest. The Depression also had a lasting impact on social welfare programs, leading to the development of programs like Social Security.

6. The New Deal and the Great Depression:

President Franklin D. Roosevelt’s New Deal programs, implemented in the 1930s, aimed to address the economic and social consequences of the Great Depression. These programs included public works projects, financial reforms, and social welfare programs, which helped to stimulate the economy and provide relief to those in need.

7. The End of the Great Depression:

The Great Depression finally began to recede with the outbreak of World War II. The war effort led to increased government spending, industrial production, and employment. However, the economic recovery was uneven, and the scars of the Depression continued to impact the economy and society for years to come.

8. Lessons Learned from the Great Depression:

The Great Depression served as a stark reminder of the importance of economic regulation, social safety nets, and responsible financial practices. It led to reforms aimed at preventing future economic crises, including the creation of institutions like the Federal Deposit Insurance Corporation (FDIC) and the Securities and Exchange Commission (SEC).

FAQs:

1. What were the main economic trends that contributed to the Great Depression?

The main economic trends that contributed to the Great Depression were:

- Overproduction and inventory glut: The focus on mass production led to an oversupply of goods, creating an inventory glut and reducing profits for businesses.

- Speculation and inflated stock prices: The stock market experienced a significant surge, fueled by speculative investments and a general optimism about the future.

- Uneven distribution of wealth: The majority of the population did not benefit from the economic growth, leading to a widening gap between the rich and the poor.

- Weak regulatory framework: The government’s laissez-faire approach to the economy allowed unchecked speculation and risky lending practices.

2. How did the stock market crash of 1929 trigger the Great Depression?

The stock market crash of 1929 marked the beginning of the Great Depression. The inflated stock prices, based on speculation rather than real value, plummeted, wiping out billions of dollars in wealth and shaking investor confidence. This led to a wave of bank failures, a credit crunch, and a decline in consumer spending, further perpetuating the economic downturn.

3. What role did the government play in the Great Depression?

The government’s laissez-faire approach to the economy during the 1920s contributed to the economic instability that led to the Great Depression. The lack of government oversight allowed for unchecked speculation and risky lending practices. However, the government’s response to the Depression, particularly through President Franklin D. Roosevelt’s New Deal programs, played a significant role in mitigating the economic and social consequences of the crisis.

4. How did the Great Depression affect global economies?

The Great Depression was not confined to the United States. It spread globally, as countries relied on international trade and investments. The collapse of the US economy had a ripple effect, leading to widespread economic hardship around the world. The Smoot-Hawley Tariff Act, designed to protect American industries, further exacerbated the global economic downturn by leading to retaliatory tariffs from other countries.

Tips:

- Focus on the economic trends: When discussing the causes of the Great Depression, emphasize the economic factors that played a crucial role.

- Avoid oversimplification: The Great Depression was a complex event with multiple contributing factors. Avoid oversimplifying the causes and presenting a single, straightforward explanation.

- Use historical context: To understand the economic trends of the 1920s, it’s essential to consider the historical context. Explain the social and political factors that contributed to the economic boom and the subsequent crash.

- Connect the dots: Clearly explain the connection between the economic trends of the 1920s and the onset of the Great Depression.

- Provide specific examples: Use specific examples and data points to illustrate the economic trends and their impact.

Conclusion:

The Great Depression, a defining event in global history, was not merely a product of bad luck or a single event. It was the culmination of a series of economic trends that developed over the course of the 1920s. The unsustainable boom, fueled by speculation and credit, was bound to collapse. While the 1920s witnessed economic prosperity, the seeds of the crash were sown in the era’s unchecked economic practices and the widening gap between wealth and poverty. The Great Depression served as a stark reminder of the importance of economic regulation, social safety nets, and responsible financial practices. The lessons learned from this catastrophic event continue to guide economic policies and financial regulations today, ensuring a more stable and resilient global economy.

Closure

Thus, we hope this article has provided valuable insights into The Roaring Twenties and the Great Depression: A Tale of Boom and Bust. We thank you for taking the time to read this article. See you in our next article!